In the realm of finance, options have emerged as powerful instruments offering astute investors opportunities to amplify their potential returns. Among the fascinating and often overlooked aspects of options trading lies a little-known force known as gamma. Understanding gamma is paramount for unlocking the true potential and managing the risks associated with options.

Image: www.projectfinance.com

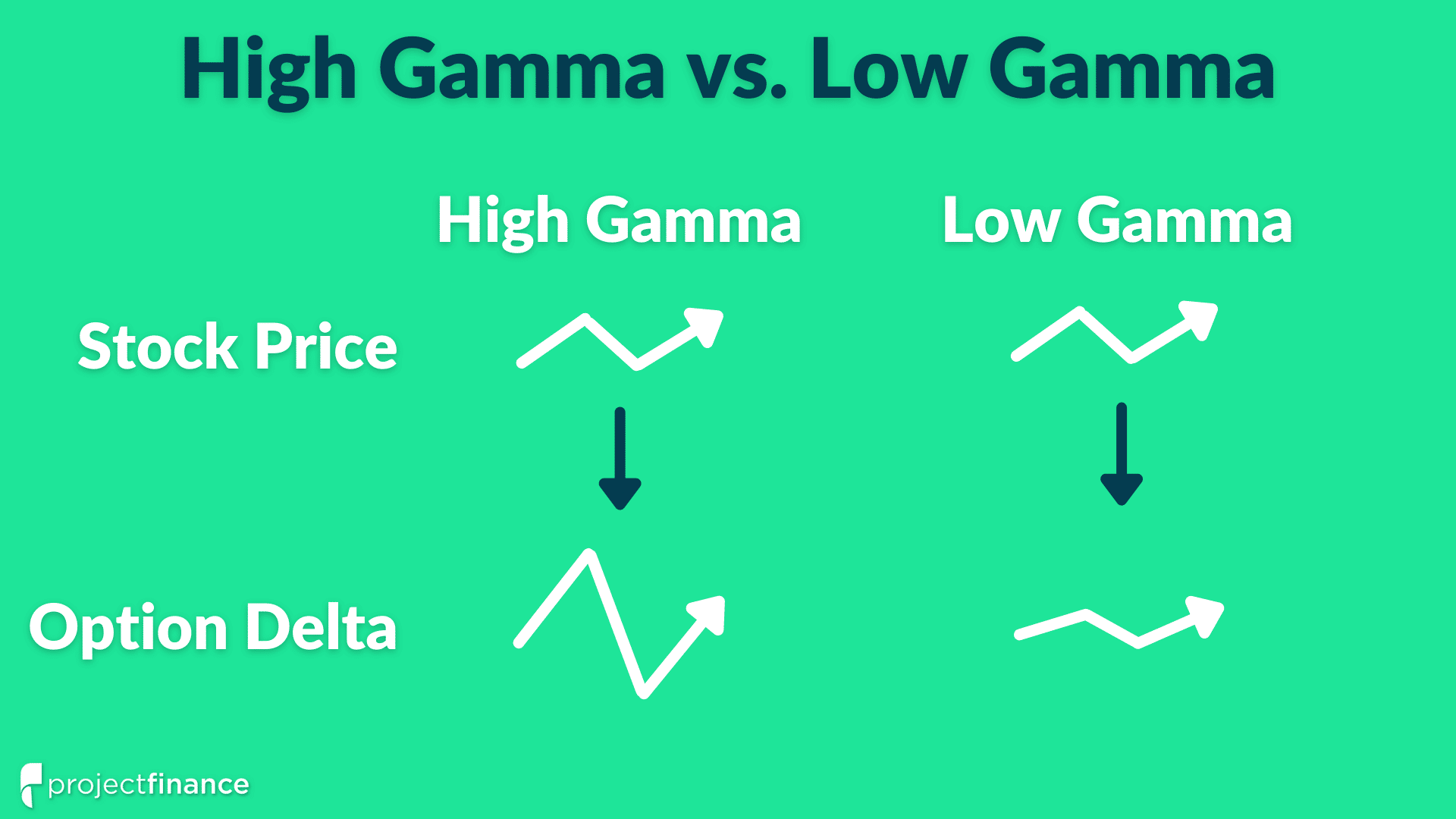

Gamma, in the context of option trading, refers to the sensitivity of an option’s delta to changes in the underlying asset’s price. Simply put, it measures how quickly an option’s delta, which represents the option’s rate of change in value with respect to the underlying asset, responds to price movements. Gamma is a dynamic concept that constantly shifts as the underlying asset’s price and the option’s time to expiration change.

Grasping the importance of gamma in the realm of option trading requires an appreciation of its profound implications. For instance, positive gamma denotes that the option’s delta is rising as the underlying asset’s price increases, while negative gamma indicates that the delta is decreasing. This understanding proves crucial for making informed decisions about options trading strategies.

Diving deeper into the nuances of gamma reveals its multifaceted nature. Short-dated options, typically defined by a remaining life of less than a month, tend to exhibit higher gamma values compared to their long-dated counterparts. This heightened gamma sensitivity stems from the accelerated impact of price changes on the option’s delta as expiration looms closer.

Furthermore, at-the-money options, whose strike price aligns closely with the underlying asset’s current market price, typically possess greater gamma than out-of-the-money options, which have strike prices significantly higher or lower than the underlying asset’s price. This disparity stems from the higher probability of an at-the-money option moving in-the-money with even minor price fluctuations, leading to a more pronounced shift in its delta.

The understanding of gamma grants traders a valuable tool for risk management and profit optimization in options trading. Positive gamma serves as a watchdog, providing a buffer against substantial losses in the event of sudden price movements in the underlying asset. On the other hand, negative gamma necessitates caution, as it amplifies losses when the underlying asset’s price moves against the trader’s position.

Harnessing the power of gamma requires a proactive approach, particularly in crafting tailored trading strategies. For instance, traders seeking to take advantage of potential upside in the underlying asset’s price may consider options with higher gamma to amplify their returns. Conversely, traders aiming to mitigate risk in volatile market conditions may opt for options with lower gamma to minimize potential losses.

As with all financial instruments, embracing gamma in option trading demands a discerning approach. It is imperative to meticulously analyze individual market conditions, including the underlying asset’s price trajectory, time to expiration, and implied volatility, before devising an optimal trading strategy.

In conclusion, gamma remains an indispensable concept in the realm of option trading, offering a gateway to unlocking profit potential while navigating market uncertainties. Thorough comprehension of gamma’s complexities empowers traders with the knowledge necessary to make well-informed decisions, ultimately increasing their chances of success in the dynamic and ever-evolving financial landscape.

Image: blog.tradesmartonline.in

Gamma In Option Trading

https://youtube.com/watch?v=kJzU3ysv0YM