I’ve always been fascinated by the world of finance. The ebb and flow of the markets, the interplay of supply and demand, the ability to harness the power of financial instruments to build wealth — it’s a captivating dance that I’ve been eager to master. And among the many investment strategies that piqued my interest, Tesla options trading stood out as a particularly compelling one. So, I decided to dive in headfirst and embark on a journey to unravel the secrets of TSLA options trading.

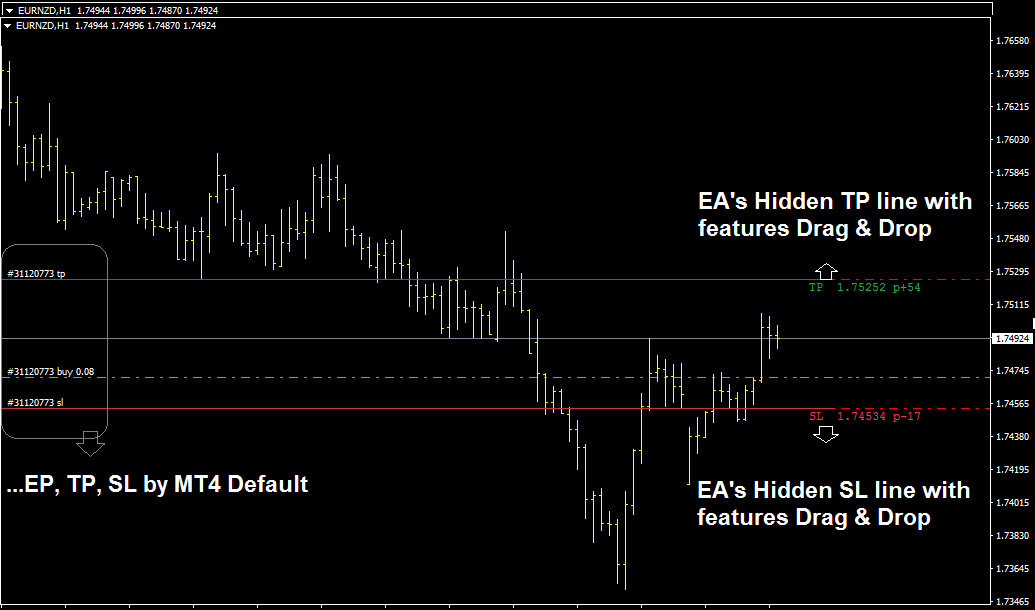

Image: www.mql5.com

Options trading, in essence, is a contract that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a predetermined date. In the case of TSLA options trading, the underlying asset is Tesla stock.

The Dynamics of TSLA Options

The TSLA options market is a bustling marketplace where investors trade contracts representing the right to buy or sell Tesla stock at a specific price (known as the strike price) on a specific date (known as the expiration date). These contracts give traders the flexibility to speculate on the future direction of Tesla’s stock price, hedge against potential losses, or generate income through premiums.

To fully grasp TSLA options trading, it’s essential to understand the two primary types of options: calls and puts. Call options grant the holder the right to buy the underlying stock at the strike price, while put options give the holder the right to sell the stock at the strike price. The price of an option (known as the premium) is influenced by factors such as the current stock price, the strike price, the time remaining until expiration, and the implied volatility of the underlying stock.

Embracing the Risks and Rewards

Like any investment strategy, options trading carries both risks and rewards. While it offers the potential for substantial profits, it’s crucial to be aware of the inherent risks involved. Options trading can be complex, and it’s essential to have a solid understanding of the factors that influence option prices. Moreover, options can expire worthless, resulting in the loss of the entire premium paid.

However, the potential rewards of TSLA options trading can be substantial. By accurately predicting the future direction of Tesla’s stock price, investors can generate significant profits. Additionally, options trading can be used to enhance portfolio diversification, generate supplemental income, and hedge against potential losses in other investments.

Mastering the Art of Options

To become a successful options trader, it’s imperative to possess a combination of knowledge, skills, and discipline. A thorough understanding of options terminology, strategies, and risk management techniques is essential. Furthermore, traders must continuously monitor market trends, keep abreast of company news and events, and have the ability to make sound judgments under pressure.

Additionally, successful options traders often employ specific strategies to enhance their chances of success. One common strategy is to trade options with a defined risk-reward ratio, ensuring that potential losses are limited while maximizing the potential for profit. Another strategy involves using options to create spreads, which can reduce the overall cost of the trade and mitigate risk.

