For aspiring and seasoned traders alike, understanding the intricacies of NSE option trading time is paramount to unlocking the full potential of this dynamic market. Navigating the ever-evolving landscape of option trading requires a deep dive into the nuances of trading hours, strategies, and market trends.

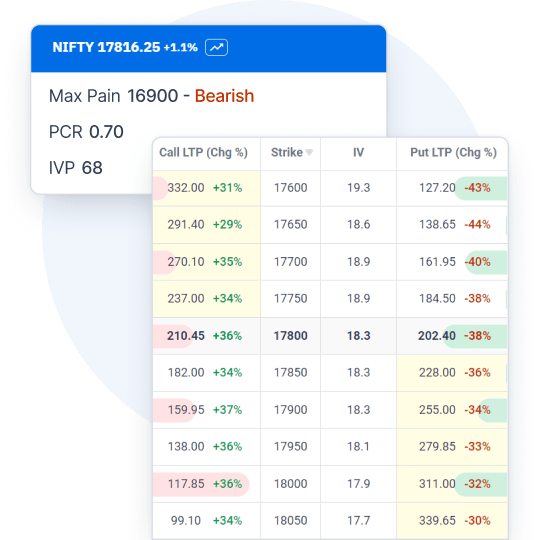

Image: sensibull.com

NSE Option Trading Hours: Unraveling the Schedule

The National Stock Exchange (NSE) of India has established specific trading hours for options, ensuring seamless trading and orderly market operations. Options contracts, derived from underlying stocks or indices, are traded within these designated time slots:

- Opening Bell: 9:00 AM (IST)

- Trading Halt: 9:05 AM to 9:15 AM (IST)

- Regular Trading: 9:15 AM to 3:30 PM (IST)

- Closing Bell: 3:30 PM (IST)

During the trading halt, the market is closed for all option trading activities, allowing market participants to review and adjust their positions.

Why Understanding Trading Hours Matters

Grasping NSE option trading time is crucial for several reasons:

- Informed Decision-making: Knowing the trading hours empowers traders to plan their trading strategies and execute trades within the stipulated time frame.

- Optimizing Execution: Traders can maximize their trading efficiency by identifying the most active trading periods, ensuring optimal liquidity and price discovery.

li>Risk Management: Understanding trading hours enables traders to manage their risk exposure effectively by square off their positions before the market close.

NSE Option Trading Timing: Strategies for Success

In the realm of NSE option trading, timing is everything. Traders who master the art of timing their trades can gain a significant edge in the market. Here are some strategies to consider:

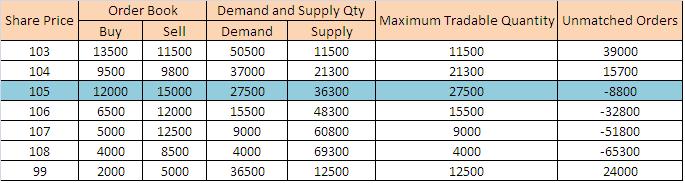

Image: www.basunivesh.com

Early Bird Advantage

Research suggests that initiating option trades close to the market open (around 9:15 AM) can be advantageous. This period often presents ample liquidity and volatility, allowing traders to capitalize on market inefficiencies and capture favorable entry prices.

Mid-Day Momentum

As the trading session progresses, volume and momentum tend to gather pace. The period between 11:00 AM and 1:00 PM is often characterized by increased trading activity, providing opportunities for intraday traders to execute profitable trades.

Afternoon Pullback

Towards the afternoon, the market may experience a period of pullback or consolidation. Around 2:00 PM, traders can look for potential trading opportunities by identifying stocks that have lost ground during the day but show signs of technical support.

NSE Option Trading Time: The Latest Buzz

Staying abreast of the latest trends and developments in NSE option trading is vital for informed decision-making. By monitoring updates from news sources, forums, and social media platforms, traders can gain valuable insights into:

- Market Sentiment: Gauging market sentiment through social listening and news headlines can provide insights into trader psychology and future market direction.

- Regulatory Changes: Keeping track of regulatory changes and announcements allows traders to adapt their strategies in accordance with evolving market conditions.

- New Trading Products: The NSE is continuously introducing new option trading products, such as index options and stock futures options. Staying informed about these products enables traders to diversify their trading portfolio.

Expert Tips and Advice for NSE Option Trading Time

Leveraging the experience and insights of seasoned traders can significantly enhance your understanding of NSE option trading time. Here’s what the experts have to say:

Trading Discipline

Maintain strict trading discipline by entering and exiting trades within the designated trading hours. Avoid holding option positions overnight or over weekends, as market conditions can change drastically during these periods.

Technical Analysis

Master technical analysis techniques to identify trading opportunities, set stop-loss orders, and determine optimal entry and exit points. Employing charts, indicators, and support/resistance levels can provide valuable insights into market trends.

Risk Management

Implement robust risk management strategies to control potential losses. Assess your risk tolerance, calculate the potential risk-to-reward ratio for each trade, and never invest more than you can afford to lose.

FAQs on NSE Option Trading Time

To address common queries related to NSE option trading time, here’s a handy FAQ section:

- Q: Can I trade options after the market closes?

A: No, all option trading ceases at 3:30 PM (IST) as per NSE regulations. - Q: What happens if I hold an option position past the trading hours?

A: Options positions held past 3:30 PM (IST) will be automatically squared off, and any remaining premium will be settled at the closing price. - Q: Is there a minimum trading volume required for option trading?

A: Yes, the NSE has established minimum trading volumes for option contracts to ensure market liquidity.

Nse Option Trading Time

Conclusion

NSE option trading time holds immense significance for traders seeking to maximize their returns and minimize risks. By understanding the trading hours, leveraging effective strategies, staying informed about market trends, and embracing expert advice, traders can navigate the dynamic world of NSE option trading with greater confidence and reap the rewards it offers.

Are you ready to delve into the exciting world of NSE option trading? Share your thoughts and questions in the comments section below. Let’s embark on this trading journey together.