Introduction

Image: learn.robinhood.com

Navigating the world of options trading can be a daunting task, but with the right tools and knowledge, you can harness its immense potential. One crucial aspect of options trading is understanding the concept of option Greeks. These are mathematical variables that quantify various risk and reward aspects of an option contract. By comprehending and applying option Greeks, traders can make informed decisions, manage risk effectively, and position themselves for success. In this comprehensive guide, we delve into the fascinating world of option Greeks, providing you with a solid foundation to conquer the financial markets.

What are Option Greeks?

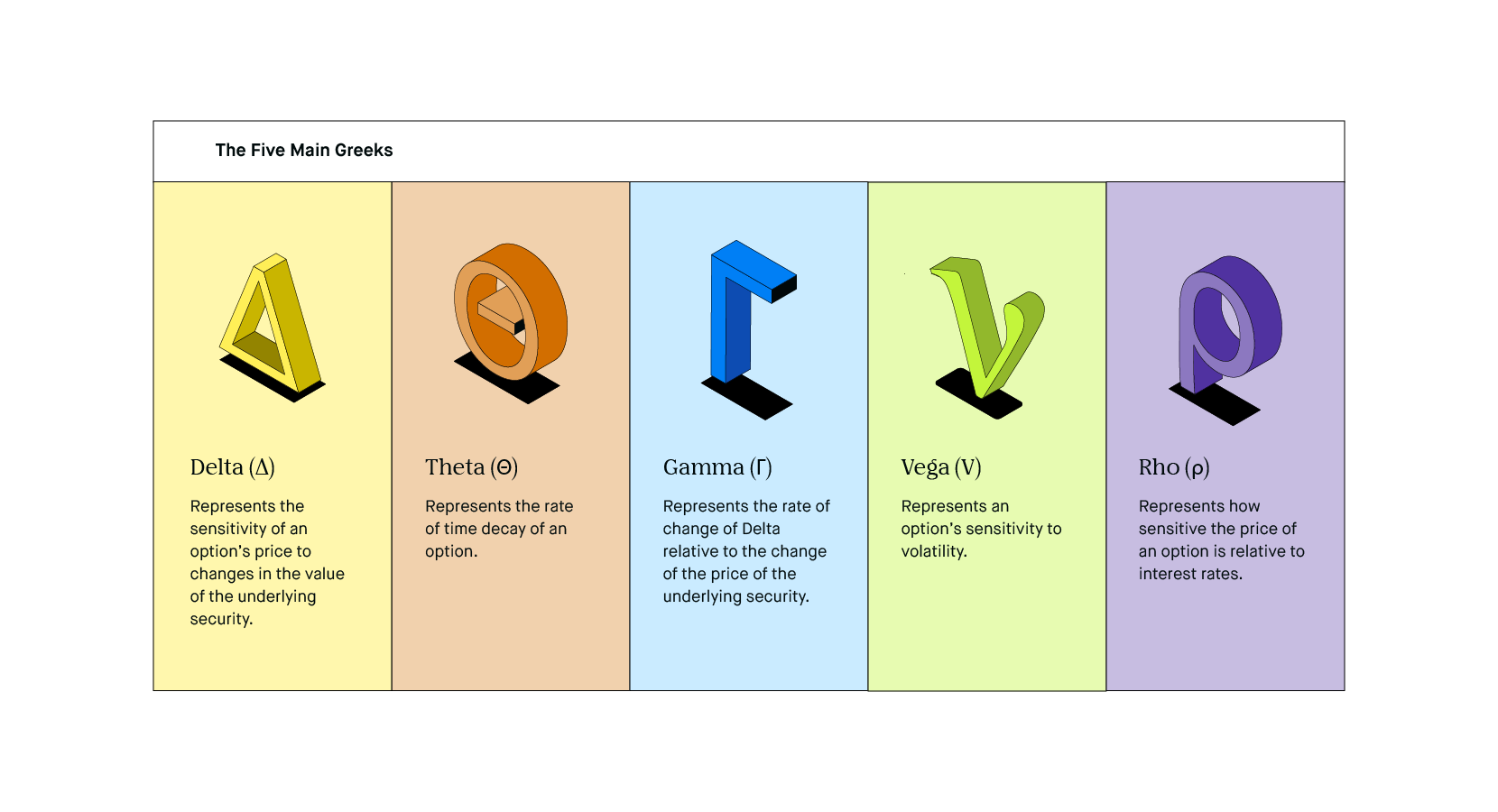

Option Greeks are mathematical calculations that measure the sensitivity of an option’s price to changes in underlying variables. They provide invaluable insights into how an option will behave under various market conditions. The most commonly used Greeks are Delta, Gamma, Theta, Vega, and Rho. Each Greek represents a specific dimension of option risk or reward, enabling traders to adjust their strategies accordingly.

Exploring the Individual Greeks

- Delta: Measures the change in option price relative to the change in the underlying security price. Delta values range from 0 to 1 for call options and -1 to 0 for put options.

- Gamma: Quantifies the sensitivity of Delta to changes in the underlying security price. Positive Gamma indicates an acceleration of Delta as the price of the underlying rises or falls.

- Theta: Represents the time decay of an option as it approaches its expiration date. Theta is always negative, implying that an option loses value as time passes.

- Vega: Measures the impact of implied volatility on the option price. Positive Vega denotes an increase in option price as implied volatility rises, while negative Vega suggests a decrease in price.

- Rho: Gauges the influence of interest rates on the option price. Positive Rho indicates an increase in option price as interest rates rise, while negative Rho implies a decrease in price.

Application and Practical Uses

Option Greeks provide actionable insights, allowing traders to:

- Assess market sentiment: Vega and Implied Volatility (IV) indicate the market’s expectations of future price movements.

- Manage risk: Delta and Gamma help traders determine the impact of underlying security fluctuations on their portfolio’s risk profile.

- Fine-tune strategies: Theta informs traders about the pace at which an option’s value erodes, enabling them to adjust their holding periods accordingly.

- Identify trading opportunities: Rho signals how interest rate changes affect option prices, providing insights for exploiting potential market inefficiencies.

Expert Insights and Actionable Tips

- “Always consider the Greeks as a synergistic ensemble rather than isolated metrics.” – Mark Sebastian, renowned options trader

- “Use Delta-neutral strategies to protect your portfolio from substantial market swings.” – Steve Burns, options expert

- “Combine Gamma scalping techniques with low volatility options to generate consistent profits.” – Karen Finerman, renowned market analyst

Conclusion

By gaining a thorough understanding of option Greeks, you empower yourself to unlock the full potential of options trading. Mastering these mathematical parameters enables traders to effectively manage risk, make informed decisions, and seize opportunities in the ever-evolving financial markets. Remember, knowledge is the ultimate weapon in the pursuit of financial success. Embrace the world of option Greeks and become an unstoppable force in the trading arena.

Image: learn.robinhood.com

Trading Option Greeks Pdf