Introduction

Options trading has emerged as a popular investment strategy for both experienced and novice traders seeking to enhance their portfolio returns. However, navigating the labyrinth of brokerages offering options trading can be a daunting task, especially when it comes to finding a platform that aligns with your budget and trading style. In this comprehensive guide, we will delve into the essential factors to consider when selecting a broker for low-cost options trading and unveil the top players in the industry who stand out with their competitive pricing and exceptional services.

Essential Considerations for Low-Cost Options Trading

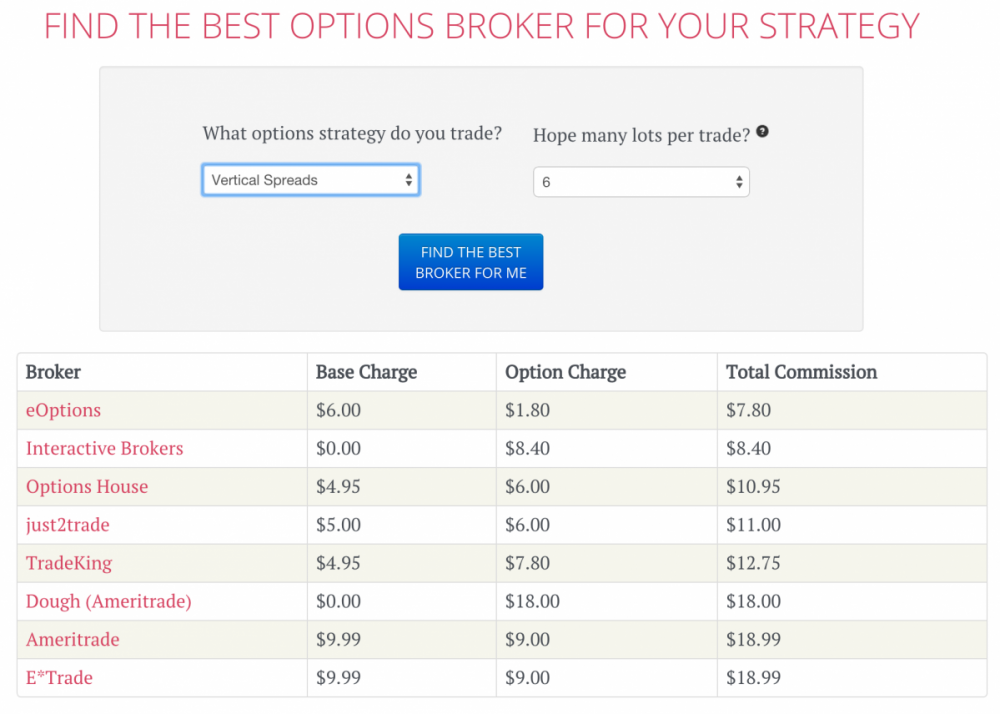

- Commission Fees: Low commission fees are paramount for frequent options traders, as they can significantly impact your overall profitability. Compare different brokerages and choose the one that offers the lowest commissions on options contracts.

- Account Minimums: Make sure the broker of your choice has reasonable account minimums that fit your trading capital. Avoid brokerages with high minimums that may restrict your ability to get started or scale your trading operations.

- Trading Platform: The trading platform’s user-friendliness, functionality, and tools can greatly influence your trading experience. Look for a platform that is easy to navigate, provides robust charting capabilities, and offers advanced order types.

- Customer Support: Responsive and reliable customer support is crucial, especially for new traders or in case of technical difficulties. Choose a broker that offers 24/7 support via multiple channels, such as phone, email, and live chat.

- Market Data Fees: Option traders often need real-time market data to make informed trading decisions. Some brokers may charge additional fees for this data, so be sure to factor these costs into your budget.

- Execution Quality: Slippage and slow order execution can erode your profits, especially during volatile market conditions. Focus on brokers that prioritize fast order execution and offer reliable fills.

Top Brokers for Low-Cost Options Trading

After carefully evaluating the market, our research has identified the following brokerages as leaders in low-cost options trading:

Interactive Brokers

Interactive Brokers is a renowned brokerage offering a wide range of trading products, including options. It is known for its low commission fees, starting at $0.65 per contract, and its powerful trading platform, Trader Workstation, which is packed with advanced tools for experienced traders.

TD Ameritrade

TD Ameritrade is another popular choice for options traders, thanks to its user-friendly platform, Thinkorswim, which features an array of charting and analysis tools. TD Ameritrade offers reasonable commission fees, starting at $0.60 per contract, and provides educational resources for aspiring and experienced traders.

Fidelity

Fidelity is a trusted brokerage with a long history in the industry. It stands out with its zero commission fees on options trades up to 10 contracts per leg, making it an attractive option for low-volume traders. Fidelity also offers a comprehensive trading platform, Active Trader Pro, and research tools.

Tastyworks

Tastyworks is a dedicated options trading platform designed for both beginners and experienced traders. It offers low commission fees, starting at $1.00 per contract, and a proprietary platform that features a unique approach to technical analysis. Tasteworks is particularly popular among options traders seeking educational resources and community support.

Webull

Webull is an up-and-coming brokerage known for its zero commission fees on options trades. It offers a mobile-first trading platform that is ideal for traders who prefer to execute trades on the go. While Webull’s platform may be less sophisticated than established brokerages, its low fees make it an appealing choice for small-scale traders.

Additional Tips for Low-Cost Options Trading

- Trade During Off-Peak Hours: Brokerages often charge higher commission fees during peak trading hours. Opt for trading options during off-peak times to reduce your costs.

- Negotiate Commission Rates: High-volume traders may be able to negotiate lower commission rates with their broker. Inquire about any potential discounts or rebates you may qualify for.

- Consider Bundling Services: Some brokers offer discounted pricing when you bundle multiple services, such as options trading with stock trading. Explore these options to save money.

- Use Limit Orders: Limit orders can help you avoid slippage and improve execution quality, which can result in lower overall trading costs.

- Manage Your Risk: Proper risk management is crucial for successful options trading. Understand the risks involved and implement strategies to mitigate potential losses.

Conclusion

Navigating the landscape of low-cost options trading brokerages requires careful consideration of factors such as commission fees, trading platform capabilities, customer support, and execution quality. By thoroughly researching and comparing your options, you can find a broker that aligns with your trading style and budget. Remember, low-cost options trading is not simply about minimizing fees but also about maximizing your trading opportunities while managing your risk. By adhering to these guidelines and choosing the right broker, you can set yourself up for success in the exciting world of options trading.

Image: options.cafe

Image: retail-focus.co.uk

Best Broker For Low Cost Options Trading