Introduction

Image: www.fastcompany.com

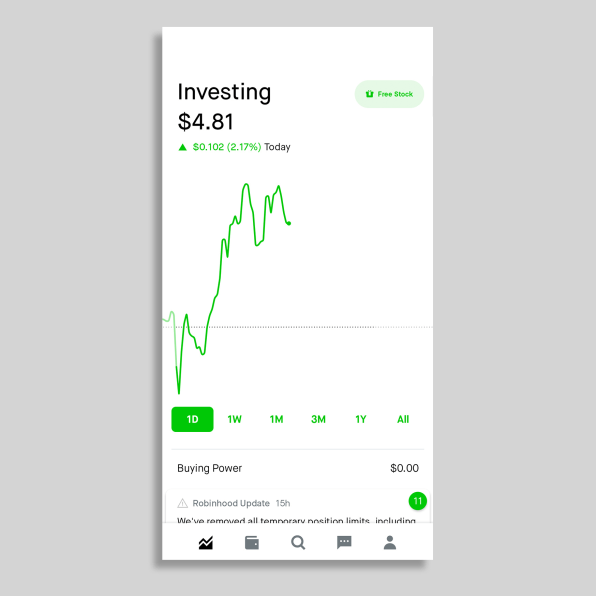

The allure of financial freedom and the potential to multiply wealth have drawn countless individuals to the world of investing. Among the various investment vehicles available, options trading has emerged as a popular choice for those seeking the chance for exponential returns. In recent years, the advent of online brokerages like Robinhood has made options trading more accessible than ever before, offering investors with limited capital the opportunity to participate in this exciting market. However, venturing into the realm of options trading, especially on margin, requires a thorough understanding of the risks and complexities involved. In this article, we will take a deep dive into trading options on margin with Robinhood, equipping you with the knowledge and insights you need to navigate this financial landscape responsibly.

Understanding Margin Trading

Margin trading is a form of leveraged investing that allows investors to borrow funds from their brokerage to trade securities. While it amplifies potential profits, it also magnifies potential losses beyond the initial capital invested. Before trading on margin, it is crucial to understand the basics of margin trading and carefully evaluate your financial situation. Robinhood requires that users maintain a minimum margin balance in their accounts to trade on margin, and failure to meet this requirement can result in a margin call, forcing you to deposit additional funds or liquidate positions to cover any shortfall.

Options Trading on Robinhood

Options are financial instruments that give the holder the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) an underlying security at a predefined price (the strike price) on or before a specific date (the expiration date). Trading options on margin involves borrowing funds from Robinhood to purchase options contracts, thereby increasing the potential returns while also heightening the risks involved.

Risks of Margin Trading Options on Robinhood

While margin trading options on Robinhood offers the allure of enhanced profits, it also comes with significant risks that should not be overlooked. Here are some key risks to consider:

- Magnified Losses: Using margin to trade options amplifies potential losses beyond your initial investment. In unfavorable market conditions, you could lose more than the amount of capital you put in.

- Margin Call: If the value of your options positions falls below a certain threshold, Robinhood may issue a margin call, requiring you to deposit additional funds or liquidate positions to meet the margin requirement. Failure to do so could result in the forced liquidation of your positions and significant financial losses.

- Limited Control: When trading options on margin, you are essentially using borrowed funds to make investment decisions. This can limit your control over your positions, as Robinhood may restrict trading or force liquidations based on its margin requirements.

- Emotional Trading: Margin trading can lead to emotional decision-making, especially during market volatility. The amplified potential returns can evoke a sense of urgency and overconfidence, potentially leading to unwise investment decisions.

Expert Insights on Margin Trading Options

Before embarking on margin trading options on Robinhood, it is wise to seek advice from experienced traders and financial professionals. Here are some expert insights to bear in mind:

“Margin trading options is a double-edged sword. It provides an opportunity for substantial profits but carries immense risk as well. Be conservative in your approach, only trade with funds you can afford to lose, and maintain a sound understanding of the risks involved.” – Mark Douglas, renowned trading coach

“Options trading on margin can be a powerful tool for experienced investors who are comfortable with risk management and short-term trading strategies. However, beginners should approach it with caution and seek professional guidance before engaging in margin trading.” – Jim Cramer, financial commentator

Conclusion

Trading options on margin with Robinhood can be a potential avenue for amplifying profits, but it carries inherent risks that must be carefully considered and managed. Before dipping your toes into margin trading, it is imperative to assess your financial situation, understand the associated risks, and develop a sound trading strategy. By approaching this financial venture with a clear mind, prudent decision-making, and a realistic understanding of the risks involved, you can harness the potential benefits of margin trading options on Robinhood while mitigating the pitfalls that lie along the path.

Image: www.warriortrading.com

Trading Options On Margin Robinhood