Imagine navigating a stormy sea of financial markets, where sudden shifts and unpredictable turbulence can capsize even the most seasoned investors. In such a volatile environment, the VIX, or Volatility Index, emerges as a beacon of stability, providing a measure of the market’s expected volatility over the next 30 days. Enter VIX options – sophisticated trading vehicles that empower investors to harness this volatility to their advantage. But before you dive in, understanding VIX option trading hours is crucial.

Image: etffocus.substack.com

What are VIX Options, Exactly?

VIX options are derivative contracts that allow traders to speculate on the future value of the VIX. By trading these options, investors can hedge against market volatility, enhance their portfolio returns, and strategically manage risk. However, these powerful tools come with a unique set of trading hours that you must be aware of to maximize their potential.

VIX Option Trading Hours: Unveiling the Market’s Rhythm

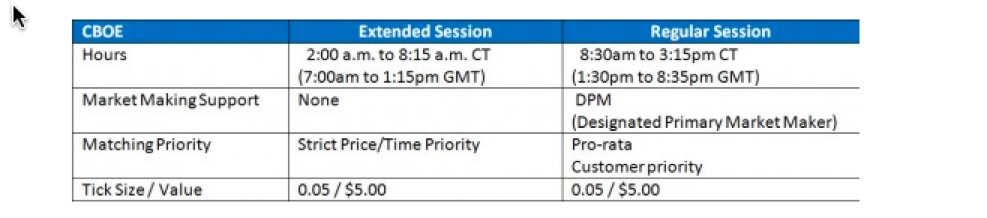

VIX options trade during the regular trading hours of CBOE Global Markets, the exchange where they are listed. These hours generally extend from 9:30 AM to 4:15 PM ET, Monday through Friday, excluding holidays. However, extended-hours trading is available for VIX options, allowing traders to place orders before and after the regular market hours.

-

Pre-market trading session: 8:00 AM to 9:30 AM ET

-

Post-market trading session: 4:15 PM to 5:15 PM ET

The extended-hours trading sessions provide greater flexibility and enable investors to respond to overnight market events or anticipate market movements during the pre-market period. Nonetheless, liquidity may be lower during these extended hours, so traders must adjust their expectations accordingly.

Expert Insights: Navigating the VIX Option Market

“Understanding VIX option trading hours is paramount,” emphasizes Dr. Mark Sebastian, a leading expert in volatility trading. “The timing of your trades can significantly impact your profitability. By grasping the market’s rhythm, you can position yourself to capitalize on volatility spikes and minimize potential losses.”

Dr. Sebastian further advises, “Leverage the extended-hours trading sessions to your advantage. Many traders prefer to enter or exit positions before or after the regular market hours to avoid the price gaps that can occur during the market open or close.”

Image: optiontiger.com

Actionable Tips for VIX Option Traders

-

Study historical VIX option trading patterns to identify optimal entry and exit points.

-

Monitor market news and events that could influence VIX volatility.

-

Utilize technical analysis tools to identify potential support and resistance levels.

-

Manage your risk carefully by using stop-loss orders and position sizing strategies.

Vix Option Trading Hours

Image: www.investopedia.com

Conclusion: Embracing the Volatility Advantage

VIX option trading hours are a crucial aspect of successful volatility trading. By understanding these hours and incorporating the insights shared by experts, you can unlock the power of VIX options to navigate the ever-changing market landscape. Embrace the volatility advantage and seize the opportunity to enhance your portfolio’s performance and mitigate market risks with confidence.