In the realm of finance, where time is of the essence and decisions can profoundly impact financial well-being, algorithmic trading has emerged as a transformative force. This state-of-the-art technology empowers traders by automating their trading strategies, enabling lightning-fast execution and capitalizing on market opportunities that were previously unattainable for the average investor. Delve into this comprehensive guide as we unravel the intricacies of algorithmic trading options, exploring its advantages, potential risks, and the profound impact it has on the modern financial landscape.

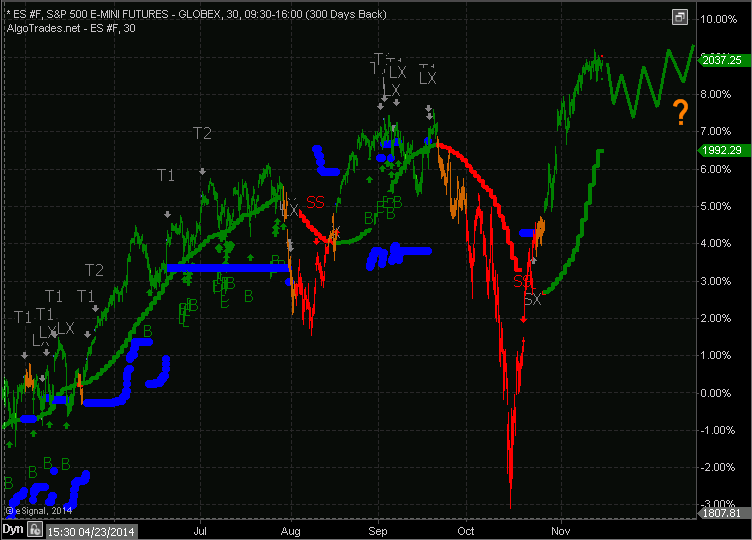

Image: www.algotrades.net

Delving into the World of Algorithmic Trading Options

Algorithmic trading options, a sophisticated fusion of computer science and financial acumen, involve the use of complex algorithms to execute trades based on predefined parameters. These algorithms meticulously monitor market conditions, scanning for specific patterns or indicators that align with the trader’s strategy. Upon identifying a viable opportunity, the algorithm swiftly executes the trade, oftentimes within milliseconds, leveraging speed and precision that far surpasses human capabilities.

Navigating the Advantages and Considerations of Algorithmic Trading Options

The embrace of algorithmic trading options has bestowed upon traders a multitude of advantages that were heretofore unavailable. Speed and precision reign supreme, allowing traders to respond to market movements with unparalleled agility and seize fleeting opportunities. Moreover, algorithmic trading options offer consistent execution, adhering steadfastly to predefined rules, thereby minimizing the impact of emotions or biases that can often cloud human judgment.

Despite these undeniable advantages, algorithmic trading options are not without their potential risks. The inherent complexity of algorithms demands a thorough understanding and meticulous monitoring to ensure optimal performance. Moreover, rapid market fluctuations or unexpected events can challenge the efficacy of predetermined trading strategies, potentially leading to losses.

Unveiling the Expert Insights and Actionable Tips

To harness the full potential of algorithmic trading options, it is imperative to glean wisdom from seasoned experts in the field. Industry leaders emphasize the significance of meticulously defining and backtesting trading strategies, ensuring their alignment with market conditions and risk tolerance. Furthermore, they advocate for ongoing monitoring to adapt to evolving market dynamics and to mitigate potential risks.

Image: morioh.com

Algorithmic Trading Options

Embracing Algorithmic Trading Options: A Foundation for Informed Decision-Making

Algorithmic trading options have profoundly transformed the financial landscape, empowering traders with unprecedented speed, precision, and the ability to implement complex trading strategies. While the potential rewards are substantial, the inherent risks must be carefully considered. By embracing the insights of experts and adhering to prudent risk management practices, traders can leverage the power of algorithmic trading options to navigate the complexities of the financial market and pursue their investment goals.