Understanding Call and Put Options

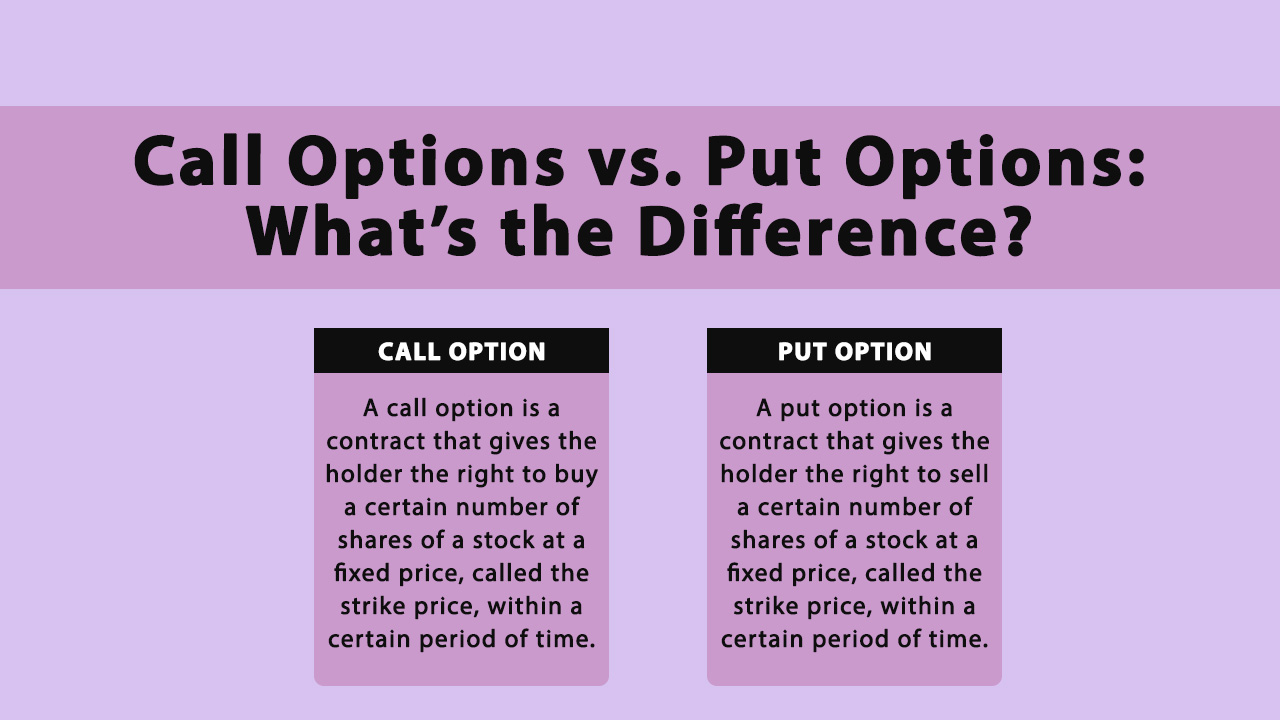

Options are flexible financial instruments that provide investors with the opportunity for leveraged exposure to a particular asset, granting the right (but not the obligation) to buy or sell an underlying security at a predetermined price (strike price) until a certain date (expiration). Options are classified into two primary categories: call options and put options.

Image: www.myfinopedia.com

Call Options: Call options bestow the right to buy an underlying security (asset or stock) at the specified strike price. If the security appreciates in value, the call option becomes valuable. Investors typically employ them to capitalize on anticipated price increases or hedge against potential losses.

Put Options: Conversely, put options provide the right to sell an underlying security at the predetermined strike price. They thrive in scenarios where the underlying security is expected to decline in value. Investors utilize them to wager on price decreases or as insurance against market fluctuations.

The Art of Trading Call vs. Put Options

Trading options involves making strategic choices between call and put options based on market conditions and investment objectives. Here are some critical factors to consider:

-

Market Outlook: If an individual anticipates an upward trend in the underlying asset’s price, a call option grants the right to buy at a reduced price, potentially yielding profit. In contrast, a put option would be chosen if a downward trend is anticipated.

-

Underlying Security Price: The option’s strike price determines the potential profit or loss of the investor. When the underlying security price moves in favor of the option holder, profit is generated.

-

Time Value: Options have an expiration date, influencing their value. As expiration approaches, the time value of options diminishes. This factor impacts the profit or loss potential, particularly in short-term trades.

-

Volatility: High volatility increases the price of options, presenting opportunities for both potential gains and losses. Investors must carefully assess market volatility to gauge the likelihood of a significant price movement and navigate potential risks.

Expert Tips for Options Trading

-

Conduct Thorough Research: Understand the nuances of options trading, including strike prices, expiration dates, and implied volatility, before making any trades.

-

Manage Risk Wisely: Determine the appropriate position size based on your risk tolerance. Limit exposure to multiple contracts, and consider employing risk-management strategies like hedging.

-

Trade with a Plan: Have a clear trading strategy that aligns with your financial goals. Determine your entry and exit points before initiating trades.

-

Understand the Greeks: Study Greek letters (e.g., Delta, Gamma, Theta) to analyze the sensitivity of options to changes in underlying security prices and volatility.

-

Seek Professional Guidance: Consult with financial professionals or reputable brokerage firms to enhance your knowledge and make informed decisions.

Frequently Asked Questions on Options Trading

-

What is the difference between a call and a put option?

- Call option: Gives the right to buy an underlying security at a specific strike price.

- Put option: Grants the right to sell an underlying security at a predefined strike price.

-

When to use call options?

- When an investor expects the value of an underlying security to increase.

-

When to use put options?

- When an investor projects the value of an underlying security to decline.

-

What are the risks involved in options trading?

- Limited profit potential and unlimited loss potential, time decay, volatility risk, and liquidity risk.

![[WIP] Enrollment – Options Trading Program | Beyond Insights](https://www.beyondinsights.net/wp-content/uploads/Call-vs-Put-Options.png)

Image: www.beyondinsights.net

Trading Options Call Vs Put

Conclusion

Trading options can be a powerful strategy for market participation, providing both potential gains and risk. By comprehending the intricacies of call and put options, assessing market conditions, and implementing prudent risk management, investors can navigate the complexities of options trading and make informed decisions. Embracing a proactive approach, traders can unlock the rewards of profitable options trading while safeguarding their capital.

Tell us: Are you intrigued by the world of options trading? We encourage you to delve deeper into this subject matter.