Embrace the After-Hours Edge

Immerse yourself in the realm of after-hours trading, where the pulsating heart of markets carries on its rhythm beyond the conventional trading session. Join us as we delve into the intricacies of this unique investing arena, uncovering the strategies and insights to turn the post-market hours into opportunities for profit.

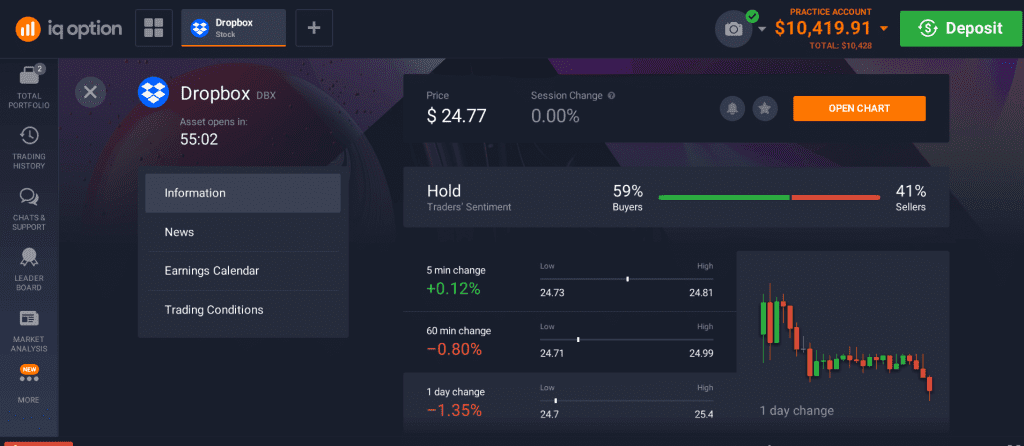

Image: blog.iqoption.com

Unveiling the After-Hours Options Arena

After-hours options trading, operating after the market closes, presents a dynamic platform for investors seeking to extend their trading horizons. It offers an avenue to respond to market events, adjust portfolio positions, and potentially capitalize on market movements that occur after the bell. Options, versatile financial instruments granting the right to buy or sell an underlying asset at a specific price, play a central role in this realm.

Navigating the Shifting Market Dynamics

As the lights dim in the trading halls, the market’s character shifts subtly. Liquidity, the lifeblood of efficient trading, becomes more elusive. Volatility, the measure of market fluctuations, often intensifies. These dynamics demand adaptability and a keen understanding of market behavior during these hours.

Strategies for Profiting in the After-Hours Market

- Escalate Information Advantage: After-hours trading offers access to company news, earnings reports, and economic data that may move markets after hours. Harness this information edge to make informed trading decisions.

- Adjust Positions Strategically: Use after-hours trading to fine-tune portfolio positions, adjusting to new market developments.

- Capitalize on Volatility: Embrace higher volatility to capture profit opportunities. Volatility can present both risks and rewards, so manage risk accordingly.

- Hedge against Market Swings: Utilize options for hedging strategies, protecting open positions from adverse price movements in a volatile post-market landscape.

Image: northtrader.medium.com

Tips and Expert Advice for After-Hours Traders

- Establish a Dedicated Trading Plan: Outline your trading strategy, risk management protocols, and profit targets, providing the foundation for your after-hours trading endeavors.

- Monitor News and Company Announcements: Stay informed of market-moving events by monitoring news sources and company announcements, adapting your trading strategy accordingly.

Frequently Asked Questions

Q: What are the benefits of after-hours options trading?

A: Expanded trading hours, response to news events, portfolio adjustments, market movement capitalization, and volatility-based trading opportunities.

Q: What are the risks associated with after-hours options trading?

A: Reduced liquidity, higher volatility, potential price manipulation, and diluted market depth.

Q: Is after-hours options trading suitable for all investors?

A: While accessible to all investors, it is particularly suited for experienced traders with a sound understanding of options and market behavior, as well as the ability to manage risk in a less liquid and more volatile environment.

Afterhours Options Trading

Conclusion

After-hours options trading invites skilled traders into a realm of strategic decision-making and potential profit. By harnessing information, understanding market dynamics, and implementing tailored strategies, traders can navigate this unique market and capture the benefits it holds.

So, are you ready to embrace the after-hours edge and unlock the potential profits it offers? Let your trading journey extend beyond the closing bell, and explore the exhilarating possibilities of after-hours options trading.