A Guide to Understanding Option Day Trading

In today’s fast-paced financial market, the allure of option day trading captivates many aspiring investors seeking quick returns. Day trading, the practice of buying and selling financial instruments within the same trading day, offers a potentially lucrative yet highly volatile opportunity. Options, complex financial contracts derived from underlying assets like stocks, provide traders with a versatile tool to capitalize on market fluctuations. However, before embarking on the potentially profitable but risky realm of option day trading, it is imperative to comprehend the complexities and challenges associated with this practice.

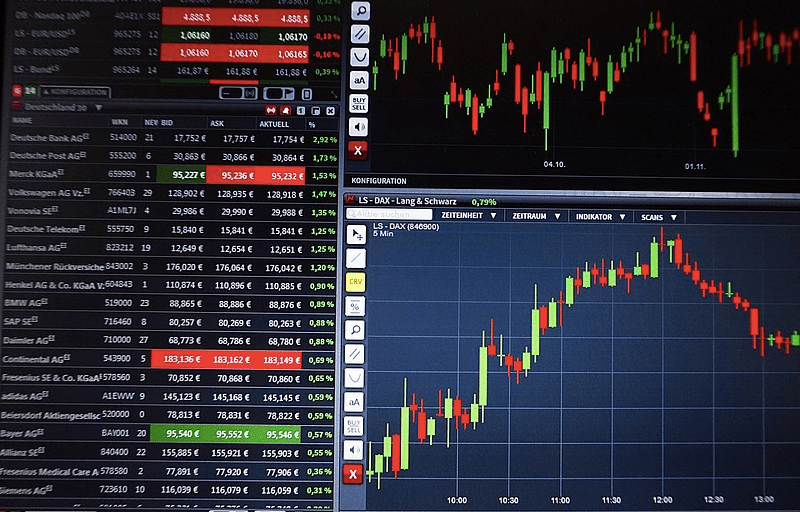

Image: www.daytrading.com

Defining Option Day Trading

Option day trading involves utilizing options contracts to speculate on the price movements of underlying assets within a single trading day. As opposed to traditional long-term stock trading, day traders seek to capitalize on price alterations throughout the trading day to generate profits. They typically close their positions before the market closes, aiming to profit from short-term market movements rather than long-term investment strategies.

Understanding Option Day Trading Strategies

Traders engage in various option day trading strategies to capitalize on diverse market scenarios. Common strategies include:

- Long calls: Purchasing a call option anticipates the rise in an underlying asset’s price, offering the right to buy the asset at a specific price before the expiration date.

- Short calls: Selling a call option implies the expectation of a decrease in the underlying asset’s price, conveying the obligation to sell the asset at a specified price if assigned.

- Long puts: Buying a put option forecasts a decline in the underlying asset’s price, providing the right to sell the asset at a defined price.

- Short puts: Selling a put option assumes an increase in the underlying asset’s price, carrying the responsibility to buy the asset at a specified price if assigned.

Assessing Your Suitability for Option Day Trading

Option day trading is not for the faint of heart. It demands a profound understanding of options dynamics, disciplined risk management, and tolerance for significant volatility. Key skills for this activity include:

- Technical analysis: Using price charts and patterns to anticipate market movements efficiently

- Option pricing: Comprehending the determinants of options prices to make informed trading decisions

- Risk management: Establishing stop-loss orders and position sizes proportionate to account size to mitigate potential losses

- Emotional control: Maintaining composure and avoiding impulsive decisions amidst market volatility

- Accountability: Recognizing the risks and being prepared for potential losses

Image: tradeproacademy.com

Recommended Steps for Option Day Trading

For beginners considering option day trading, a gradual approach is advisable:

- Educate yourself: Dedicate time to learning options basics, including types, strategies, and pricing mechanisms

- Practice: Employ simulated trading platforms to refine your strategies without risking capital

- Choose a brokerage: Select a broker with low commissions, advanced trading capabilities, and educational resources

- Start small: Begin with small trade sizes until you gain experience and comfort in the market

- Manage risk: Employ stop-loss orders and limit risk to a manageable percentage of your account

Can I Play Option Day Trading

Image: www.youtube.com

Conclusion

Can you play option day trading? The answer depends on your knowledge, skills, and tolerance for risk. Option day trading presents a potentially rewarding yet challenging opportunity. Individuals contemplating this path must possess a firm grasp of options dynamics, strategic expertise, and profound risk management techniques. By adhering to the recommended steps, practicing extensively, and embracing continuous learning, aspiring option day traders can potentially navigate the market’s complexities.