Prelude: The Intriguing Tale of Hedging and Growth

In the realm of financial markets, a perpetual dance unfolds between stocks and options, each instrument offering distinct benefits and risks. Stocks, as slices of company ownership, provide a direct avenue to ride the waves of business performance. On the other hand, options, with their complex tapestry of contracts, offer a versatile tool to tailor investment strategies. This discourse aims to unravel the intricacies of trading stocks against an option position, empowering you to navigate the financial landscape astutely.

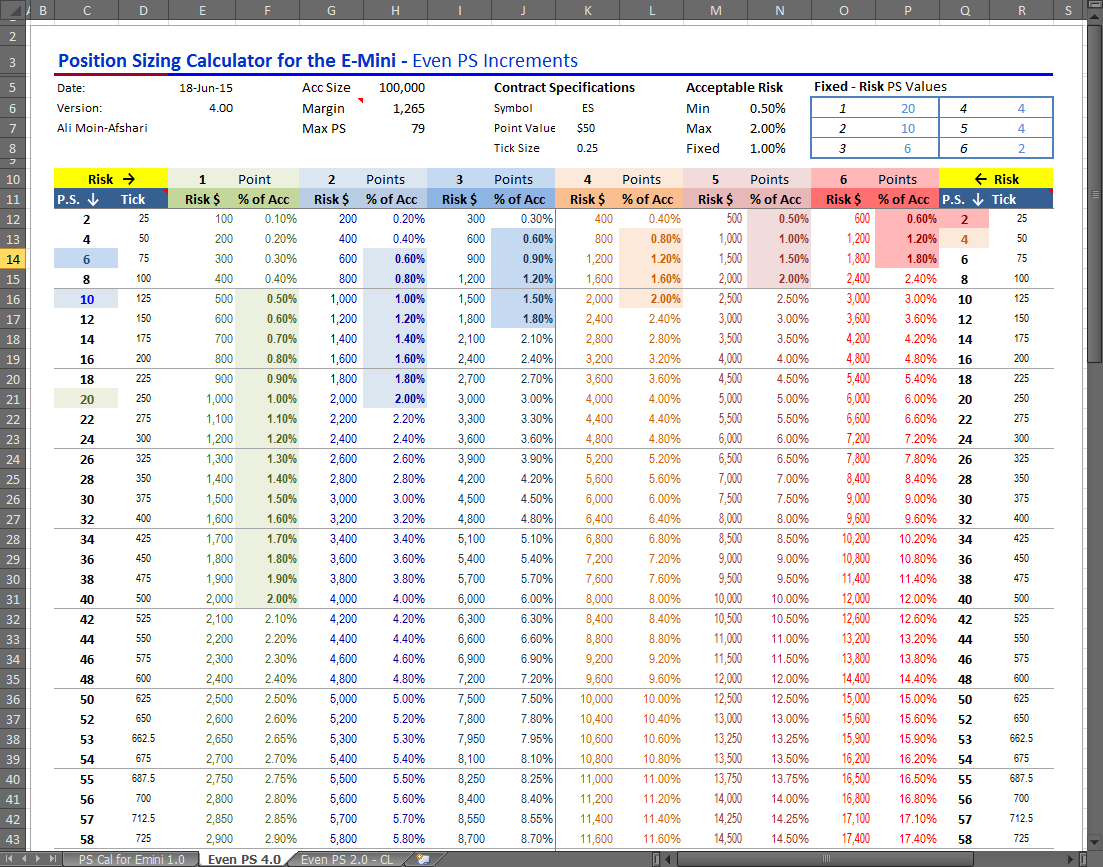

Image: otrabalhosocomecou.macae.rj.gov.br

Decoding the Stock-Option Dichotomy

Stocks embody a forward-looking stake in a company’s destiny. Buying a stock implies an optimistic outlook, anticipating its value appreciation. In contrast, options, often described as ‘leveraged derivatives,’ afford numerous strategic possibilities. Options contracts delve into the realm of time, granting the holder the right (but not the obligation) to buy or sell an underlying asset at a predetermined strike price. This flexibility empowers traders to construct intricate hedging strategies and leverage their market insights.

