Delve into the fascinating world of financial markets with Python, a powerful programming language designed to simplify the complexities of option trading. As an ardent advocate of option trading, I’ve witnessed firsthand the transformational impact Python can have on this dynamic market. Let’s embark on a journey to unleash Python’s potential, empowering you with sophisticated trading strategies and enhanced investment outcomes.

Image: studybullet.com

Join me in exploring this captivating realm, where we’ll delve into the fundamentals of option trading and unpack Python’s versatility. Together, we’ll navigate the challenges and reap the rewards of this exciting financial landscape, equipped with the knowledge and tools to make informed decisions. Are you ready to embrace the fusion of technology and finance? Let’s get started!

Python’s Brilliance in Option Trading

Python’s brilliance shines in the realm of option trading, where its versatility streamlines complex tasks and enhances trading decisions. Its ability to automate repetitive operations, analyze vast amounts of data, and execute trades swiftly empowers traders with an edge. Python’s extensive library of tools tailored for finance provides a robust foundation for developing trading strategies and risk management systems.

Moreover, Python’s open-source nature fosters a thriving community of developers who continuously contribute enhancements and new features, ensuring that traders stay at the forefront of technological advancements. By leveraging Python’s prowess, traders gain access to a world of possibilities, maximizing their potential for success in the ever-evolving financial markets.

A Comprehensive Guide to Option Trading

Options, financial instruments that grant the right but not the obligation to buy or sell an underlying asset at a specified price on or before a certain date, introduce an element of flexibility and strategic decision-making to the investment landscape. Understanding the types of options, their pricing mechanisms, and trading strategies is paramount for harnessing their potential effectively.

Python offers a robust suite of tools to analyze option prices, forecast market movements, and simulate trading strategies. By leveraging its capabilities, traders can gain insights into market trends, identify attractive trading opportunities, and optimize their risk-to-reward ratio. The harmonious integration of Python with financial data sources empowers traders with real-time market information, enabling them to make informed decisions and adapt swiftly to market dynamics.

The Latest Trends and Developments in Option Trading

The world of option trading is constantly evolving, driven by technological advancements, economic conditions, and regulatory changes. Staying abreast of emerging trends and developments is essential for traders seeking to stay ahead of the curve and seize new opportunities.

Artificial intelligence (AI) and machine learning (ML) are transforming the landscape of option trading, enabling traders to automate complex tasks, analyze vast amounts of data, and develop sophisticated trading strategies. Additionally, the rise of mobile trading platforms provides traders with real-time access to market information and the ability to execute trades from anywhere at any time. Regulatory changes, such as those introduced by the Dodd-Frank Wall Street Reform and Consumer Protection Act, have had a significant impact on option trading, shaping the industry’s practices and risk management frameworks.

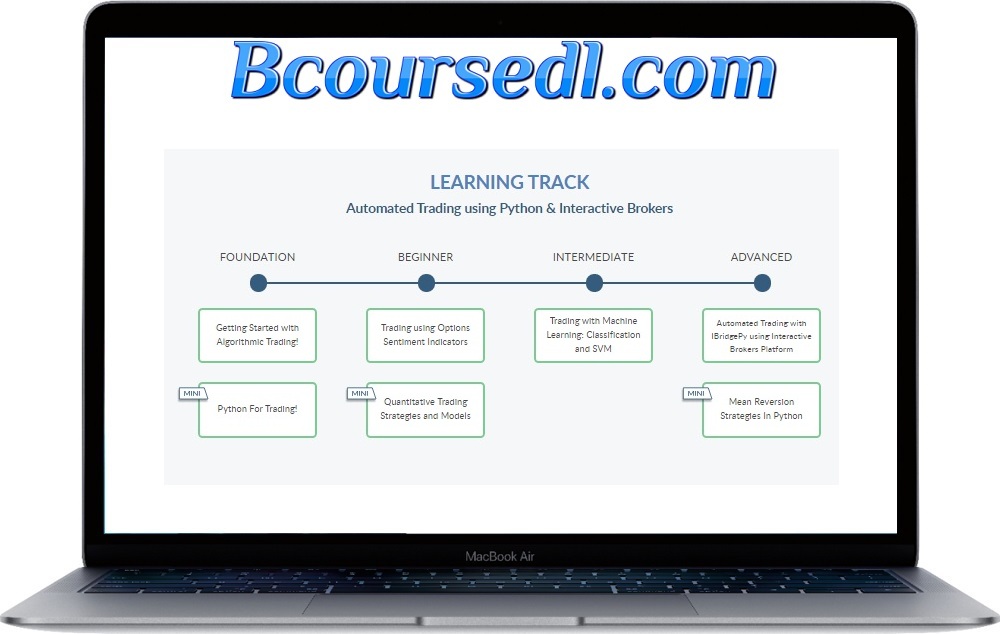

Image: dlecourses.com

Expert Tips and Advice for Enhanced Option Trading

Embarking on an option trading journey requires a sound understanding of the underlying concepts, prudent risk management practices, and a disciplined approach. Seasoned traders have navigated the intricacies of this dynamic market and generously offer their insights to guide aspiring traders toward success.

Thoroughly research and comprehend the different types of options, their pricing mechanisms, and trading strategies. This foundational knowledge will anchor your trading decisions and enable you to navigate the complexities of the market. Implement rigorous risk management measures to safeguard your investments. Define your risk tolerance, establish stop-loss orders, and diversify your portfolio to mitigate potential losses.

Frequently Asked Questions on Option Trading

Q: What is the best strategy for beginners in option trading?

A: Start with low-risk strategies such as covered calls or cash-secured puts. Gradually progress to more complex strategies as you gain experience and confidence.

Q: How do I calculate option premiums?

A: Option premiums are determined by multiple factors, including the underlying asset’s price, volatility, time to expiration, and interest rates. Utilize Python’s financial libraries to automate premium calculations.

Q: What are some common mistakes to avoid in option trading?

A: Overtrading, failing to manage risk, chasing losses, and trading on emotions are common pitfalls. Stay disciplined, adhere to your trading plan, and seek guidance from experienced traders.

Option Trading Using Python

Conclusion

Option trading, when approached with knowledge, strategy, and the right tools, can be a rewarding endeavor in the financial markets. Python, with its versatility and power, empowers traders with the ability to automate tasks, analyze data, and execute trades efficiently. By harnessing Python’s capabilities, traders can navigate the complexities of option trading, identify potential opportunities, and maximize their chances of success.

Whether you’re a seasoned trader or just starting your journey into the world of options, I encourage you to explore the transformative potential of Python. Embrace the opportunity to enhance your trading strategies, optimize your risk management, and elevate your investment outcomes. Unlock the world of option trading with Python today and experience the transformative power of technology and financial acumen.