Options trading has emerged as a potent tool for investors seeking to navigate the complexities of the financial markets. However, the question of where the central exchange for options trading resides remains a mystery to many. Embark on an enlightening journey as we delve into the core of this matter, dispelling misconceptions and shedding light on the vibrant tapestry of options trading.

Image: www.cmtrading.com

The Genesis and Evolution of Options Exchanges: A Chronicle of Market Innovation

The concept of an options exchange has its roots in the early days of finance, when merchants sought to mitigate risk by trading contracts. These contracts granted the buyer the option, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. Over time, as the financial landscape evolved, dedicated exchanges emerged, catering specifically to the burgeoning options market.

The Chicago Board Options Exchange (CBOE), established in 1973, stands as a testament to the rise of organized options trading. This revolutionary platform provided a centralized marketplace where standardized options contracts could be traded, ensuring transparency, liquidity, and standardized trading practices. In its wake, other exchanges, both domestic and international, followed suit, establishing a robust ecosystem for options trading.

Dissecting the Central Exchange: A Nexus of Options Activity

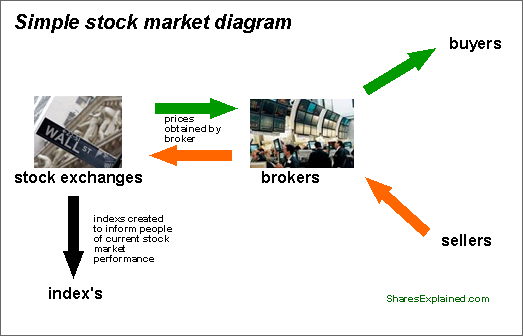

Today, the central exchange for options trading serves as a vibrant hub where buyers and sellers congregate to execute their strategies. These exchanges play a pivotal role in the options market, facilitating the seamless execution of options contracts and ensuring market integrity. Traders can access a vast array of options contracts, ranging from single-stock options to complex multi-asset strategies.

The central exchange also serves as a price discovery mechanism, reflecting the collective wisdom of market participants. In this marketplace of ideas, supply and demand forces interact, determining the fair value of each options contract. This transparent price discovery process fosters confidence among traders and enhances the overall efficiency of the options market.

Venturing Beyond Central Exchanges: The Rise of Decentralized Trading

While central exchanges continue to dominate the options trading landscape, decentralized exchanges have gained significant traction in recent years. These blockchain-based platforms empower traders with greater anonymity and autonomy, offering an alternative to the traditional exchange model. Decentralized exchanges often leverage automated market makers (AMMs) to facilitate peer-to-peer trading, eliminating the need for intermediaries.

Despite their potential, decentralized exchanges still face challenges in terms of liquidity and regulatory oversight. As this nascent space matures, it remains to be seen whether decentralized exchanges can rival the dominance of central exchanges in the options trading realm.

Image: www.managementguru.net

The Future of Options Trading: Innovation in the Digital Age

As technology relentlessly reshapes the financial landscape, the future of options trading appears both promising and uncertain. The convergence of artificial intelligence, big data, and blockchain technology has the potential to revolutionize the way options are traded, analyzed, and executed.

Algorithmic trading strategies, fueled by AI and machine learning, are poised to enhance trading efficiency and capture market opportunities. Advanced data analytics tools will empower traders with unprecedented insights into market dynamics, enabling data-driven decision-making. Furthermore, blockchain technology has the potential to streamline settlement processes and reduce counterparty risk.

Embracing these transformative technologies, the options trading ecosystem is poised for continued growth and innovation. The central exchange, while remaining a cornerstone of the market, may evolve to accommodate these advancements, fostering a more sophisticated and interconnected options trading landscape.

Where Is The Central Exchange For Options Trading

Image: www.worldatlas.com

Conclusion: Empowered Options Trading in the 21st Century

Exploring the central exchange for options trading has unveiled a world of market dynamics, innovation, and potential. Whether you are a seasoned trader or just starting your journey into the world of options, understanding the core principles and future trends of this market is paramount. By staying abreast of these developments, you empower yourself to make informed decisions, navigate market complexities, and harness the full potential of options trading in the 21st century.