Option trading is a popular way to speculate on the movement of stocks, indices, and other financial assets. It offers the potential for significant profits, but it is also a complex and risky strategy. In this article, we will discuss how much you can make on option trading, the factors that affect profitability, and the risks involved.

Image: club.ino.com

How Much Can You Make?

The amount of money you can make on option trading depends on a variety of factors, including the underlying asset, the type of option, the strike price, and the time to expiration. However, there is no limit to the amount of profit you can potentially make. In fact, some option traders have made millions of dollars in profits.

Of course, the potential for profit also comes with the potential for loss. If the underlying asset moves in the opposite direction of your prediction, you could lose all of your investment. For this reason, it is important to carefully consider the risks before entering into any option trade.

Factors that Affect Profitability

The following factors can all affect the profitability of an option trade:

- The underlying asset: The volatility of the underlying asset is a major factor in determining the profitability of an option trade. High-volatility assets are more likely to experience large price movements, which can lead to large profits (or losses).

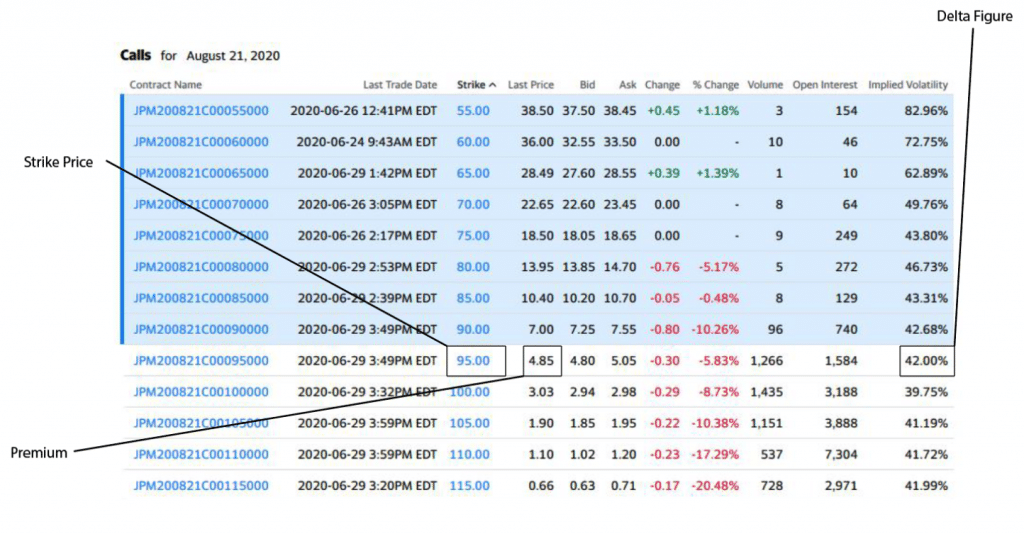

- The type of option: There are two main types of options: calls and puts. Call options give the holder the right to buy the underlying asset at a specified price, while put options give the holder the right to sell the underlying asset at a specified price. The type of option you choose will depend on your prediction about the direction of the underlying asset’s price.

- The strike price: The strike price is the price at which the holder of the option can buy or sell the underlying asset. The strike price you choose will depend on your prediction about the movement of the underlying asset’s price.

- The time to expiration: The time to expiration is the amount of time remaining until the option expires. The shorter the time to expiration, the more expensive the option will be.

Risks Involved

Option trading involves a number of risks, including:

- The risk of losing your entire investment: If the underlying asset moves in the opposite direction of your prediction, you could lose all of your investment.

- The risk of expiring worthless: If the underlying asset’s price does not reach the strike price by the expiration date, the option will expire worthless.

- The risk of being assigned: If you are the seller of an option, you may be assigned to buy or sell the underlying asset at the strike price. This can lead to a significant loss if the market price of the underlying asset is much lower or higher than the strike price.

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

Image: keysgame.pl

Is Option Trading Right for You?

Option trading can be a profitable way to speculate on the movement of stocks, indices, and other financial assets. However, it is important to understand the risks involved before entering into any option trade. If you are not comfortable with the risks, you should consider other investment options.

If you are interested in learning more about option trading, there are a number of resources available online and in libraries. You should also consider speaking with a financial advisor to discuss whether option trading is right for you.

How Much Can You Make On Option Trading

Conclusion

Option trading can be a powerful tool for generating profits, but it is also a complex and risky strategy. It is important to understand the risks involved before entering into any option trade. If you are not comfortable with the risks, you should consider other investment options.