Introduction: Embarking on the Adventure of Options Trading

The world of finance is a captivating realm, offering opportunities for financial growth and wealth accumulation. Among its diverse landscape of investment options, options trading stands out as an alluring prospect for those seeking potential gains. However, navigating the intricacies of this trading arena can be daunting for beginners, especially when faced with the myriad of options trading platforms available. To simplify this journey, we delve into the characteristics of the easiest options trading platform, empowering you with the knowledge to make an informed choice and embark on your options trading adventure with confidence.

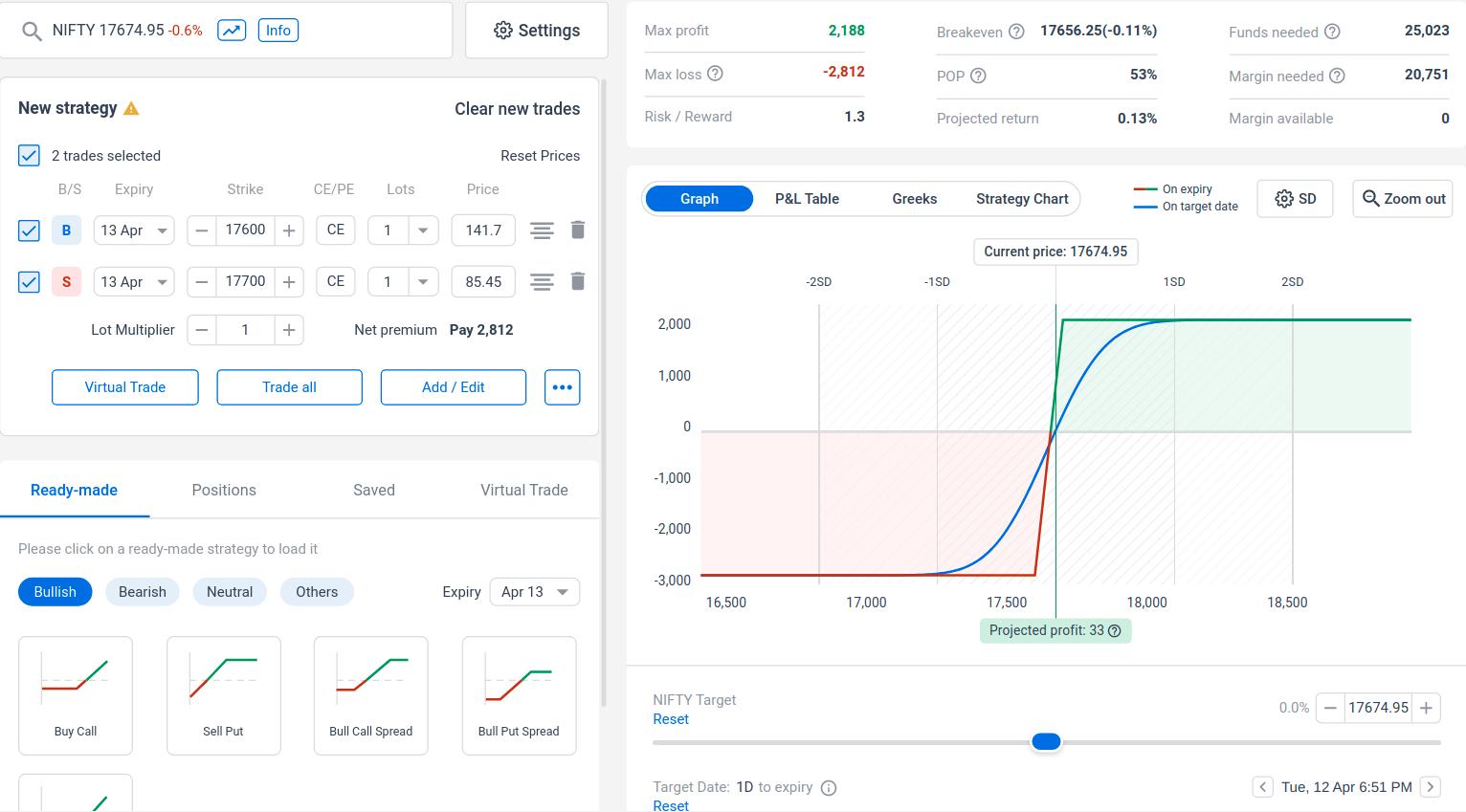

Image: www.pinterest.com

The Quest for Simplicity: Identifying an Easy-to-Use Platform

The complexities of options trading can be overwhelming, but the right platform can transform this perception. An easy-to-use platform serves as a guiding star, illuminating the path towards successful trades. Look for platforms that prioritize user-friendliness, featuring intuitive interfaces and straightforward navigation. Features like clear order entry systems, comprehensive charting tools, and real-time market data empower you to make informed decisions with ease.

Defining Simplicity in Options Trading

Simplicity in options trading manifests in several key aspects. First, the platform should present a user-friendly interface that mirrors the simplicity of everyday tools. Second, it should feature intuitive order entry systems, eliminating the need for complex coding or confusing jargon. Additionally, a robust educational component can profoundly enhance your understanding of options trading, empowering you to make informed decisions and navigate market complexities with greater confidence.

Exploring the Nuances of Options Trading

Understanding the fundamentals of options trading is paramount to unlocking its potential. Options can be perceived as contracts that grant you the right, but not the obligation, to buy (in the case of calls) or sell (in the case of puts) an underlying asset at a specified price on or before a predetermined date. Mastering the art of options trading requires a comprehensive grasp of the different options strategies, enabling you to customize your trades to align with your investment goals.

Image: stewdiostix.blogspot.com

Unveiling the Strategies of Options Trading

Options trading encompasses a diverse arsenal of strategies, each with its unique nuances. Covered calls involve selling a call option while owning the underlying asset, allowing you to generate income while maintaining potential upside. Cash-secured puts involve selling a put option while holding cash, granting you the potential to acquire the underlying asset at a lower price. Additionally, more complex strategies like spreads and multi-leg options offer advanced techniques for experienced traders.

