Introduction

The burgeoning world of binary options trading has garnered significant attention, offering investors the allure of quick profits and high returns. However, the industry has also been plagued by controversies and concerns, prompting the emergence of regulatory frameworks to protect traders. Understanding the intricacies of binary options trading platform regulation is paramount for investors seeking to navigate this dynamic landscape responsibly and mitigate risks.

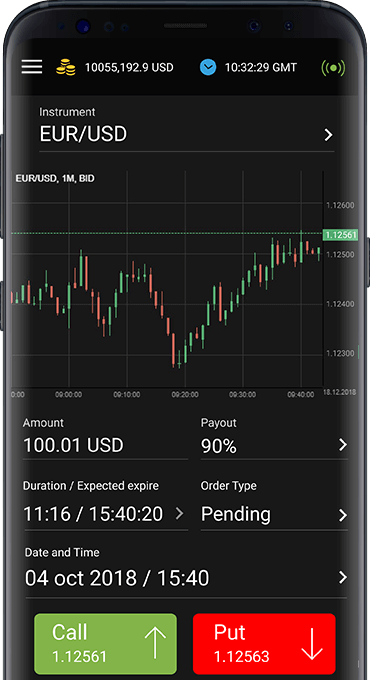

Image: www.dukascopy.com

Binary options, in essence, are financial instruments that allow traders to speculate on the future price movement of an underlying asset, such as stocks, currencies, or commodities. The unique characteristic of binary options lies in their binary nature, where the trader either earns a fixed payout if the prediction is correct or loses the entire investment if it is incorrect. This all-or-nothing proposition necessitates diligent analysis and a thorough grasp of the platform regulations to minimize potential losses.

Historical Evolution of Binary Options Regulation

The history of binary options regulation varies significantly across jurisdictions. In the early days, these instruments were largely unregulated, providing ample latitude for unscrupulous actors to exploit unsuspecting traders. However, as the industry expanded and concerns grew, governments and regulatory bodies began to implement measures to safeguard investors.

In 2009, the U.S. Securities and Exchange Commission (SEC) issued a ruling that binary options platforms must register as broker-dealers, subject to the same regulations and requirements as other financial institutions. This move aimed to enhance transparency, prevent fraud, and ensure the fair treatment of traders.

The European Securities and Markets Authority (ESMA) followed suit in 2018, enacting a series of measures designed to protect investors in the European Union. These measures included leverage limits, restrictions on marketing practices, and mandatory risk warnings.

Key Aspects of Binary Options Platform Regulation

Registration and Licensing

Regulated binary options platforms must typically obtain licenses or registrations from relevant regulatory bodies in their jurisdictions. These bodies vet the platforms to ensure they meet minimum capital requirements, have adequate risk management policies, and comply with all applicable laws.

Transparency and Disclosure

Transparency is vital for investors to make informed decisions. Regulated platforms are required to provide clear and easily accessible information about their operations, including trading conditions, payout rates, and risk factors.

Dispute Resolution Mechanisms

Robust dispute resolution mechanisms are crucial for protecting traders’ rights. Regulated platforms must provide fair and impartial procedures for resolving disputes between traders and the platform.

Segregation of Funds

To safeguard trader funds, regulated platforms are often required to segregate client money from company funds. This measure prevents platforms from using trader funds for their own operations or for fraudulent activities.

Risk Management and Leverage

Regulators play a pivotal role in managing risks associated with binary options trading. They may impose leverage limits to prevent traders from overleveraging their positions and incurring excessive losses.

Marketing Restrictions

Aggressive and misleading marketing practices have been a concern in the binary options industry. Regulations often restrict the use of unverifiable claims and ensure that marketing materials are presented in a fair and balanced manner.

Benefits of Trading on Regulated Platforms

Embracing regulation offers several advantages to binary options traders, including:

- Protection against Fraud: Regulated platforms are subject to strict oversight and must adhere to ethical practices, mitigating the risk of fraud and scams.

- Enhanced Transparency: Regulations mandate platforms to provide transparent information, enabling traders to make informed decisions based on objective data.

- Fair Treatment: Regulatory frameworks establish clear rules and guidelines, ensuring that traders are treated fairly and have recourse in case of disputes.

- Reduced Risks: Regulation imposes risk management measures, such as leverage limits, which help minimize the potential for excessive losses.

- Reputation and Credibility: Operating within a regulated environment enhances the platform’s reputation and instills confidence among traders.

Image: forexpops.com

International Regulatory Landscape

The regulatory landscape for binary options platforms varies globally. Some countries, such as the United States and the United Kingdom, have implemented comprehensive regulatory frameworks. In contrast, others have yet to establish clear guidelines, leaving traders vulnerable to potential abuses.

Investors are advised to research the regulatory status of binary options platforms in their jurisdictions before engaging in trading activities. Trading on unregulated platforms poses significant risks and may expose traders to fraud, unfair treatment, and financial losses.

Future Outlook for Regulation

The binary options industry is continuously evolving, and it is likely that regulation will remain a pivotal aspect of shaping its future. Regulators worldwide are striving to strike a delicate balance between investor protection and fostering innovation.

Emerging technologies, such as blockchain and distributed ledger systems, may play a transformative role in enhancing transparency and accountability in the industry. Additionally, international cooperation is crucial to address cross-border challenges and establish harmonized regulatory frameworks.

Binary Options Trading Platform Regulated

Image: t2conline.com

Conclusion

The regulation of binary options trading platforms plays a vital role in protecting investors, promoting fair trading practices, and fostering confidence in the industry. By understanding the key aspects of regulation and embracing licensed platforms, traders can minimize risks and increase their chances of success in binary options trading. The regulatory landscape is ever-changing, so it is imperative for traders to stay informed and adapt accordingly. As regulation continues to evolve, binary options trading has the potential to become a more transparent, equitable, and accessible financial instrument for investors worldwide