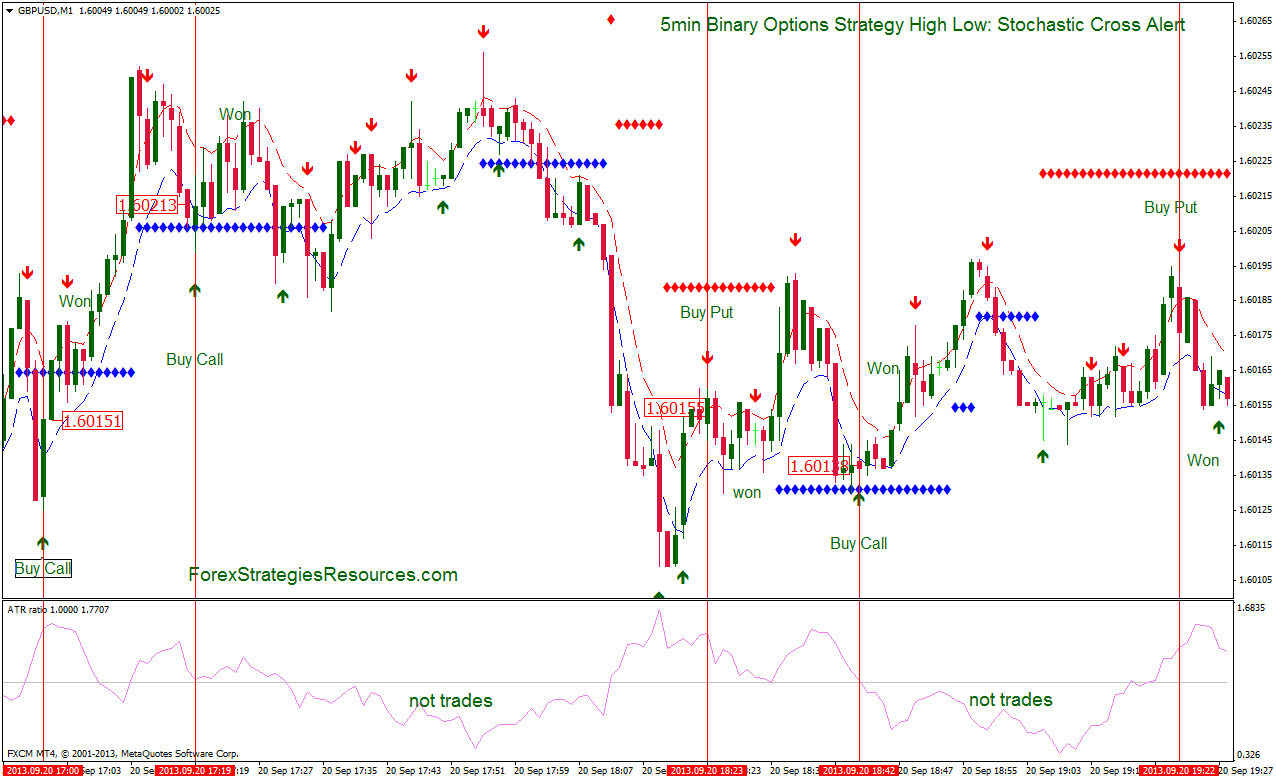

Image: www.forexstrategiesresources.com

Tips and Expert Advice for Success

Based on my experience as a blogger and my interactions with experts in the field, here are a few valuable tips to guide you on your TSLA options trading journey:

- Educate Yourself: Before venturing into TSLA options trading, it’s essential to gain a comprehensive understanding of the basics. Read books, articles, and attend webinars to equip yourself with the necessary knowledge.

- Start Small: Begin your options trading journey with small trades to minimize potential losses. As you gain experience and confidence, you can gradually increase the size of your trades.

- Manage Your Risks: Risk management is paramount in options trading. Always calculate your potential profit and loss before entering a trade and have a plan in place to exit if the trade goes against you.

- Monitor the Markets: Stay informed about market trends, company news, and economic events that may impact Tesla’s stock price. This will enable you to make informed trading decisions.

- Trade with a Reputable Broker: Choose a brokerage firm with a proven track record, low trading fees, and a user-friendly trading platform.

FAQs on TSLA Options

- Q: What is the minimum amount of capital required to start TSLA options trading?

A: The minimum capital required varies depending on the brokerage firm you choose. Some brokers offer options trading with a minimum account balance of $2,000, while others may require higher minimums.

- Q: What is the best way to learn options trading?

A: There are several ways to learn options trading. Online courses, books, and webinars can provide a solid foundation. Additionally, consider seeking guidance from a mentor or joining a trading group.

- Q: How do I choose the right options strategy?

A: The choice of options strategy depends on your individual trading goals, risk tolerance, and time frame. You can consult with a financial advisor or do your own research to identify the strategy that best suits your needs.

Tsl Options Trading

https://youtube.com/watch?v=iGpkI3uj7mk

Conclusion

TSLA options trading is a complex and rewarding investment strategy that requires a combination of knowledge, skills, and discipline. By embracing the principles outlined in this article and seeking continuous improvement, you can increase your chances of success in this dynamic and ever-changing market.

Are you intrigued by the world of TSLA options trading? Let us know in the comments below! Your insights and experiences will enrich our collective knowledge and contribute to a vibrant discussion on this captivating topic.