Unveiling the Gateway to Smart Option Trading

For those navigating the dynamic world of financial markets, option trading presents a lucrative opportunity to capitalize on market volatility. India, with its burgeoning economy and robust financial ecosystem, offers a thriving landscape for option traders. Among the plethora of platforms available, certain ones stand out as the epitome of reliability, functionality, and innovation, empowering traders with the tools they need to make informed decisions and maximize their profits. Embark on this comprehensive guide as we delve into the nuances of option trading and uncover the best platforms that India has to offer.

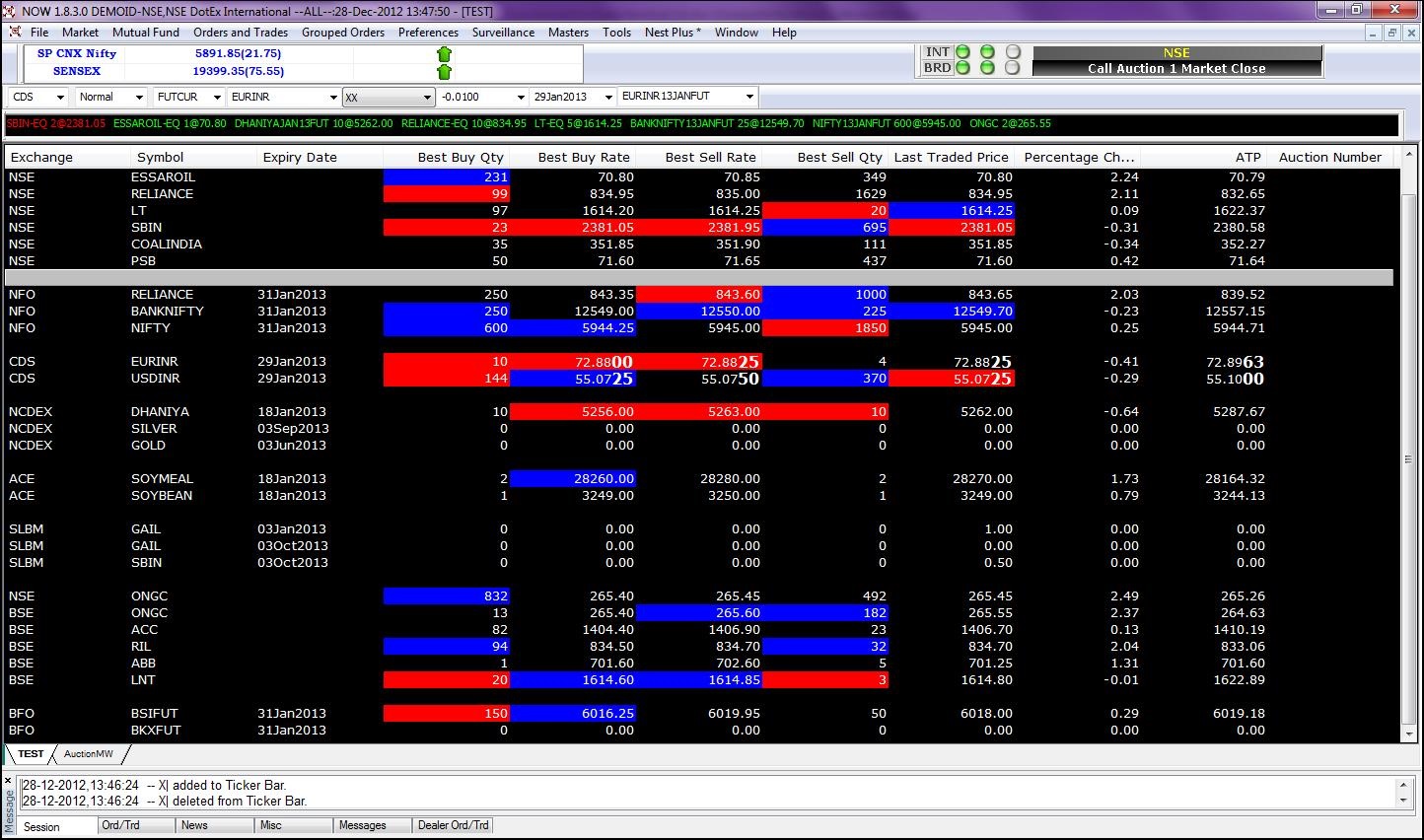

Image: equityblues.com

Decoding Option Trading: A Foundation for Success

Option trading involves the buying and selling of contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and time. Options provide traders with flexibility and leverage, allowing them to profit from market movements without the need for outright ownership of the underlying asset. Understanding the intricacies of option pricing, strategies, and risk management is crucial for aspiring traders.