Navigating the Evolving Landscape of Options Trading

The realm of options trading is constantly evolving, propelled by advancements in technology and market dynamics. Staying abreast of these trends is crucial for successful navigation. Monitor reputable sources, including financial news outlets, trading forums, and social media platforms, to gain insights into the latest strategies, market conditions, and regulatory changes. Incorporating these updates into your trading approach empowers you to stay ahead of the curve and adapt to the ever-changing landscape.

Expert Tips: Embracing Informed Options Trading

Seasoned traders have accumulated a wealth of experience, providing invaluable insights for aspiring options traders. Embrace their wisdom by implementing these expert tips:

- Start small: Begin your options trading journey with modest trades, gradually increasing your involvement as you gain confidence and experience.

- Educate yourself: Diligently study the intricacies of options trading through books, articles, and online resources. Knowledge is your most potent weapon in this market.

- Master risk management: Develop a robust risk management strategy to mitigate potential losses. Options trading involves inherent risks, so it’s essential to safeguard your financial well-being.

- Leverage technology: Embrace the power of technology to enhance your trading experience. Utilize charting software, backtesting tools, and market scanners to refine your decision-making process.

Frequently Asked Questions: Unlocking Options Trading Concepts

- What is the difference between a call and a put option?

- Call options grant you the right to buy an underlying asset, while put options grant you the right to sell.

- Can I lose more money than I invest in options trading?

- Yes, options trading involves leverage, which amplifies both potential profits and losses.

- How do I choose the right options trading platform?

- Consider user-friendliness, educational resources, trading tools, and fees when selecting a platform.

- What are the most important factors to consider when evaluating an options strategy?

- Factors include the underlying asset’s price, volatility, time to expiration, and your risk tolerance.

Easiest Options Trading Platform

Conclusion: Empowering Your Options Trading Journey

The path to successful options trading begins with choosing the easiest trading platform, one that aligns seamlessly with your skill level and preferences. Embrace the simplicity, harness the power of education, and stay attuned to the evolving landscape of options trading. By incorporating expert tips and navigating the nuances of options strategies, you can embark on this exciting financial adventure with confidence. Remember, the journey of a thousand trades begins with a single step. Are you ready to step into the world of options trading?