Introduction:

Option trading offers a dynamic and lucrative avenue for market participants. In India, options trading has gained significant traction, with a vast array of strategies available to navigate the complex financial landscape. This comprehensive guide in PDF format provides a deep dive into the intricacies of option trading strategies in India, empowering traders with the knowledge to embark on this journey.

Image: tradingstrategyguides.com

Options are financial instruments that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a predetermined date (expiration date). Option trading strategies involve combining different options contracts to create a customized position that seeks to achieve specific financial objectives.

Understanding Option Trading Strategies

Option trading strategies are broadly classified into two primary categories:

-

Directional Strategies: These strategies aim to profit from anticipated movements in the underlying asset’s price. They include buying or selling calls and puts outright, as well as utilizing call or put spreads.

-

Non-Directional Strategies: These strategies seek to generate income or hedge existing positions regardless of the direction of the underlying asset’s price movement. Popular non-directional strategies include covered calls, cash-secured puts, and iron condors.

Types of Option Trading Strategies

The Indian options market offers a wide range of option trading strategies, each with unique characteristics and risk-reward profiles. Prominent strategies include:

-

Bull Call Spread: Involves buying a lower-strike call option and selling a higher-strike call option to capitalize on a gradual increase in the underlying asset’s price.

-

Bear Call Spread: Created by selling a lower-strike call option and buying a higher-strike call option, this strategy exploits a gradual decline in the underlying asset’s price.

-

Iron Condor: Combines a bear put spread and a bull call spread to profit from a sideways movement in the underlying asset’s price.

-

Covered Call: Involves selling a call option against an underlying stock that is already owned, generating income from the premium received while limiting the potential upside for the stock.

Factors Influencing Option Strategy Selection

Selecting the appropriate option trading strategy hinges on several factors:

-

Market Outlook: The trader’s anticipation of the underlying asset’s price movement significantly influences strategy selection.

-

Risk Tolerance: Traders should align their strategy with their risk appetite, as some strategies involve higher levels of risk than others.

-

Capital Requirements: Different strategies require varying levels of capital, and traders should ensure they have adequate funds to execute their desired strategy.

-

Time Horizon: The expiration date of the option contracts plays a crucial role, and traders should select strategies that align with their investment time frame.

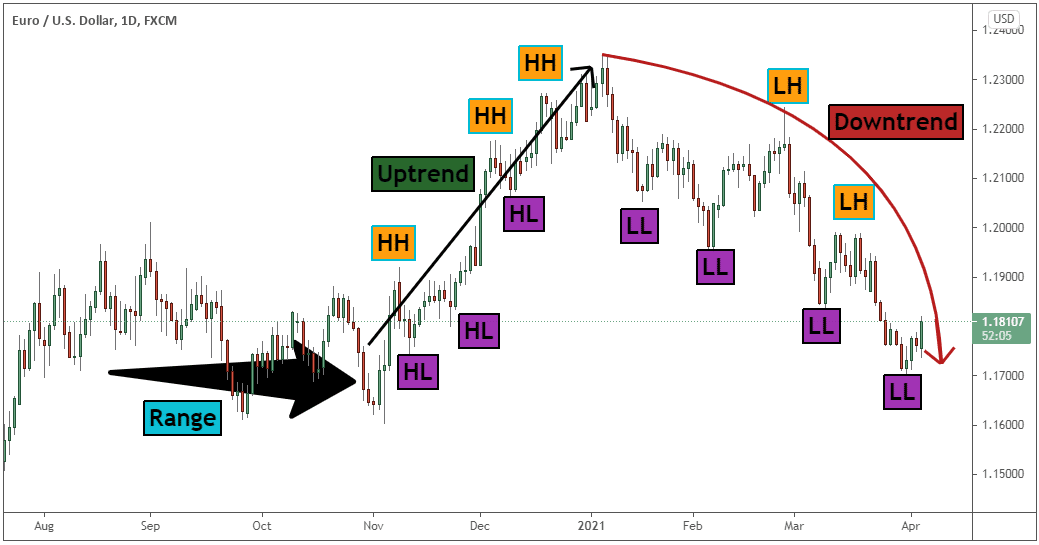

Image: www.tradethetechnicals.com

Advantages and Limitations of Option Trading Strategies

Option trading strategies offer several advantages:

-

Flexibility: Options provide a wide range of strategies to cater to diverse market conditions and objectives.

-

Risk Management: Options can help mitigate risk exposure by allowing traders to define their potential loss upfront.

-

Income Generation: Non-directional strategies provide opportunities for income generation, even in volatile markets.

However, it’s essential to acknowledge the limitations associated with option trading strategies:

-

Complexity: Option trading strategies can be intricate, requiring a thorough understanding of options pricing and market dynamics.

-

Time Decay: The value of options decays over time, especially for short-term strategies, which can impact profitability.

-

Market Volatility: Extreme market volatility can lead to unpredictable price movements, potentially negating strategy effectiveness.

Option Trading Strategies India Pdf

Conclusion:

Harnessing the power of option trading strategies requires a comprehensive understanding of market trends, risk factors, and strategy mechanics. By equipping themselves with this knowledge, Indian traders can tap into the vast potential of options trading to enhance their financial portfolio and navigate market fluctuations. This comprehensive guide in PDF format serves as an invaluable resource for those seeking to delve into the dynamic world of option trading strategies in India.