Introduction

In today’s rapidly evolving financial landscape, cryptocurrency options have emerged as a sophisticated tool for managing risk and maximizing returns. They offer traders the flexibility to adapt their strategies in response to market volatility, enhancing their potential for profit. As a crypto enthusiast, I have witnessed firsthand the transformative power of options trading and am eager to share my insights and experiences to empower fellow traders.

Image: www.hedgethink.com

What Are Crypto Options?

Crypto options are financial contracts that grant buyers the right, but not the obligation, to buy or sell a specific cryptocurrency at a predetermined price (strike price) on or before a set date (expiration date). Options traders can choose between two types: call options, which give the right to buy, and put options, which confer the right to sell.

Benefits of Trading Crypto Options

Crypto options offer several advantages over traditional crypto trading, including:

- Hedging against risk: Options enable traders to protect their portfolio against downside risk by purchasing put options.

- Leveraging volatility: Cryptocurrency markets are known for their high volatility, which options traders can exploit to generate substantial profits.

- Capital efficiency: Options require less capital upfront compared to spot trading, making them accessible to a wider range of traders.

Choosing a Crypto Options Trading Platform

Selecting a reputable and reliable crypto options trading platform is crucial for success. Consider the following factors:

- Security: Look for platforms with robust security measures to safeguard your funds and personal information.

- Fees: Compare fees for different platforms to find one that best suits your trading strategy.

- Trading tools: Opt for platforms that provide advanced trading tools such as charting, technical analysis, and order types.

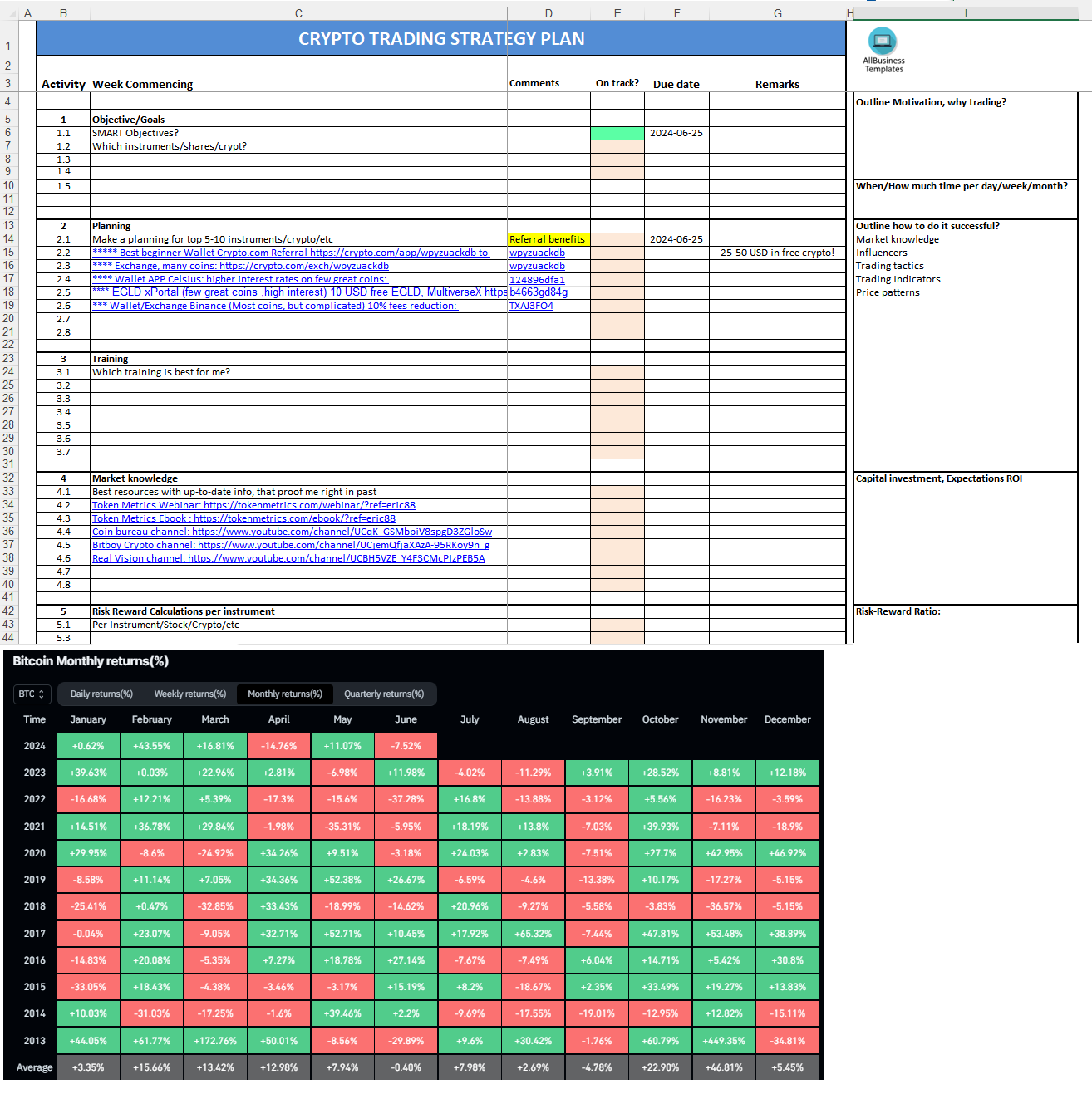

Image: www.allbusinesstemplates.com

Tips and Expert Advice for Crypto Options Traders

- Manage risk prudently: Options trading involves risk, so set realistic profit targets and maintain strict risk management practices.

- Study market trends: Keep an eye on market news, price movements, and technical indicators to make informed trading decisions.

- Understand options pricing: Familiarize yourself with the factors that influence options pricing, such as time to expiration, implied volatility, and interest rates.

Frequently Asked Questions (FAQs)

Q: What are the risks of trading crypto options?

A: Key risks include market volatility, option decay, and potential for unlimited loss.

Q: How do I calculate the potential profit or loss in options trading?

A: Use an options calculator or refer to the options chain provided by your trading platform.

Q: What strategies can I employ using crypto options?

A: Common strategies include hedging, arbitrage, covered call writing, and straddles.

Trading Options Crypto

Conclusion

Crypto options trading offers a powerful tool for managing risk and unlocking profit opportunities in the cryptocurrency market. By understanding the principles, choosing a reputable platform, and implementing sound risk management practices, traders can navigate the market effectively and capitalize on its transformative potential. Embrace the opportunities and challenges that options trading presents, and let your crypto investments soar to new heights. Are you ready to embark on the exciting journey of crypto options trading?