Introduction

In the realm of finance, options trading has emerged as a prevalent practice involving the buying and selling of contracts that confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and within a specified timeframe. While options trading has gained considerable traction in the global financial markets, it has also sparked intense debate within the Islamic finance community. Many scholars, guided by the principles of Islamic law, have deemed option trading inherently incompatible with the tenets of Islam, highlighting a number of fundamental reasons that render it haram.

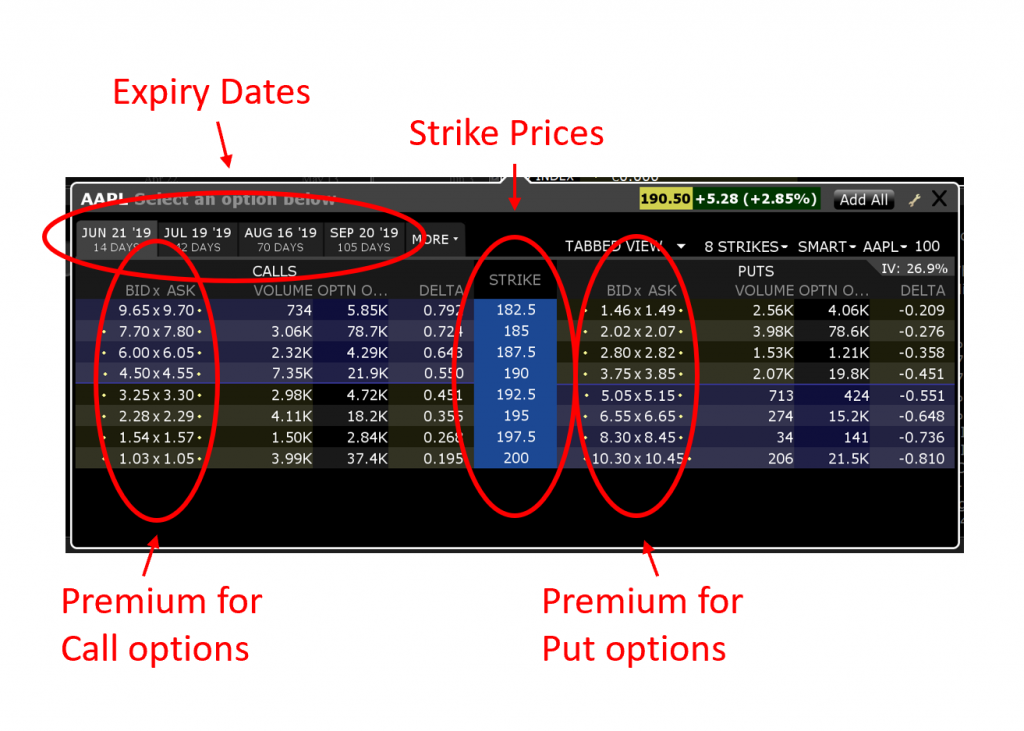

Image: visiongatorfadeskateboarddeckfast.blogspot.com

Inherent Uncertainty and Gharar

One of the primary factors that prohibit option trading in Islam is its inherent uncertainty. Options contracts grant the holder the right to exercise the option at a specified price on or before a predefined date. However, the actual underlying asset price may fluctuate significantly during the option’s lifetime, leading to unpredictable outcomes. This uncertainty introduces an element of gharar, or excessive uncertainty, which is strictly forbidden in Islamic finance. Gharar undermines the principle of fair exchange, as it leaves one or both parties to the contract vulnerable to unforeseen risks and losses.

Riba and Speculation

Another reason why option trading is considered haram is its potential to generate profits through speculation and interest, which are both strictly prohibited in Islam. Options trading often involves buying or selling options with the primary intention of profiting from price movements, rather than owning or using the underlying asset. This speculative nature conflicts with the Islamic principle of trade, which emphasizes the exchange of real goods and services with tangible value. Moreover, options trading can lead to the generation of interest payments, which are considered riba and are categorically forbidden in Islam.

Uncertain Delivery and Shirking of Obligations

In Islamic finance, contracts must clearly define the obligations of both parties and ensure the timely delivery of goods or services. However, option contracts may not always result in the actual purchase or sale of the underlying asset. The holder of an option has the right but not the obligation to exercise the option, which introduces an element of uncertainty into the contract. This uncertainty contradicts the Islamic principle of certainty in contracts and may lead to shirking of contractual obligations, which is considered a grave offense in Islam.

Image: ruangmenggambarnya16.blogspot.com

Exploitation and Unfair Gains

Option trading can create opportunities for exploitation and the acquisition of unfair gains. The inherent uncertainty surrounding options prices can lead to situations where one party takes advantage of the other’s lack of knowledge or information. This exploitation undermines the Islamic principle of justice and equity, which prohibits any form of unlawful gain or exploitation of others.

Alternative Islamic Solutions

Given the inherent incompatibility of option trading with Islamic principles, scholars have sought to develop alternative financial instruments that comply with the Shariah. These instruments, such as forward contracts and commodity murabaha, provide Islamic investors with legitimate avenues for managing risk and pursuing investment opportunities. By adhering to the ethical guidelines of Islam, these alternatives promote fairness, transparency, and the avoidance of excessive uncertainty.

Why Option Trading Is Haram

Conclusion

In conclusion, option trading is considered haram in Islam due to its inherent uncertainty, potential for speculation and riba, uncertain delivery, and exploitation risks. These elements contradict the fundamental principles of Islamic finance, which emphasize fairness, certainty, and the prohibition of excessive uncertainty and interest. While option trading may present opportunities for financial gain, it is ultimately incompatible with the values and ethical principles of the Islamic faith. Alternative Islamic financial instruments provide permissible options for risk management and investment within the boundaries of Shariah law, ensuring that Muslim investors can participate in financial markets while adhering to their religious values.