Have you ever wondered what the fuss is all about concerning options trading? In the realm of investments, options play a pivotal role, and understanding their intricacies can open doors to a lucrative world. Today, we’re diving into the captivating world of call and put options, unlocking the secrets of these versatile financial instruments.

Image: tradebrains.in

In this comprehensive guide, we’ll embark on a journey into the heart of options trading, exploring the history, concepts, and applications. Along the way, we’ll shatter the veil of complexity that often shrouds this topic and emerge with a newfound clarity that empowers informed investment decisions.

Call Options: A Shot at Ascendance

Imagine you believe a certain stock is poised to soar like an eagle. You envision its price climbing steadily, granting you handsome returns. This is where call options step into the limelight, like a magical genie granting wishes of financial triumph.

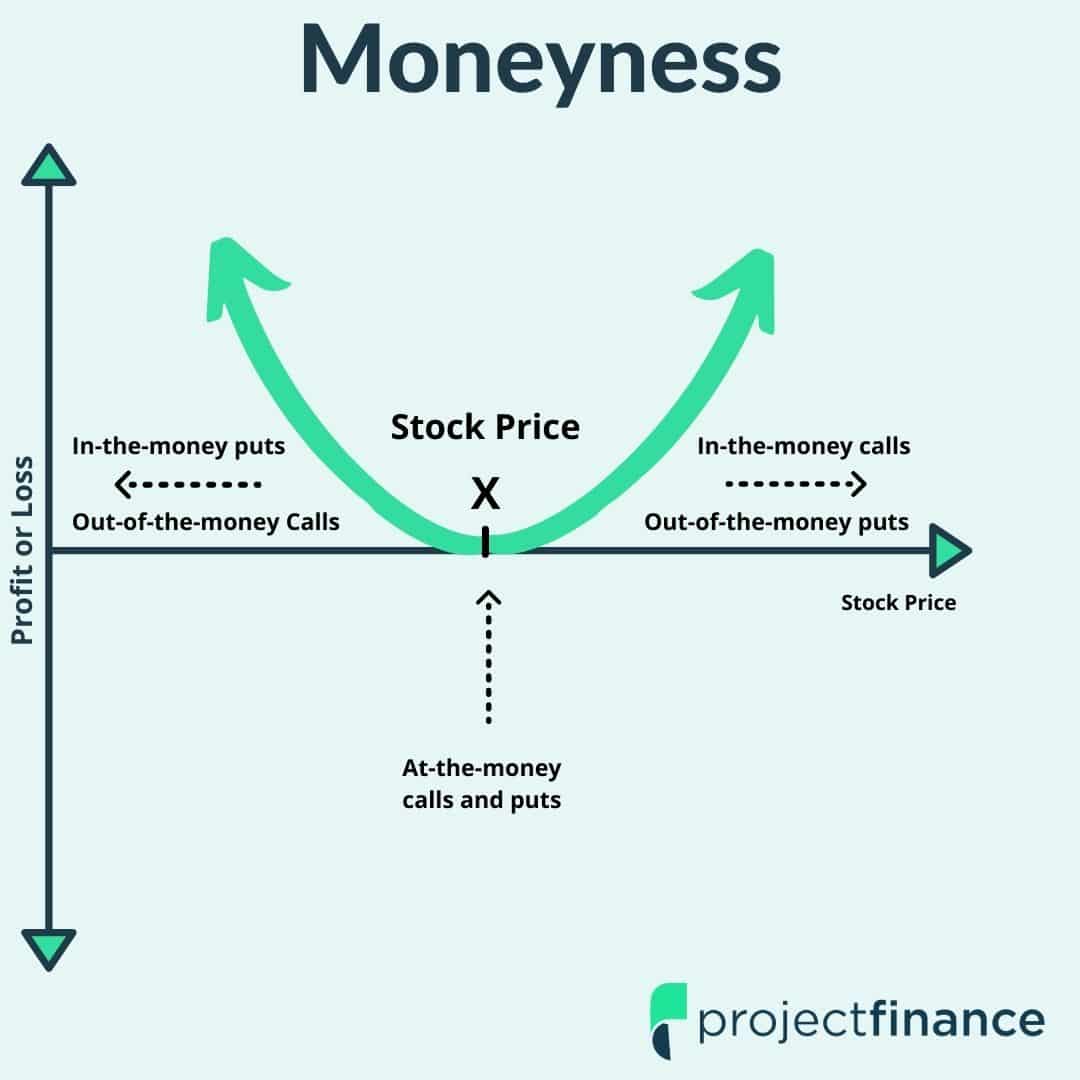

A call option bestows upon you the power to purchase an underlying asset, such as a stock, at a predetermined price, aptly termed the “strike price.” This transaction is scheduled to take place at a specific date, known as the “expiration date.”

The allure of call options is that they offer a tantalizing opportunity to profit from rising asset prices. If your prediction holds true and the stock takes flight, the value of your call option will soar, unlocking a gateway to substantial gains. However, like any form of investment, there’s always an element of risk involved.

Put Options: Hedging Against the Storm

Now, let’s shift our focus to the other side of the spectrum, where put options emerge as the valiant protectors against plummeting asset prices. Picture this: the clouds of uncertainty gather, casting shadows upon the financial landscape. A sense of unease grips the market, and you fear a particular stock might take a nosedive. This is where put options come to your rescue, like a trusty umbrella shielding you from the treacherous storm.

Upon acquiring a put option, you secure the right to sell an underlying asset, once again at a predetermined strike price and on a specified expiration date. Should your prophecy of a stock’s decline materialize, the value of your put option will blossom, potentially offsetting any losses incurred from the underlying asset’s devaluation.

History: Tracing the Roots of Options Trading

The history of options trading is a tapestry woven with threads of ingenuity and innovation. Its origins can be traced back to the vibrant trading floors of ancient Greece, where merchants engaged in practices resembling modern-day options.

Centuries later, the Dutch East India Company, renowned for its pioneering spirit, introduced options into the world of commodities. As global commerce expanded and financial markets blossomed, options gained widespread recognition and adoption.

Image: www.projectfinance.com

Applications: Unveiling the Versatility of Options

Options trading has evolved into an indispensable financial tool, employed by a diverse spectrum of investors. From risk-averse individuals seeking protection to seasoned professionals pursuing speculative gains, options offer a flexible and adaptable trading strategy.

Seasoned traders utilize options to hedge against potential losses, enhance portfolio returns, and even generate income through sophisticated strategies. The allure of options lies in their remarkable versatility, providing a customizable solution for a multitude of investment objectives.

What Is A Call And A Put In Options Trading

Conclusion: Unlocking the Potential of Call and Put Options

Options trading, with its blend of complexity and potential rewards, has captivated the financial world. By embracing a deep understanding of call and put options, you gain the power to navigate market uncertainties, maximize returns, and protect your investments from unfavorable conditions.

Delving into the intricacies of options trading unveils a world of possibilities, empowering you to shape your financial future with informed decisions. Embrace the knowledge, embrace the strategies, and embrace the transformative potential of options trading. As the master of your financial destiny, you can unlock doors to wealth creation and secure your financial well-being.