Imagine this: You wake up on a Monday morning, check your phone, and see your option trading account has skyrocketed overnight. A sense of euphoria washes over you, the feeling of a life-changing win. You’ve hit the jackpot, a single trade transforming your financial landscape. This, my friends, is the dream of every option trader, the pursuit of the highest possible profit.

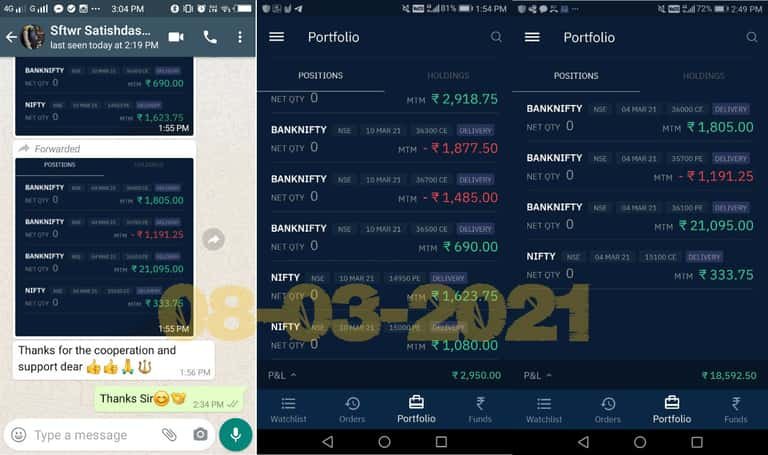

Image: wintradersoft.com

But behind this alluring mirage of instant wealth lies a complex world of risk, strategy, and market dynamics. Option trading, a thrilling dance with financial leverage, offers the potential for immense profits, but also the very real danger of significant losses. So, let’s delve into the fascinating reality of option trading, exploring the highest profits, the strategies driving them, and the crucial lessons every trader must learn.

Unlocking the World of Option Trading

Options, unlike stocks, are contracts giving the right (not obligation) to buy (call) or sell (put) an underlying asset at a specific price (strike price) before or on a certain date (expiration date). This flexibility introduces a powerful tool for maximizing potential gains, but at the cost of increased risk.

Imagine you believe a particular stock will rise significantly in the next few months. You buy a call option, effectively betting on the price increase. If your prediction is correct, you can buy the stock at the strike price, even if the market price is much higher. This difference is your profit, amplified by the leveraged nature of options.

But, what if the stock goes down? You lose the premium paid for the option. This is the risk in option trading, and it’s magnified by the potential for unlimited losses.

The Allure of High Profits: A Closer Look

The allure of the highest option trading profits is undeniable. It’s the story of a single, well-timed trade turning a small investment into a monumental sum. The potential is there, especially for traders with a deep understanding of market behavior and the ability to predict future price movements.

Here’s the reality:

- The highest possible profit is often capped by the contract’s underlying price: Options are limited by the maximum price of the underlying asset.

- They’re leveraged: This means a small investment can produce big returns, but also big losses.

- Time decay is a factor: Options expire, reducing their value over time.

Strategies for Profit: Building a Secure Foundation

Option trading isn’t a game of chance. It’s a carefully crafted strategy informed by market trends, risk management, and a deep understanding of underlying assets. Here’s an overview of common strategies:

- Covered Call Writing: Selling a call option against a stock you own, generating income and mitigating potential losses.

- Protective Puts: Buying a put option alongside a stock position, creating a buffer against potential price decline.

- Straddles: Buying both a call and put option with the same strike price and expiration date, betting on volatility, but risking both ways.

- Strangles: Similar to straddles but with different strike prices, offering a lower premium but less potential gain.

These strategies offer different risk and reward profiles. Understanding them is crucial for choosing the right approach based on your risk tolerance, trading goals, and market insights.

Image: www.litefinance.org

The Wisdom of Risk Management: Navigating the Market’s Tides

High profits often go hand in hand with high risks. This is where risk management becomes paramount. Here are some essential principles:

- Know your limits: Define your maximum allowable losses for each trade and stick to them.

- Diversify your portfolio: Spread your trades across different markets and asset classes to reduce risk.

- Use stop-loss orders: Automatic orders to sell if the price drops below a certain level, limiting potential losses.

- Don’t chase losses: Keep your emotions in check and avoid risky trading to recover from previous losses.

Remember, responsible trading requires discipline, careful planning, and a healthy dose of skepticism.

The Role of Market Volatility: A Double-Edged Sword

Volatility, the measure of price fluctuations, can be both friend and foe in option trading. While high volatility can create lucrative opportunities for traders, it also amplifies risks.

Volatility is a key component of option pricing: Higher volatility usually means higher option premiums, potentially leading to larger profits.

But, it also increases risks: A sudden price drop can wipe out your investment quickly.

Understanding the volatility of your chosen market is crucial for assessing your entry and exit points, and for managing risk effectively.

The Power of Knowledge: Education is Your Arsenal

Successful option trading doesn’t happen overnight. It’s a journey of continual learning and adaptation.

Invest time in learning: Understanding basic option principles, market dynamics, and risk management is essential.

Continuously update your knowledge: The market is constantly evolving, and staying informed is key to successful trading.

Develop your trading plan: Define your goals, risk tolerance, and trading strategies to guide your decisions.

Expert Insights: Navigating the Uncharted Waters

The best traders are not driven by luck, but by meticulous planning and knowledge. Veteran investors often share these insights:

- “Trading without a plan is like sailing without a compass.” A clear strategy and risk management plan are critical for success.

- “Embrace losses as learning opportunities.” Even the most experienced traders make mistakes. Analyze your losses to identify patterns and improve your strategies.

- “There’s no magic formula for success.” Option trading demands dedication, discipline, and a willingness to learn and adapt.

Highest Option Trading Profit

https://youtube.com/watch?v=PX–usft25o

The Path to Profit: A Journey of Skill and Discipline

The pursuit of the highest option trading profits is a journey of skill and dedication. It involves understanding the underlying dynamics of the market, mastering the art of risk management, and staying committed to continuous learning.

While the allure of massive gains is enticing, it’s crucial to remember the inherent risks involved. Approach option trading with a balanced perspective, focusing on learning, building a solid foundation, and nurturing a sustainable approach to managing your financial future. The rewards, while not guaranteed, can be substantial, but only with careful planning, rigorous discipline, and a deep understanding of the market’s complex forces.

Take the first step: Explore further resources, seek mentorship from experienced traders, and embark on your journey toward financial mastery. The world of option trading awaits, full of potential and challenges, demanding both courage and wisdom. Will you rise to the occasion?