The allure of binary options trading has captivated traders worldwide, offering a potentially lucrative avenue to profit. However, the regulatory landscape in the United States casts a shadow over this speculative realm. Join us as we delve into the intricacies of binary options trading in the United States, examining its legal status, risks, and implications.

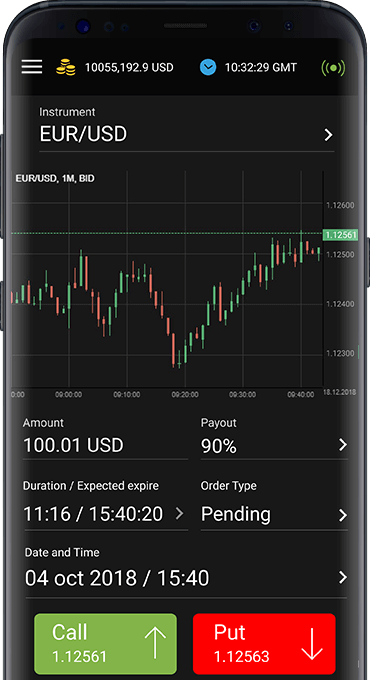

Image: www.dukascopy.com

The Binary Options Conundrum

Binary options, with their allure of potential fast rewards, have been the subject of heated debate. In this trading arena, speculators wager on the future price movement of an underlying asset, typically within a defined time frame. The payout structure is binary, either a fixed return or nothing at all, depending solely on whether the prediction proves correct.

Is Binary Options Trading Legal in the US?

The legal status of binary options trading in the United States is complex and fluid, a regulatory tempest that traders must navigate with caution. In 2018, the Securities and Exchange Commission (SEC) issued a statement declaring that binary options offered by foreign brokers operating in the US are largely deemed securities, making them subject to US securities laws. This ruling effectively prohibited the unregulated offering of binary options to US retail investors.

The Regulatory Labyrinth

The SEC’s stance has created a regulatory labyrinth, with foreign brokers largely barred from soliciting US clients for binary options trading. Domestically, the Commodity Futures Trading Commission (CFTC) regulates binary options offered by US exchanges or brokers, mandating stringent compliance measures and risk disclosures. These regulatory hurdles have significantly curtailed the accessibility of binary options trading in the United States.

Image: binarycampus.com

Navigating the Risks

Binary options trading, by its very nature, carries inherent risks that traders must carefully consider. As demonstrated by the SEC’s intervention, the regulatory landscape remains unstable, with potential changes and enforcement actions always on the horizon. Moreover, the binary payout structure amplifies the risk of losing one’s entire investment, particularly in volatile markets.

Tips for Cautious Traders

If you’re considering venturing into binary options trading in the United States, tread cautiously. Seek out US-regulated brokers who adhere to CFTC regulations and thoroughly understand the risks involved. Educate yourself about market trends and trading strategies to make informed decisions. Never invest more than you can afford to lose, and remember that the allure of quick profits often comes with a high price.

Frequently Asked Questions

Q: Are binary options legal in the US?

A: Binary options offered by domestic exchanges or brokers are subject to regulation by the CFTC, while foreign brokers offering binary options to US clients are largely prohibited by the SEC.

Q: What are the risks involved in binary options trading?

A: The risks include potential for substantial losses due to the binary payout structure, regulatory uncertainty, and market volatility.

Binary Options Trading United States

Image: www.top10binary.net

Conclusion

Binary options trading in the United States presents a complex and evolving landscape. US investors must proceed with extreme caution, cognizant of the regulatory restrictions and risks involved. While the potential for profits may be alluring, it is paramount to approach this speculative adventure with a clear understanding of the challenges and pitfalls that lie ahead.

Are you intrigued by the world of binary options trading? Let us know your thoughts and questions in the comments section, and stay tuned for more insightful content on this captivating topic.