Have you ever wished you could capitalize on market swings, capturing profits when stocks soar or tumble? Maybe you’ve heard about “options” and wondered if they could be the key to unlocking your investment potential. But the term “options trading” can sound intimidating, shrouded in mystique and technical jargon. Fear not! This comprehensive guide will demystify options trading for beginners, providing a clear path to understanding and, potentially, profiting from these powerful financial instruments.

Image: tradeproacademy.com

Imagine a world where you could leverage a small amount of capital to control large positions, potentially amplifying your gains (or losses). That’s the beauty of options trading. While it can be riskier than traditional stock investing, options present a unique opportunity to generate profits not only from price movements but also from the volatility of the market itself. This is especially valuable in today’s dynamic and unpredictable economy.

So, What Are Options, Exactly?

Options are contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date). The underlying asset can be anything from a stock or ETF to a futures contract or even a cryptocurrency. Options come in two main types:

- Calls: A call option grants you the right to buy the underlying asset at the strike price. You would buy a call if you believe the price of the underlying asset will rise.

- Puts: A put option grants you the right to sell the underlying asset at the strike price. You would buy a put if you believe the price of the underlying asset will fall.

Decoding the Language of Options

Before diving deeper, let’s understand some key terms:

- Premium: The price you pay to purchase an option contract.

- In-the-money: An option is in-the-money when its strike price is below the current market price of the underlying asset for a call, or above for a put.

- Out-of-the-money: An option is out-of-the-money when its strike price is above the current market price of the underlying asset for a call, or below for a put.

- At-the-money: An option is at-the-money when its strike price is equal to the current market price of the underlying asset.

- Expiration: The date on which the option contract expires.

Mastering the Basics: Call Options Explained

To understand call options, think of them like a rental agreement for a specific asset. For a premium, the call option gives you the right, but not the obligation, to buy the asset at the strike price.

Let’s consider a simple example:

- You buy a call option for 100 shares of Company ABC at a strike price of $50 per share, expiring in three months. You pay a premium of $2 per share.

- If, in three months, the price of Company ABC’s stock rises to $60, you have the right to buy the shares at $50.

- You can exercise your option, buying the shares at $50 and immediately selling them at the market price of $60, generating a profit of $10 per share, minus the premium you paid.

However, if the price of Company ABC’s stock falls below your strike price of $50, your call option becomes worthless because you would be better off simply buying the stock at its lower market price. In such a scenario, you would lose your premium of $2 per share.

Image: www.newtraderu.com

Demystifying Put Options

Put options function in the opposite direction of call options. They give you the right, but not the obligation, to sell the underlying asset at the strike price.

Consider this scenario:

- You buy a put option for 100 shares of Company XYZ at a strike price of $40 per share, expiring in three months. You pay a premium of $1 per share.

- In three months, the price of Company XYZ’s stock drops to $35. You have the right to sell the shares at $40.

- You exercise your option by buying the shares at $35 and immediately selling them using your put option at $40, realizing a profit of $5 per share, minus the premium.

However, if the price of Company XYZ’s stock rises above your strike price of $40, your put option will become worthless as you would be better off selling the shares at the higher market price. You would lose your premium of $1 per share.

