Harness the Power of Derivatives for Informed Trading Decisions

Image: optionstradingiq.com

Navigating the world of futures and options trading requires a deep understanding of the underlying principles and strategies that drive these complex financial instruments. In this comprehensive guide, we embark on a journey to unravel the intricacies of futures and options trading, empowering you with the knowledge to make informed and lucrative trading decisions.

**Defining Futures and Options: Key Concepts**

A **futures contract** is an agreement to buy or sell a specific quantity of an underlying asset at a predetermined price on a future date. Options contracts, on the other hand, grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price within a certain time frame. These derivatives provide traders with powerful tools to manage risk, speculate on price movements, and capitalize on market opportunities.

**Fundamentals of Futures Trading Strategies**

Futures trading strategies revolve around predicting future price movements and aligning trades accordingly. Here are some fundamental approaches:

- Trend Following: Involves identifying and riding trend reversals in the futures market.

- Counter-Trend Trading: Capitalizes on short-term price fluctuations within the broader market trend.

- Breakout Trading: Targets trades when prices break through predefined support or resistance levels.

- Hedging: Utilizes futures contracts to offset risks associated with underlying positions.

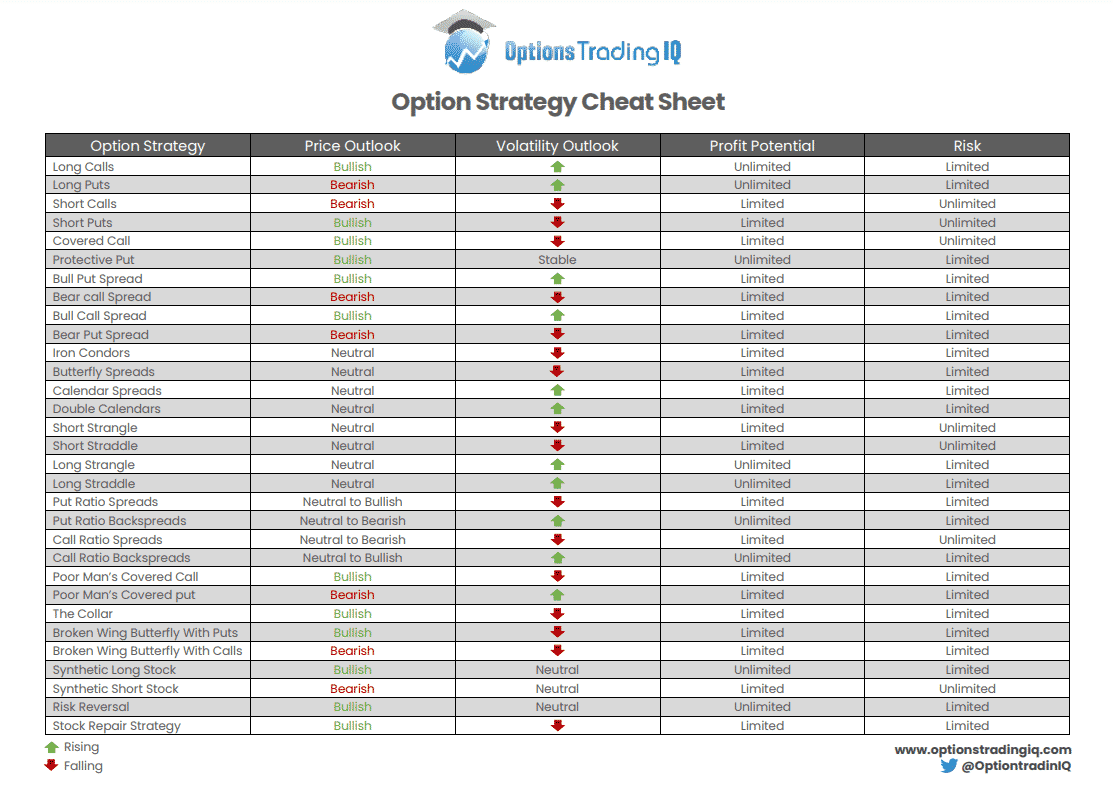

**Understanding Options Trading Strategies**

Options trading strategies leverage the unique characteristics of options to create tailored risk and return profiles. Common strategies include:

- Covered Calls: Involves selling a call option while holding an underlying asset, creating limited income potential but downside protection.

- Cash-Secured Puts: Similar to covered calls, but involves selling a put option while holding cash. It offers downside protection with a higher income potential.

- Bull Call Spreads: Buys a call option at a lower strike price and sells a call option at a higher strike price, betting on a substantial price increase.

- Bear Put Spreads: Buys a put option at a higher strike price and sells a put option at a lower strike price, speculating on a significant price decline.

Image: alphabetastock.com

**Practical Tips from Seasoned Traders**

To enhance your futures and options trading success, consider these insights from industry veterans:

- Manage Risk Prudently: Employ stop-loss orders, position sizing, and hedging strategies to control potential losses.

- Master Technical Analysis: Study price charts, indicators, and support/resistance levels to identify trading opportunities.

- Stay Informed: Keep abreast of market news, macroeconomic data, and expert insights to make informed trading decisions.

- Backtest and Refine Strategies: Test potential strategies on historical data before implementing them in real-time trading.

FAQs: Resolving Common Queries on Futures and Options Trading

Q: What is the difference between futures and forwards contracts?

A: Futures contracts are standardized and traded on exchanges, while forwards are customized and traded over-the-counter.

Q: How do options premiums affect option trading strategies?

A: Premiums represent the cost of options. Higher premiums imply greater market expectations of price movements.

Q: Can I lose more money than I invest in futures or options trading?

A: Yes, futures and options can be leveraged instruments, potentially leading to significant losses beyond the initial investment.

Futures And Options Trading Strategies Pdf

**Conclusion**

Navigating futures and options trading requires a comprehensive understanding of strategies, effective risk management, and ongoing knowledge acquisition. By embracing the principles and techniques outlined in this guide, you can embark on a journey to informed trading decisions and potentially achieve substantial gains in the competitive world of financial derivatives.

If futures and options trading fascinate you, delve deeper into its multifaceted dimensions. The knowledge you gain will empower you to make informed decisions, maximize the potential of these instruments, and potentially unlock financial success.