In the electrifying realm of finance, options trading holds a mesmerizing allure. Among the myriad options strategies, knockout options stand out as a high-impact technique, offering both exhilaration and risk.

Image: traders-paradise.com

Picture yourself, a novice trader, navigating the bustling floor of the stock exchange. Your pulse quickens as you witness the adrenaline-fueled trading frenzy. Options, with their enigmatic charm and tantalizing potential, beckon you. You venture into the uncharted waters, eager to master this complex art.

Knockout Option Trading: An Introduction

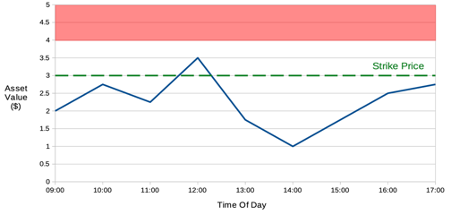

Knockout options, a distinctive form of options trading, bear a characteristic feature: a “knockout” level. This level acts as a trigger, and when the underlying security breaches it, the option expires worthless, effectively “knocking out” its holder.

Knockout options offer traders the alluring prospect of amplified returns, but this potential gain comes with the added risk that the option will be prematurely extinguished. The higher the knockout level set, the lower the premium, but also the greater the probability of the option being knocked out.

Deciphering the Knockout Option Vernacular

To navigate the intricacies of knockout option trading, it’s essential to grasp the key terminology:

- Knockout Level: The pre-defined price at which the option expires worthless.

- Premium: The price paid to the option writer (the seller) by the option holder (the buyer).

- Underlying Security: The stock, bond, or other asset that the option represents.

Understanding the Risks and Rewards

Like any high-stakes endeavor, knockout option trading demands a meticulous understanding of both the potential rewards and risks. Knockout options offer enhanced profit potential compared to traditional options due to lower premiums.

Conversely, the added risk of premature expiration looms over knockout options. This risk must be carefully managed through diligent analysis.

Image: www.daytrading.com

Harnessing Knockout Options Strategically

Seasoned traders employ knockout options in diverse stratagems. One popular tactic is the “bull call spread” with a knockout option. This strategy involves purchasing a higher-priced call option while simultaneously selling a lower-priced call option, with the knockout level set above the strike price of the purchased call option.

Another approach, known as the “bear put spread” with a knockout option, entails buying a higher-priced put option while selling a lower-priced put option, with the knockout level set below the strike price of the purchased put option.

Seeking Expert Guidance

Mastering knockout option trading demands continuous learning and expert counsel. Consult with seasoned traders, delve into industry publications, and attend workshops to hone your skills.

Remember, understanding market dynamics and managing risk are paramount to your success. By carefully calibrating your knockout option strategies, you can exploit the potential of this high-impact technique.

FAQs: Unveiling the Enigma of Knockout Options

Q: What are the advantages of knockout options?

A: Knockout options provide the potential for greater returns and lower premiums.

Q: What are the key risks associated with knockout options?

A: The premature expiration due to the knockout level poses a significant risk.

Q: How do I determine the optimal knockout level for my trades?

A: Understanding the underlying asset’s volatility and analyzing market trends are crucial in setting the knockout level.

Knock Out Option Trading

Conclusion: Embracing the Excitement of Knockout Options

Knockout option trading, with its inherent volatility and alluring profit potential, offers an adrenaline-charged trading experience. By embracing a thorough understanding of the mechanics, risks, and strategies involved, traders can harness this high-impact technique to navigate the ever-evolving financial landscape.

As you delve into the exhilarating world of option trading, remember the pivotal role of knowledge, risk management, and expert advice. Are you prepared to dare to venture into the captivating realm of knockout options?