The Enigmatic World of Today’s Option Trading

In today’s rapidly evolving financial landscape, options trading has emerged as an enigmatic yet transformative force. This intricate art of using derivatives to speculate on underlying assets offers immense opportunities and risks. Whether you’re a seasoned investor or a curious enthusiast, navigating this dynamic arena requires a comprehensive understanding of its intricacies. This article aims to illuminate the enigmatic world of today’s option trading, empowering you with the knowledge and insights to make informed decisions and harness its vast potential.

Image: purepowerpicks.com

Origins and Evolution of Option Trading: From Humble Beginnings to Modern Marvel

The roots of option trading can be traced back to ancient Greece, where philosophers traded contracts to buy or sell wheat at a fixed price in the future. However, it wasn’t until the 19th century that organized options markets began to take shape in Europe. In the post-World War II era, the United States emerged as a global hub for options trading, with the establishment of the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE). Today, option trading has evolved into a sophisticated financial instrument, utilized by a wide range of market participants, from individual investors to institutional giants.

Understanding the Building Blocks of Option Trading

At its core, an option contract represents the right, not the obligation, to buy or sell an underlying asset (e.g., a stock or commodity) at a predetermined price (the strike price) on or before a set expiration date. There are two main types of options: calls and puts. Call options grant the buyer the right to purchase the underlying asset, while put options give the buyer the right to sell the underlying asset. The price of an option contract (the premium) is determined by a combination of factors, including the price and volatility of the underlying asset, the time to expiration, and the current market conditions.

Exploring the Nuances of Call and Put Options

Call options are typically used when an investor expects the underlying asset to rise in price. If the price of the underlying asset increases beyond the strike price, the buyer of the call option has the right to exercise it, profiting from the difference between the exercise price and the current market price. On the other hand, put options are typically used when an investor expects the underlying asset to decline in price. If the price of the underlying asset falls below the strike price, the buyer of the put option has the right to exercise it, profiting from the difference between the exercise price and the current market price. It’s important to note that exercising an option is not an obligation, but rather a right held by the buyer.

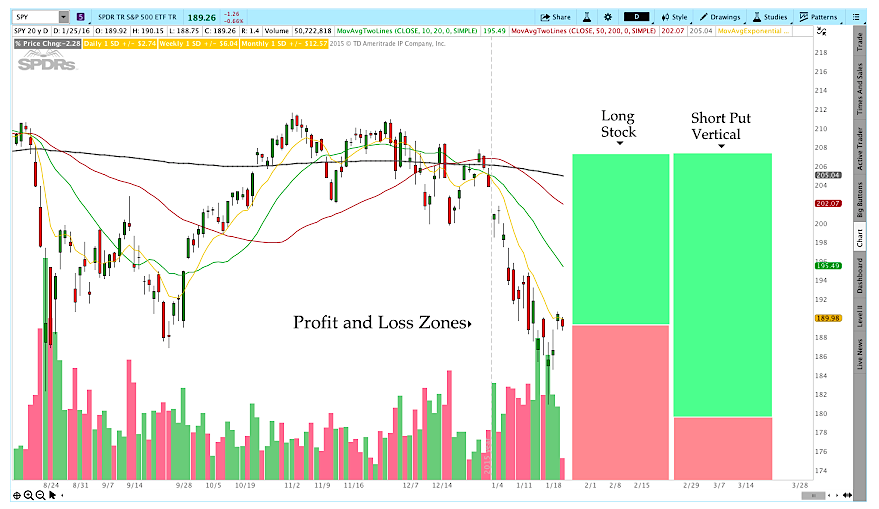

Image: www.seeitmarket.com

Harnessing Option Trading Strategies to Maximize Potential

Option trading offers a versatile arsenal of strategies, enabling investors to tailor their positions to specific market scenarios and risk tolerance. Some of the most common strategies include:

• Covered Call: Selling a call option against an underlying asset that you own to generate additional income while limiting downside risk.

• Protective Put: Buying a put option to protect against a potential decline in the value of an underlying asset that you own.

• Bull Call Spread: Buying a call option with a lower strike price and selling a call option with a higher strike price, creating a limited profit range.

• Bear Put Spread: Selling a put option with a lower strike price and buying a put option with a higher strike price, creating a limited profit range.

The Allure of Option Trading: Potential Profits and Calculated Risks

Option trading holds immense potential for profit generation for astute investors who possess a thorough understanding of the market intricacies and exercise careful risk management. By leveraging option strategies effectively, investors can enhance their returns, hedge against market downturns, and construct sophisticated income-generating positions. However, it’s crucial to recognize that option trading also involves substantial risk. The value of options can fluctuate drastically, and there is always the possibility of losing the entire investment.

Seeking Expert Guidance and Continuous Learning: The Path to Success

In the ever-evolving world of option trading, seeking expert guidance and committing to continuous learning are essential for success. Consulting with financial professionals, attending workshops and webinars, and studying educational materials can help you refine your strategies and stay abreast of the latest market developments. Remember, option trading is a dynamic field that requires ongoing knowledge and adaptive thinking.

Today Option Trading

Conclusion: Embracing the Power of Option Trading

Today’s option trading presents a transformative financial instrument, empowering investors to navigate the complexities of modern markets. By comprehending the core concepts, strategies, and risks involved, prudent investors can harness its vast potential to enhance returns, manage risk, and achieve their financial aspirations. Nevertheless, it’s paramount to approach option trading with a blend of calculated risk-taking and continuous learning. By embracing the challenges and rewards that it presents, you can unlock the power of today’s option trading and take a confident stride towards financial empowerment.