In the labyrinth of financial markets, options trading stands as a multifaceted realm where opportunities and risks intertwine. As an intrepid adventurer who ventured into this trading arena, I have witnessed firsthand the exhilarating highs and sobering lows. It is with this firsthand experience that I embark on this literary journey to unravel the complexities of options trading, providing you with the essential knowledge and expert insights to navigate this dynamic world.

Image: www.phatinvestor.com

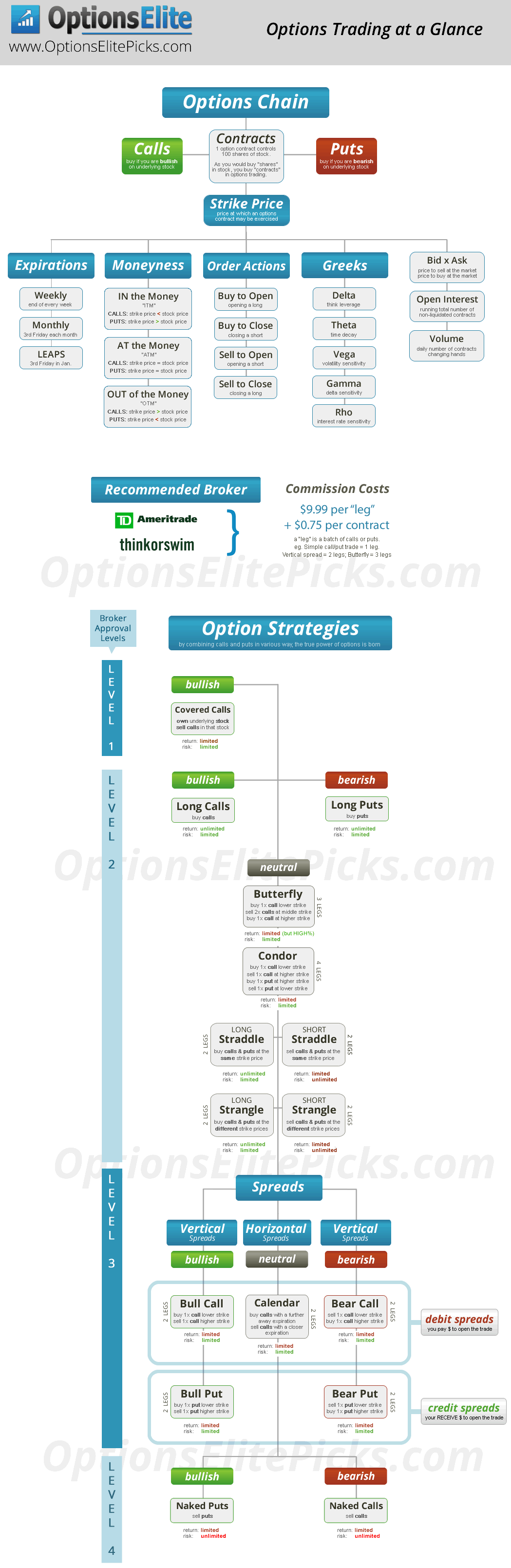

Options trading, in essence, grants the trader the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. This unique feature allows traders to speculate on the future price movements of assets, hedge against market risks, or generate income through various strategies.

A Historical Odyssey: The Evolution of Options Trading

From Humble Beginnings to Market Maturity

The origins of options trading can be traced back to ancient Greece, where philosophers and merchants engaged in agreements that granted them the option to buy or sell goods at a future date. Over the centuries, these rudimentary practices evolved into the sophisticated instruments we know today. The Chicago Board Options Exchange (CBOE), founded in 1973, played a pivotal role in the institutionalization of options trading, providing a centralized platform for trading standardized options contracts.

The Rise of Electronic Trading and Innovation

The advent of electronic trading in the late 20th century revolutionized options trading. High-speed data processing and automated execution algorithms transformed the market, allowing traders to access real-time information and execute trades with lightning speed. This technological evolution spurred innovation, leading to the development of new options strategies and the emergence of exchange-traded funds (ETFs) that track options indices.

Image: medium.com

Mastering the Options Landscape

Types of Options Contracts

Options contracts come in two primary flavors: calls and puts. Call options give the holder the right to buy the underlying asset, while put options grant the right to sell. Each option contract specifies the underlying asset, the strike price (the price at which the option can be exercised), the expiration date, and the premium (the price paid to purchase the option).

Option Premiums and Pricing

The value of an option premium is influenced by various factors, including the intrinsic value (the difference between the strike price and the current market price of the underlying asset), the time to expiration, and the volatility of the underlying asset. Volatility, a measure of price fluctuations, plays a crucial role in option pricing, as higher volatility generally leads to higher premiums.

Understanding Options Greeks

Options Greeks are metrics that measure the sensitivity of an option’s price to changes in underlying factors. Key Greeks include Delta (the change in option price for a $1 change in the underlying asset price), Gamma (a measure of how Delta changes as the underlying price changes), Theta (the decay in option value as time passes), and Vega (the change in option price for a 1% change in implied volatility).

Expert Strategies for Options Success

Seasoned options traders employ a diverse arsenal of strategies to enhance their trading performance. Covered calls involve selling a call option against a corresponding long position in the underlying asset to generate premium income while limiting potential upside. Cash-secured puts entail selling a put option and simultaneously setting aside cash to purchase the underlying asset if the option is exercised, offering downside protection with limited upside potential.

Tips for Aspiring Options Traders

Embrace a continuous learning mindset to stay abreast of market trends and evolving strategies. Diligently manage your risk by understanding your options positions and employing stop-loss orders to limit potential losses. Seek guidance from experienced traders or consult reputable resources to refine your trading acumen. Remember that options trading is not a get-rich-quick scheme; consistent dedication and meticulous execution are key.

Frequently Asked Questions on Options Trading

Q: What are the risks involved in options trading?

Options trading carries inherent risks, including the potential loss of the premium paid and the underlying asset value.

Q: Is options trading suitable for all investors?

Options trading requires a comprehensive understanding of financial markets and risk management. It is not recommended for novice investors or those with a low appetite for risk.

Q: How do I determine the best options strategy for my goals?

The optimal options strategy depends on your investment objectives, risk tolerance, and market outlook. Consider seeking advice from a financial professional to identify strategies aligned with your needs.

Www.Options Trading.Com

Image: thestockmarketwatch.com

Conclusion: Embracing the Options Arena

Navigating the world of options trading requires a curious mind, prudent risk management, and an unwavering pursuit of knowledge. By absorbing the insights shared in this article, you have equipped yourself with a solid foundation to venture into this dynamic trading arena. Remember, success in options trading lies not in seeking instant gratification but in cultivating a holistic understanding and employing sound execution. Embrace the opportunities and challenges that await you, and let your options trading journey be a testament to your financial prowess and trading wisdom.

Are you ready to delve into the exhilarating world of options trading? Let your curiosity guide you as you explore the myriad opportunities and insights that await.