The world of futures trading presents a plethora of opportunities for traders seeking to capitalize on market fluctuations. If you’re eager to delve into this dynamic realm, selecting the right futures contract is paramount. Read on to explore the best options available and equip yourself to navigate the financial markets with confidence.

Image: o3schools.com

Essential Elements of Futures Contracts

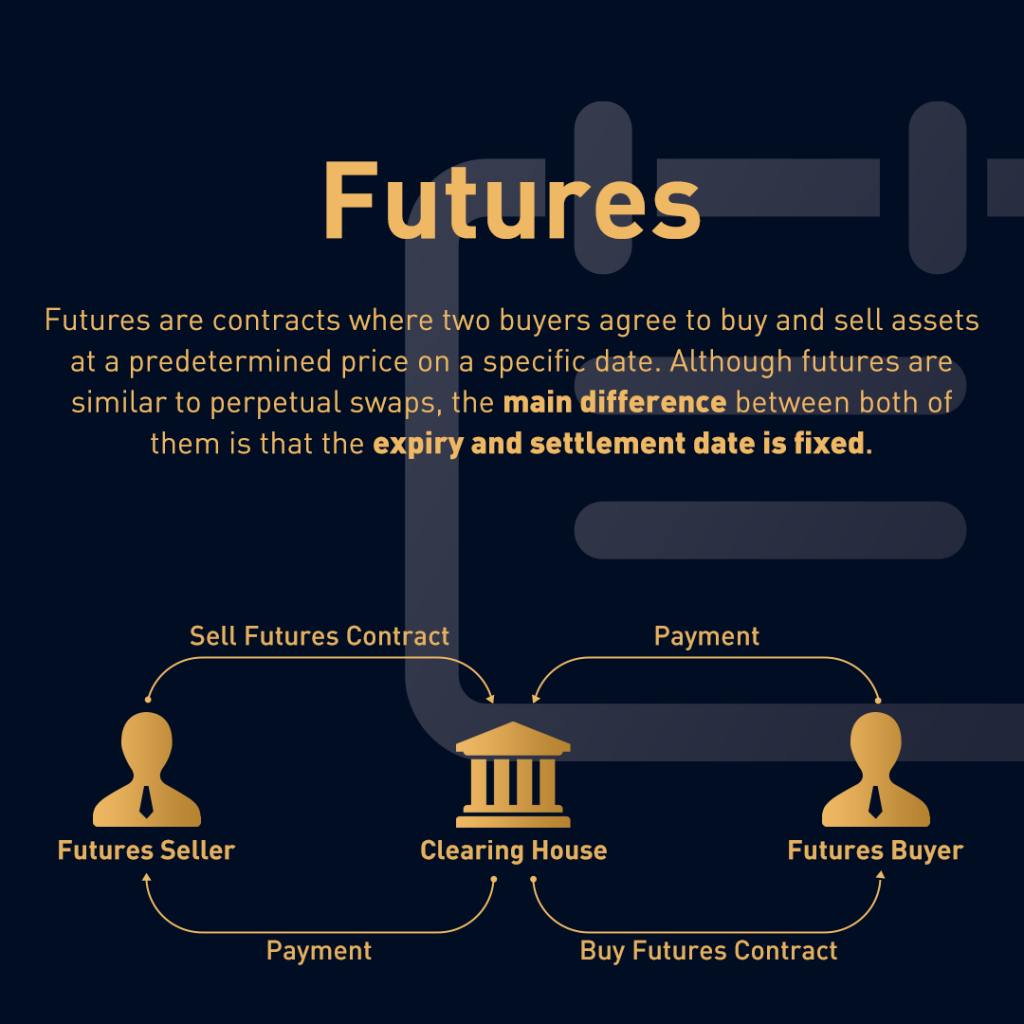

Futures contracts are standardized agreements that obligate the buyer to purchase, and the seller to deliver, a specific underlying asset (e.g., commodities, currencies, or stock indices) at a predetermined price, quantity, and date in the future.

To maximize your returns, it’s crucial to understand the underlying asset’s fundamentals, market dynamics, and potential risks. Thorough due diligence and a well-informed approach can significantly improve your trading outcomes.

Top Futures Contract Options

1. Agricultural Products: Futures contracts based on agricultural commodities (e.g., wheat, corn, livestock) offer exposure to the food and agricultural markets. These contracts provide a hedging tool for producers and consumers alike and can offer seasonal trading opportunities.

2. Energy Products: Futures based on energy sources (e.g., crude oil, natural gas) allow traders to capitalize on global energy demand and supply dynamics. These markets can be highly volatile, but offer significant profit potential with careful risk management strategies.

3. Currencies: Currency futures enable traders to hedge against exchange rate fluctuations or speculate on interest rate differentials between countries. Trading these contracts provides exposure to the global foreign exchange market.

4. Stock Indices: Stock index futures provide a convenient and cost-effective way to bet on the overall direction of the stock market. These contracts track the performance of a broad basket of stocks, allowing for diversified exposure to equity markets.

5. Metals: Futures contracts based on precious metals (e.g., gold, silver) often serve as a safe haven asset during periods of economic uncertainty. They can diversify portfolios and offer potential for capital appreciation.

Expert Trading Tips

- Thoroughly Research Underlying Assets: Understand the fundamentals, supply/demand dynamics, and risk factors associated with the underlying asset of your choice.

- Define Trading Strategy and Risk Tolerance: Establish clear entry/exit points, profit targets, and stop-loss levels before executing any trades.

- Practice Discipline and Patience: Emotional trading can lead to poor decisions. Stick to your strategy and have the patience to wait for favorable market conditions.

- Manage Risk Effectively: Use stop-loss orders, diversify your trades, and avoid over-leveraging to mitigate potential losses.

- Stay Informed and Adaptable: Monitor market news, economic indicators, and geopolitical events that can impact your futures positions.

Image: www.quora.com

Frequently Asked Questions (FAQs)

Q: What is the minimum capital required for futures trading?

A: The required capital can vary depending on the broker and contract. Contact your brokerage for specific margin requirements.

Q: How do futures contracts differ from options contracts?

A: While both are derivative contracts, futures contracts create an obligation to buy/sell an asset at a set price, whereas options contracts give the buyer the right, but not the obligation, to do so.

Q: Why do futures markets experience volatility?

A: Futures markets are influenced by a myriad of factors, including supply and demand fluctuations, macroeconomic news, and speculative trading activity. This can lead to both opportunities and risks for traders.

Best Options A Futures Trading

https://youtube.com/watch?v=WsTAgI2pyiM

Conclusion

The realm of futures trading offers a diverse array of options, each presenting unique opportunities and challenges. By understanding the underlying assets, choosing appropriate contracts, and following expert advice, traders can enhance their chances of success. Are you ready to navigate the dynamic world of futures trading and unlock the potential rewards?