Image: www.spxoptiontrader.com

Introduction

The S&P 500 index, a benchmark for the overall U.S. stock market, offers investors a unique opportunity to participate in the market’s growth or hedge against downturns. Trading S&P 500 index options on TD Ameritrade, a renowned online brokerage platform, allows you to magnify your returns or minimize your risks.

Unveiling the Power of Index Options

Index options are financial instruments that give you the right, but not the obligation, to buy (call option) or sell (put option) an underlying index (in this case, the S&P 500) at a specific price (strike price) on or before a predetermined date (expiration date). They provide a versatile tool for investors with varying goals and risk tolerances.

Navigating the TD Ameritrade Platform

TD Ameritrade’s intuitive trading platform offers a comprehensive suite of features and tools tailored for index options traders. The platform enables you to:

- Monitor index prices and option chains in real time

- Place and manage option orders seamlessly

- Analyze option Greeks and risk metrics

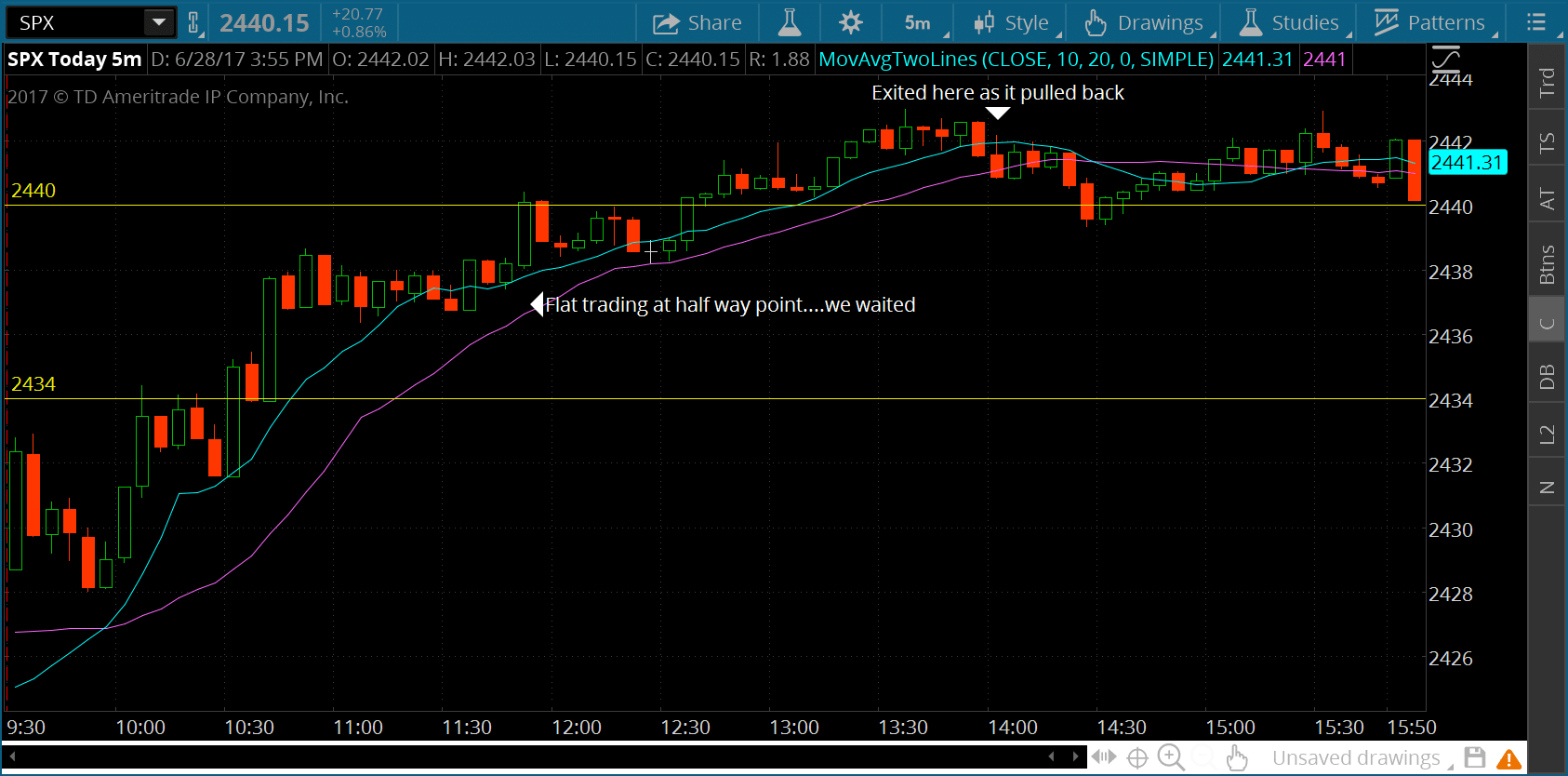

- Trade directly from charts for a comprehensive visual analysis

Expert Insights: Mastering Option Trading

“Options trading presents a powerful opportunity to enhance your investment strategies,” says renowned trader and market analyst, Emily Jones. “By understanding the nuances of index options and leveraging the right tools, investors can navigate market volatility and achieve their financial objectives.”

Actionable Tips for Successful Trading

To maximize your success in trading S&P 500 index options on TD Ameritrade, consider the following tips:

- Stay informed about the latest market trends and economic indicators.

- Choose expiration dates that align with your trading strategy.

- Determine appropriate strike prices that match your risk appetite.

- Calculate option premiums and Greeks to assess potential returns and risks.

- Manage your trades actively and adjust your positions based on market movements.

Exploring the Benefits of S&P 500 Index Options

Trading S&P 500 index options on TD Ameritrade offers a myriad of benefits:

- Enhanced Returns: Amplify your potential returns by leveraging the power of leverage.

- Risk Management: Protect your portfolio from market downturns by utilizing put options as a hedge.

- Income Generation: Sell options premiums to generate additional income.

- Flexibility: Adjust your trading strategies based on market conditions.

Conclusion

Trading S&P 500 index options on TD Ameritrade provides a compelling opportunity to harness the market’s fluctuations. By leveraging the platform’s advanced tools, accessing expert insights, and implementing actionable tips, investors can enhance their returns, mitigate risks, and achieve their financial goals. Embrace the power of index options and take your trading strategies to the next level.

Image: payehuvyva.web.fc2.com

Trading The Spx Index Options Tdameritrade

Image: www.youtube.com