Have you ever wondered when the best time to trade options in the US market is? As an eager stockbroker navigating the fast-paced world of options trading, I stumbled upon a crucial factor that significantly impacted my success: understanding the nuances of US option trading hours. Join me as I unveil the secrets of the market’s temporal pulse, empowering you to optimize your trading strategy and maximize your returns.

:max_bytes(150000):strip_icc()/dotdash_Final_After_Hours_Trading_Oct_2020-01-e1708defac9e432eb6179f9c74d318a6.jpg)

Image: www.investopedia.com

In the realm of options trading, timing is everything. The ebb and flow of the market throughout the day presents unique opportunities and challenges for traders. By aligning your trading activities with the optimal trading hours, you can harness the market’s momentum and mitigate potential risks.

US Option Trading Hours: A Precise Schedule

In the United States, options trading takes place on designated exchanges during specific hours. The primary trading hours for options are from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday. During these hours, liquidity is at its peak, providing traders with the tightest spreads and the most favorable execution prices.

Pre-Market and After-Market Trading: Expanding Your Options

While the primary trading hours offer the most active market conditions, pre-market and after-market trading sessions can also provide lucrative opportunities for savvy traders. Pre-market trading begins at 8:00 AM ET, allowing you to gauge market sentiment and position yourself before the official market open. After-market trading extends from 4:00 PM to 8:00 PM ET, providing an additional window to capitalize on market movements and adjust your positions.

Market Rhythm: Unraveling the Patterns

Throughout the trading day, the options market exhibits distinct patterns that can influence your trading decisions. During the first hour of trading, the market tends to be more volatile, as traders react to overnight news and events. As the day progresses, volatility generally subsides, and the market enters a calmer phase. The final hour of trading can again bring increased volatility, as traders square off their positions before the market close.

By understanding these market rhythms, you can tailor your trading strategy to capitalize on specific market conditions. For instance, if you prefer volatile trading, the first and last hours of the trading day may be more suitable for your approach. Alternatively, if you seek more stable market conditions, trading during the mid-day hours may be more advantageous.

Image: tradeproacademy.com

Expert Tips and Market Insights

To enhance your understanding of US option trading hours, I present valuable tips and expert advice from seasoned traders:

- Familiarize yourself with the trading schedule and stick to it. Consistency is key in establishing a successful trading routine.

- Monitor pre-market and after-market trading sessions to identify potential opportunities and market trends.

- Consider the market rhythm and adjust your trading strategy accordingly to optimize your returns.

- Stay informed about market news and events that may impact option prices.

- Execute trades quickly and efficiently during peak trading hours to secure the best execution prices.

By embracing these expert insights, you can refine your trading approach and increase your chances of achieving success in the dynamic and ever-evolving options market.

Frequently Asked Questions

- Q: What are the primary trading hours for options in the US?

- A: The primary trading hours for options in the US are from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday.

- Q: Are there any pre-market or after-market trading sessions for options?

- A: Yes, pre-market trading begins at 8:00 AM ET, and after-market trading extends from 4:00 PM to 8:00 PM ET.

- Q: How does the market rhythm affect option trading?

- A: The market exhibits distinct volatility patterns throughout the trading day. The first and last hours of trading tend to be more volatile, while the mid-day hours are typically calmer.

- Q: Is it crucial to trade during primary trading hours?

- A: While primary trading hours offer the most liquidity and favorable execution prices, pre-market and after-market trading sessions can also provide opportunities for experienced traders.

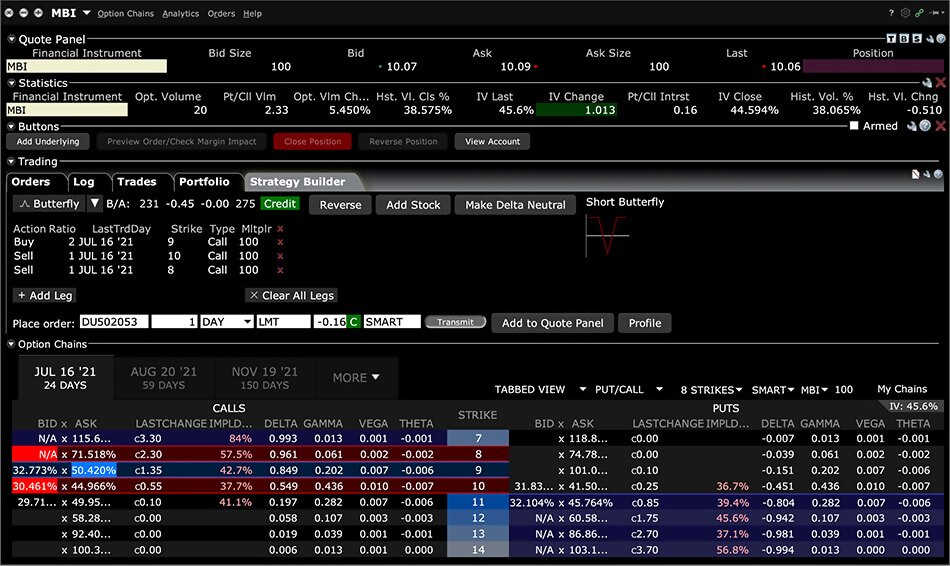

Us Option Trading Hours

Image: www.interactivebrokers.com

Conclusion

Understanding US option trading hours is a foundational step towards successful trading. By aligning your trading activities with market rhythms and incorporating expert advice, you can optimize your strategy and maximize your potential. Remember, the stock market is an ever-evolving landscape, so stay informed, adapt to changing conditions, and continually refine your approach. Whether you are a seasoned trader or just starting your options trading journey, I encourage you to explore the topic further and delve deeper into the intricacies of market timing.

So, are you ready to embrace the rhythm of the US option trading market? The clock is ticking; seize this opportunity to empower your trading decisions and unlock your path to market success!