Introduction

In the realm of financial markets, the world of options trading presents a wealth of opportunities for discerning investors seeking to amplify their returns and manage risk. One such compelling investment vehicle, Amarin Corporation (NASDAQ: AMRN), has emerged as a captivating target for those seeking to harness the power of options trading. With its fluctuating stock price and healthy volatility, Amarin options offer a tantalizing avenue to generate potentially lucrative returns while hedging against market downturns. This comprehensive guide delves into the nuances of Amarin option trading, empowering investors with the knowledge and strategies necessary to navigate this dynamic market.

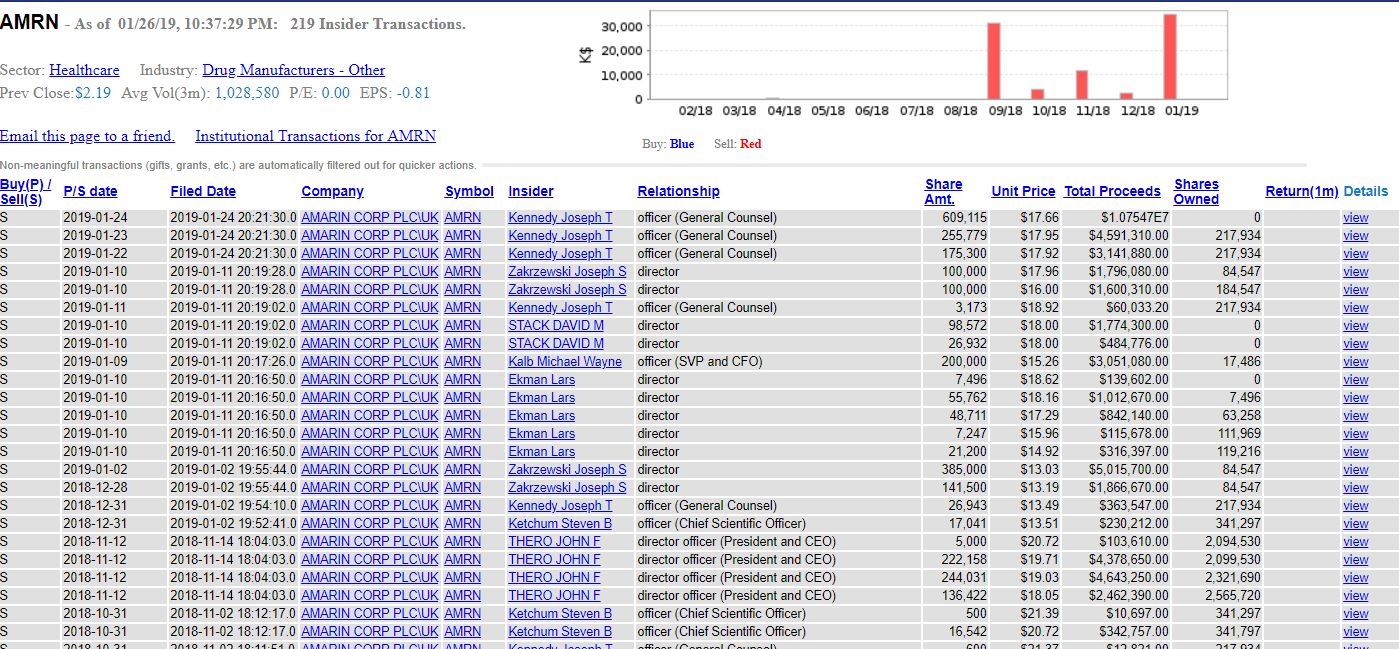

Image: seekingalpha.com

Understanding Amarin Corporation

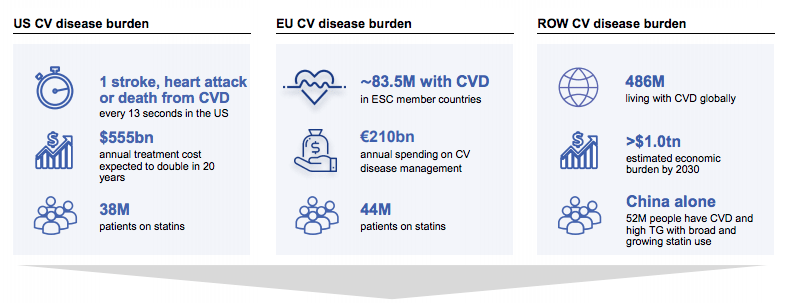

Amarin Corporation is a global biopharmaceutical company specializing in developing and commercializing innovative treatments for cardiovascular diseases. Its flagship product, Vascepa, a prescription medication used to treat high triglycerides, has gained significant traction in the marketplace, propelling Amarin’s rise as a prominent player in the pharmaceutical industry. The company’s robust pipeline of promising drug candidates further fuels investor optimism, positioning Amarin as an exciting prospect for long-term growth.

Options Trading: A Primer

Options are contracts that bestow upon the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock, at a predetermined price (strike price) on or before a specified date (expiration date). Options trading offers a versatile instrument for investors to capitalize on market movements, hedge against potential losses, or generate income through premium collection.

Trading Amarin Options: Strategies and Tactics

The diverse landscape of Amarin options provides investors with a plethora of strategic opportunities. By carefully assessing market conditions and the company’s underlying fundamentals, traders can employ various strategies to enhance their chances of success.

Image: seekingalpha.com

Bullish Call Options

When investors anticipate an upswing in Amarin’s stock price, they may consider purchasing call options. By doing so, they acquire the right to buy shares at the strike price, regardless of whether the market price has surpassed that level. This strategy enables investors to leverage their bullish outlook while limiting potential losses to the premium paid for the option.

Bearish Put Options

Conversely, if investors harbor bearish sentiments towards Amarin’s stock price, they may opt for put options. These options grant them the right to sell shares at the strike price, profiting from a decline in the stock’s value. This hedging strategy provides a valuable tool for mitigating downside risk.

Covered Call Options

For investors already holding Amarin shares, covered call options offer an income-generating strategy. By selling covered calls, investors grant others the right to buy their shares at a specific price. Should the stock price surge, the investor retains the potential for additional profits from the underlying shares. However, if the price falls, they may be obligated to sell at a lower-than-desired price.

Managing Risk in Amarin Option Trading

While options trading presents a tantalizing opportunity for financial gain, it is crucial to approach this market with a prudent risk management strategy. Several fundamental principles guide responsible option trading:

Understanding Volatility

Options premiums are directly influenced by the underlying asset’s volatility. Higher volatility implies greater price fluctuations, resulting in higher premiums. Investors must carefully consider their risk tolerance and align their trading strategies accordingly.

Setting Realistic Targets

Option trading should align with the investor’s long-term financial objectives. Setting realistic targets and adhering to a disciplined trading plan helps avoid emotional decision-making and excessive risk-taking.

Monitoring Positions Regularly

The dynamic nature of the options market necessitates continuous monitoring of open positions. Regular reviews allow investors to assess performance, adjust strategies, and mitigate potential losses.

Amarin Option Trading

Conclusion

Navigating the world of Amarin option trading requires a keen understanding of market dynamics, strategic planning, and sound risk management principles. By embracing the strategies outlined in this guide, investors can unlock the full potential of Amarin options trading while mitigating potential pitfalls. It is imperative to conduct thorough research, continuously monitor the market, and seek professional guidance whenever necessary. By