In the turbulent waters of financial markets, volatility reigns as a formidable force. For the astute investor, however, it presents a lucrative opportunity to harness its ebb and flow. One opportune strategy lies in trading weekly options at expiration, where volatility reaches its peak.

Image: peherik.web.fc2.com

As options approach their final days, their value becomes heavily dependent on the underlying asset’s price action. The closer the option gets to expiring “in the money” (i.e., exercising profitable), the greater its value can become. This surge in value is particularly pronounced during periods of high volatility, as investors scramble to hedge against potential losses or capitalize on sudden price swings.

Trading Volatility on Weekly Options

Trading volatility on weekly options involves exploiting the relationship between volatility and option premiums. When volatility increases, so does the demand for options, pushing premiums higher. Investors can capitalize on this by buying options when volatility is low and selling them near expiration when volatility is expected to peak.

The allure of trading weekly options lies in their highly leveraged nature. By committing a relatively small amount of capital, investors can gain exposure to a much larger position in the underlying asset. This leverage provides the potential for significant profits, but it also magnifies risks.

Key Considerations

Navigating the labyrinth of trading volatility on weekly options demands a keen understanding of key concepts:

- Theta Decay: Options lose value as they approach expiration, especially after the initial large decay of overnight theta decay.

- Implied Volatility: This metric gauges market expectations for future volatility. Higher implied volatility indicates that investors anticipate more significant price fluctuations.

- Delta: Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price.

- Rollover Strategies: These tactics involve rolling over expiring options to later expiration dates to extend their time decay.

Expert Advice

- Trade with Confidence: Understand the inherent risks of volatility trading and have a clear trading plan.

- Monitor Volatility: Employ tools like the CBOE’s VIX index to gauge expected volatility levels.

- Leverage Option Strategies: Explore more advanced strategies such as spreads and iron butterflies to manage risk and enhance returns.

Image: www.cboe.com

Frequently Asked Questions

Q: What is the best time frame for trading weekly options?

A: Trading weekly options around earnings releases or significant news events can increase volatility and profit potential.

Q: How can I limit my risk exposure?

A: Employ risk management techniques like position sizing, stop-loss orders, and employing proper option strategy selection.

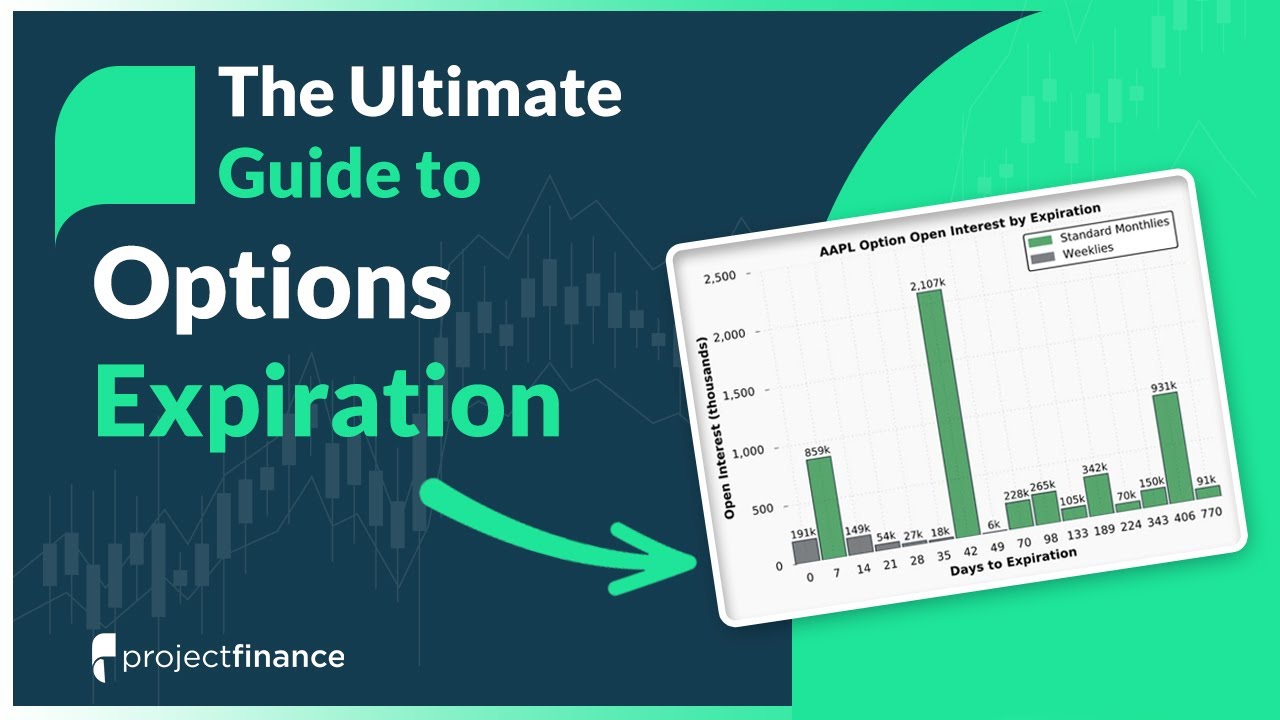

Trading Volatility On Weekly Options At Expiration

Image: www.youtube.com

Conclusion

Trading volatility on weekly options at expiration is an exhilarating and potentially lucrative strategy that requires a keen understanding of market dynamics and risk management. By harnessing the power of leverage and exploiting the relationship between volatility and option premiums, investors can navigate the turbulent seas of the financial markets and emerge with a significant return on their investment.

Are you ready to dive into the world of weekly options trading and seize the opportunities that volatility presents?