Unveiling the Mechanics of Option Trading

Options derive their value from the underlying asset’s price, the strike price, time to expiration, and volatility. Traders can choose from two primary types of options: call options, which give the holder the right to buy, and put options, which confer the right to sell. By combining options with different strike prices and expiration dates, traders can tailor strategies that align with their risk appetite and market outlook.

Mastering option trading requires a deep understanding of option pricing models, such as the Black-Scholes model, which considers factors like volatility and time decay. Furthermore, traders must possess a solid grasp of strategies like covered calls, naked puts, and vertical spreads to maximize their earning potential.

Navigating the Indian Option Trading Landscape

India’s financial markets have witnessed a surge in option trading, fueled by the growing popularity of derivatives and the availability of advanced trading platforms. Leading brokers and exchanges offer a wide array of options contracts, including Nifty options, Bank Nifty options, and individual stock options. To succeed in this competitive environment, traders need access to reliable and feature-rich platforms that cater to their specific requirements.

Introducing the Best Option Trading Platforms in India

-

Image: www.youtube.comUpstox Pro

- Intuitive interface tailored for both beginners and experienced traders.

- Fastest order execution speeds in India, ensuring seamless trade execution.

- Comprehensive charting tools and technical indicators for in-depth market analysis.

- Advanced order types, including stop-loss and trailing stop-loss, for risk management.

-

Zerodha Pi

- Industry-leading discount brokerage with low transaction costs.

- Customizable trading platform with multiple chart layouts and indicators.

- Python-based API allows for automated trading and strategy development.

- Comprehensive educational resources and webinars for trader empowerment.

-

5paisa Trading Platform

- Extensive product offerings, including options, futures, and currency trading.

- User-friendly interface with real-time market data and streaming quotes.

- Advanced charting capabilities with over 100 technical indicators.

- Excellent customer support and trader training programs.

Tips and Expert Advice for Successful Option Trading

-

Practice Risk Management

- Determine your risk tolerance and allocate capital accordingly.

- Use stop-loss orders to limit potential losses.

- Trade with a clear strategy and avoid impulsive decisions.

-

Master Option Pricing Models

- Understand the factors influencing option prices.

- Use option pricing calculators to estimate option premiums.

- Study historical volatility patterns to make informed decisions.

-

Focus on Consistent Profits

- Avoid overtrading and chase unrealistic returns.

- Build a portfolio of diversified options strategies.

- Monitor your trades closely and make adjustments as needed.

FAQs on Option Trading in India

- Q: What is the minimum capital required to start option trading in India?

A: The minimum capital requirement varies depending on the broker and the strategies you trade. Some brokers offer options trading accounts with a minimum deposit as low as ₹10,000.

- Q: What are the tax implications of option trading in India?

A: Option trading profits are subject to short-term capital gains tax (STCG) at a rate of 15%. Traders holding options until their expiration date are liable to long-term capital gains tax (LTCG) at a rate of 10%.

- Q: Is it possible to trade options without owning the underlying asset?

A: Yes, option traders can buy or sell options contracts without owning the underlying asset. This flexibility allows traders to profit from market movements without the need for substantial capital.

Best Option Trading Platform In India

Conclusion: Embracing the Option Trading Frontier

Option trading in India presents a compelling opportunity for individuals seeking to enhance their financial returns. By choosing the right platform and adhering to sound trading principles, traders can unlock the potential of this dynamic market. The platforms discussed in this article offer a combination of functionality, reliability, and innovation, enabling traders to make informed decisions and capitalize on market opportunities. Embrace the world of option trading today and embark on a journey towards financial success.

Are you ready to venture into the exciting world of option trading?