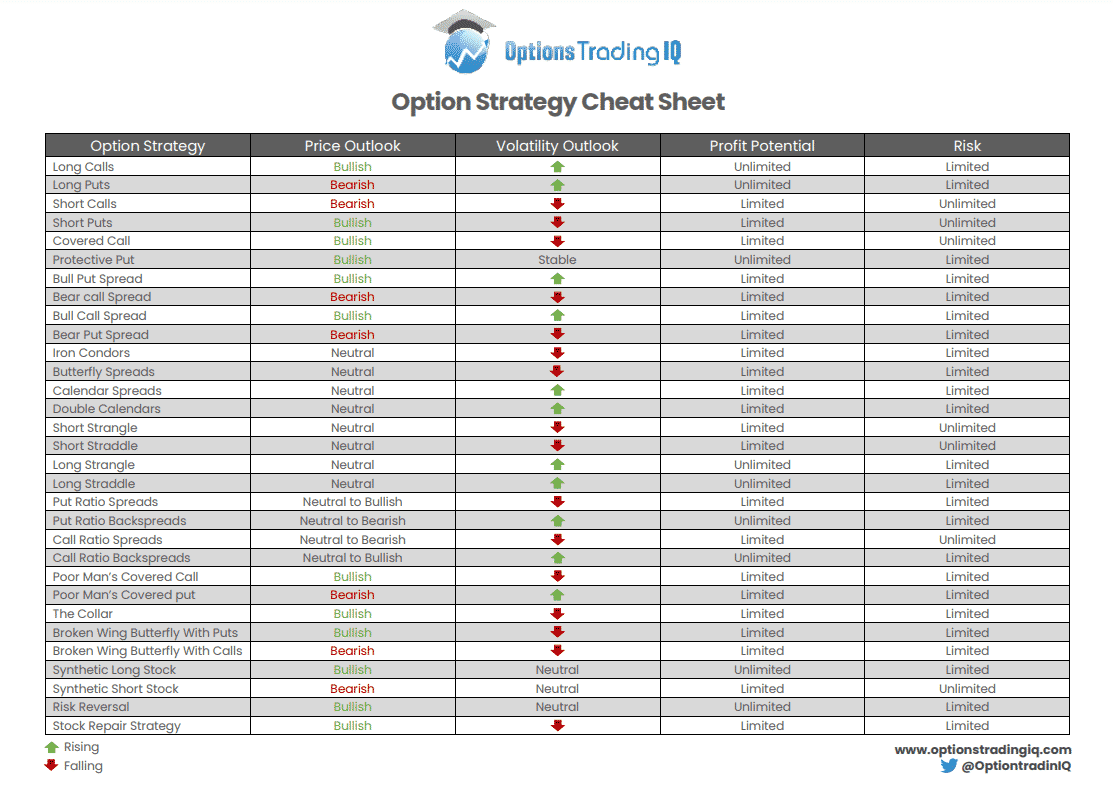

A World of Options Strategies

Options offer a wide range of strategies for both long and short positions, each with unique risk and reward profiles. Here are a few examples:

- Covered Calls: You own the underlying stock and sell a call option to generate premium income. This strategy is generally suitable for investors who expect the stock price to remain flat or rise slightly.

- Cash Secured Put: You receive a premium for selling a put option and set aside cash to cover the obligation of having to buy the stock at the strike price if the option is exercised.

- Protective Puts: You buy a put option to limit potential losses on a long stock position. It involves hedging your risk by purchasing insurance against a potential decline in the stock price.

- Straddles: You simultaneously purchase a call and a put option for the same underlying asset and expiration date. This strategy profits from significant price movements in either direction.

The Risks and Rewards of Options Trading

Like any investment, options trading comes with inherent risks:

- Time Decay: The value of options contracts naturally decays over time as they approach their expiration date.

- Limited Profit Potential: While options can provide leverage and amplify potential gains, their potential profit is capped at the strike price minus the premium paid.

- Unlimited Loss Potential: Unlike buying stocks, put and call options have unlimited loss potential since the underlying asset’s price can theoretically rise or fall indefinitely.

Important Considerations Before Entering the Options Arena

- Start Small: Don’t plunge into options trading without a solid understanding of the basics and a well-defined risk management strategy. Start with small positions and gradually increase your exposure as your confidence and knowledge grows.

- Risk Management is King: Define your risk tolerance and establish appropriate stop-loss orders to limit potential losses.

- Education is Power: Dive deep into books, courses, and reputable online resources.

- Start with Simple Strategies: Focus on understanding basic options strategies like covered calls and cash-secured puts before venturing into more complex strategies.

- Use a Brokerage with Options Trading Capabilities: Choose a reputable brokerage that offers options trading and a user-friendly platform.

- Practice with a Simulator: Use an options trading simulator to test different strategies and gain practical experience before risking real money.

Option Trading For Beginners Pdf

Options Trading: A Gateway to Investment Flexibility

Options trading, while undeniably complex, offers a powerful tool for investors to navigate market fluctuations and expand their investment horizons. By embracing education and responsible risk management, beginners can harness the potential of options strategies to potentially increase returns and build a more robust investment portfolio. Remember, options trading can be highly rewarding but also risky, making a strong foundation of knowledge and practice crucial for success.