The world of cryptocurrency trading is constantly evolving, with new and innovative ways to profit from market fluctuations emerging all the time. One of the most popular methods of crypto trading is through the use of options. Options are derivative contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a predetermined date. In the case of BTC option trading, the underlying asset is Bitcoin (BTC), and the option contract gives the buyer the right to buy or sell Bitcoin at a specified price on a specified date.

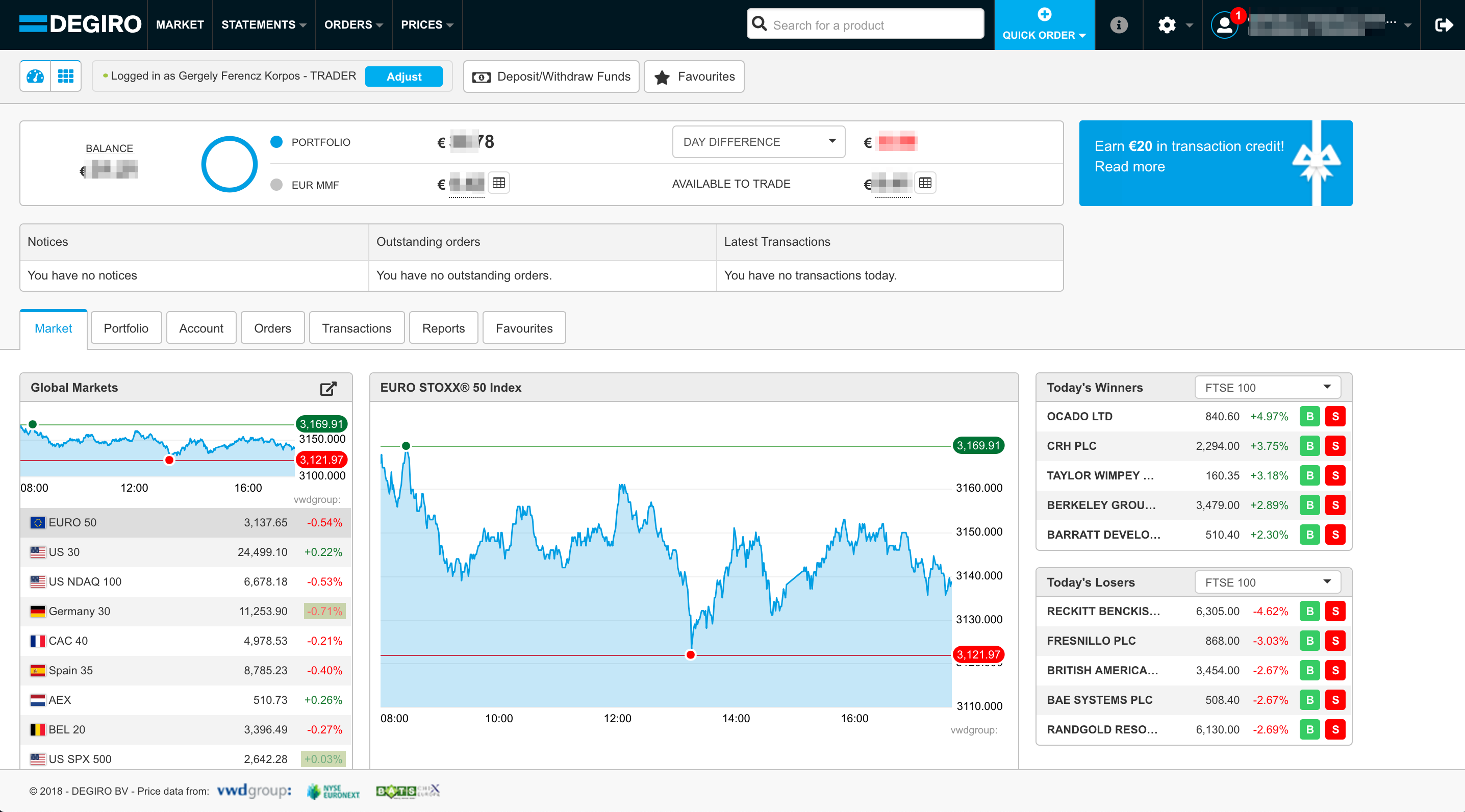

Image: brokerchooser.com

BTC option trading can be a great way to profit from the volatility of Bitcoin’s price. However, it is important to understand the risks associated with option trading before you get started. This guide will provide you with all the information you need to know about BTC option trading, including how it works, the different types of option contracts available, and the risks involved.

How Does BTC Option Trading Work?

BTC option trading is similar to traditional option trading in that the buyer of an option contract has the right, but not the obligation, to buy or sell the underlying asset at a predetermined price on a predetermined date. The main difference between BTC option trading and traditional option trading is that BTC options are traded on a decentralized exchange, which means that there is no central authority overseeing the trading process.

When you buy an option contract, you are paying a premium to the seller of the contract. The premium is the price that you pay for the right to buy or sell the underlying asset at a predetermined price on a predetermined date. The price of an option contract is determined by a number of factors, including the current price of Bitcoin, the volatility of Bitcoin’s price, and the time until the option contract expires.

If the price of Bitcoin moves in your favor, you can exercise your option contract and buy or sell Bitcoin at the predetermined price. If the price of Bitcoin moves against you, you can simply let the option contract expire, and you will lose only the premium that you paid for the contract.

Types of BTC Option Contracts

There are two main types of BTC option contracts: call options and put options. Call options give the buyer the right to buy Bitcoin at a predetermined price on a predetermined date. Put options give the buyer the right to sell Bitcoin at a predetermined price on a predetermined date.

Each type of option contract has its own advantages and disadvantages. Call options are a good way to profit from a rise in the price of Bitcoin, while put options are a good way to profit from a decline in the price of Bitcoin.

Risks of BTC Option Trading

BTC option trading can be a great way to profit from the volatility of Bitcoin’s price. However, it is important to understand the risks associated with option trading before you get started. The following are some of the risks involved in BTC option trading:

- The price of Bitcoin can fluctuate rapidly. This means that you could lose money if the price of Bitcoin moves against you.

- Option contracts can expire worthless. If the price of Bitcoin does not move in your favor, you could lose the entire premium that you paid for the contract.

- There is no central authority overseeing the BTC option trading market. This means that there is no guarantee that you will be able to find a buyer or seller for your option contract.

If you are considering BTC option trading, it is important to weigh the risks and rewards carefully before you get started. You should also make sure that you understand the terms of the option contract before you buy it.

Image: theforexgeek.com

Btc Option Trading Platform

![BTC Exchange Tutorial [Updated]: Bitfinex Trading Platform - Beginners ...](https://1.bp.blogspot.com/-NobJuoFN1ow/WLIumJMdTJI/AAAAAAAAMGc/N75pRy3neborLq0yTLYpxXUSoez6jOfCgCLcB/s1600/bitfinex%2B1.2.png)

Image: bitcointradess.blogspot.com

Conclusion

BTC option trading can be a great way to profit from the volatility of Bitcoin’s price. However, it is important to understand the risks associated with option trading before you get started. This guide has provided you with all the information you need to know about BTC option trading, including how it works, the different types of option contracts available, and the risks involved. If you are considering BTC option trading, be sure to weigh the risks and rewards carefully before you get started.