Introduction: Embarking on the Journey of Option Trading

Within the bustling world of financial markets, option trading stands as a sophisticated and nuanced endeavor. In the heart of the US, this practice has gained immense popularity, offering investors the potential for both substantial rewards and immense risks. Options, financial instruments that confer the right but not the obligation to buy or sell an underlying asset at a predetermined price, present a unique and intriguing avenue for investors to explore. To navigate this complex realm successfully, a thorough understanding of its inner workings is paramount.

Image: tradesmartu.com

Defining Options: The Essence of Contractual Flexibility

At their core, options are contracts between two parties – a buyer and a writer. The buyer of an option pays a premium to the writer in exchange for the right to either buy (in the case of a call option) or sell (in the case of a put option) a specific underlying asset at a specified strike price on or before a designated expiration date. This flexibility allows investors to tailor their investment strategies to their unique market outlook and risk tolerance.

Call Options: The Right to Acquire

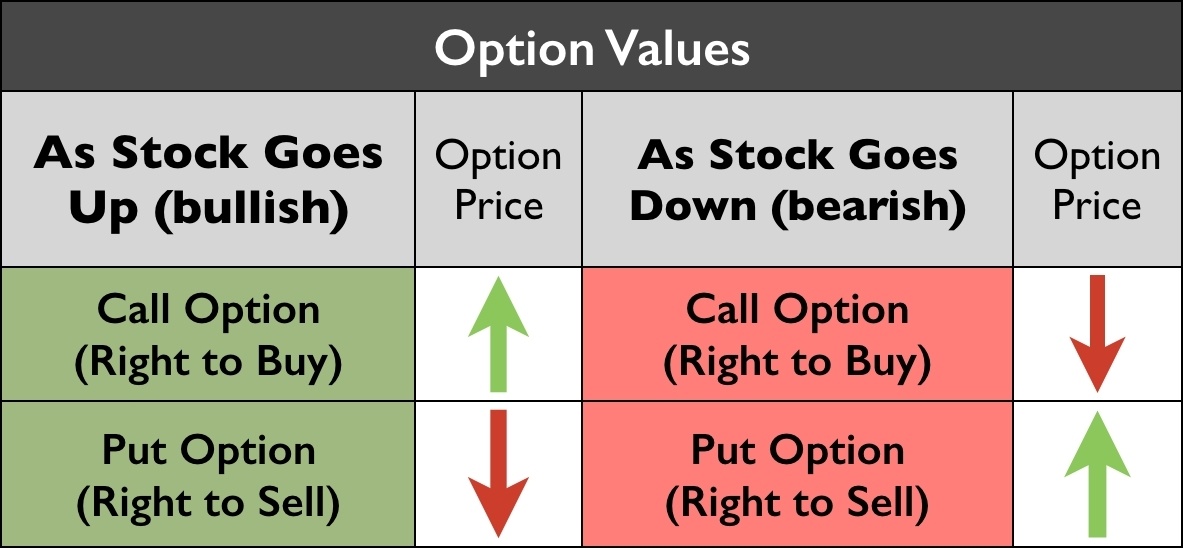

Call options grant the buyer the right to purchase an underlying asset at the strike price on or before the expiration date. Should the market price of the asset rise above the strike price, the call option becomes valuable, empowering the holder to either exercise their right to acquire the asset or sell the option to another investor for a profit.

Put Options: The Right to Divest

In contrast, put options offer the right to sell an underlying asset at the strike price on or before the expiration date. If the market price of the asset falls below the strike price, the put option becomes profitable. Like call options, put holders can choose to exercise their right to sell or sell the option for a profit.

Image: www.angelone.in

Striking a Balance: Strike Price and Expiration Date

The strike price of an option is the predetermined price at which the underlying asset can be bought (call option) or sold (put option). This pivotal value is carefully selected by investors based on their market forecasts. Additionally, options are characterized by their expiration date, the day on which the option contract expires. Options with longer expirations generally command higher premiums as they offer more time for potential market movements.

Premiums: The Cost of Options and the Promise of Profit

Option premiums represent the price paid by the buyer to the writer in exchange for the rights conferred by the option contract. Premiums are influenced by a multitude of factors, including the market price of the underlying asset, the strike price, the time to expiration, and the volatility of the underlying asset. Premiums can range from a few pennies to hundreds of dollars, reflecting the potential risks and rewards involved in option trading.

Navigating the US Option Trading Landscape

Option trading in the US is a highly regulated and sophisticated industry. The Securities and Exchange Commission (SEC) oversees all aspects of option trading, ensuring transparency and integrity in the marketplace. Investors can trade options on various exchanges, including the Chicago Board Options Exchange (CBOE), the largest options exchange in the world.

Option Trading In Us

Strategies for Success: Mastering the Art of Option Trading

In the hands of experienced investors, option trading transforms into an art form, with a multitude of strategies employed to maximize potential returns and mitigate risks. Some of the most common options strategies include covered calls,