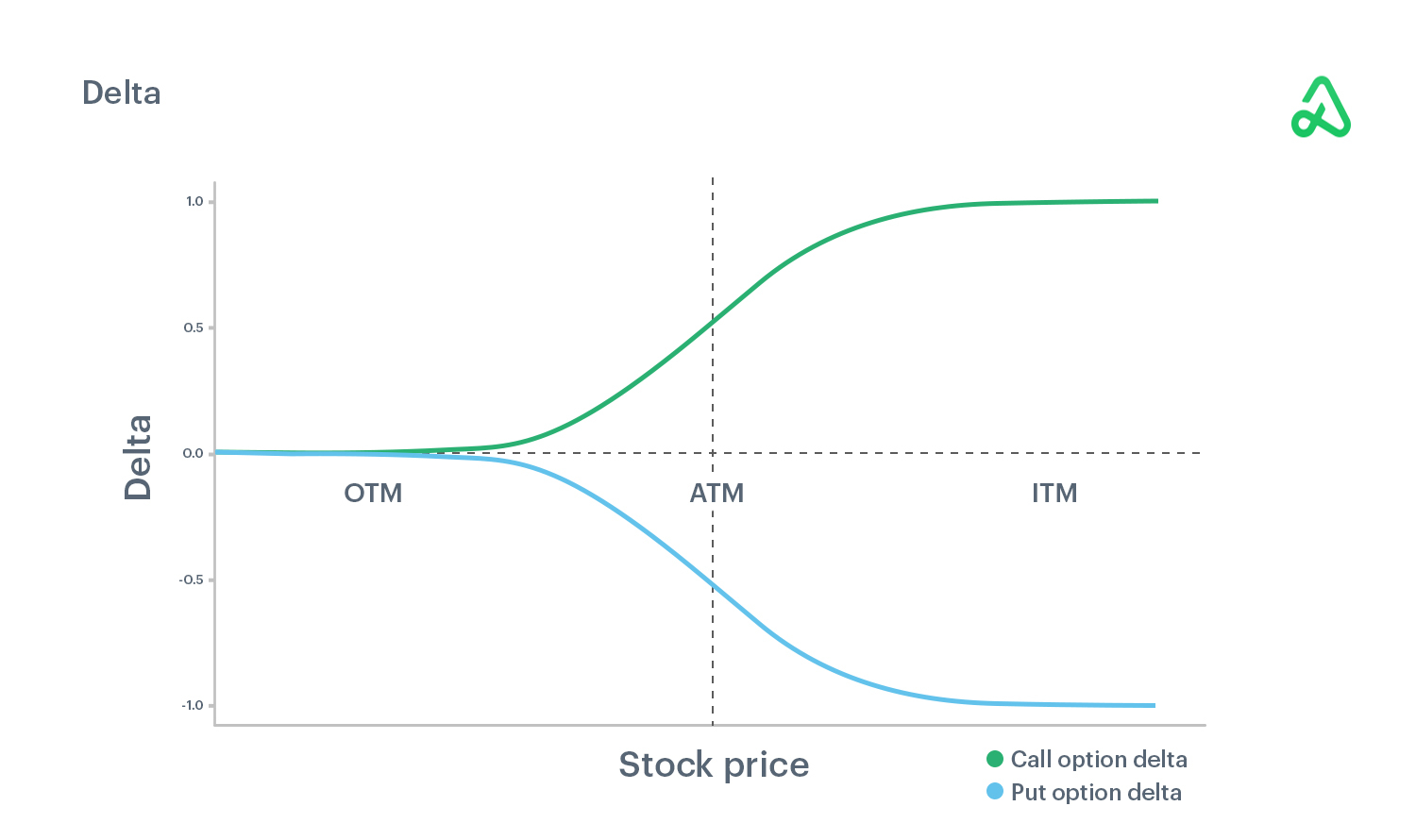

Navigating the Option Landscape: Calls and Puts Explained

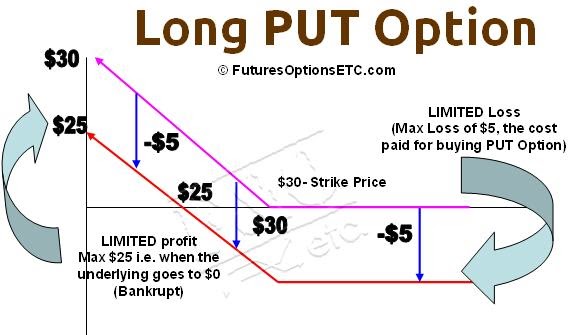

The world of options encompasses two primary breeds: calls and puts. Call options bestow the right to purchase the underlying asset at the strike price, thus favoring an anticipated price surge. Conversely, put options grant the right to sell the underlying asset at the strike price, thriving in scenarios where price declines are expected. The strategic deployment of these options allows traders to not only protect their capital but also magnify their gains when market dynamics align with their predictions.

Leveraging Options for Stock Position Enhancement

The synergistic interplay between stocks and options can amplify investment outcomes. For stock owners, options offer an invaluable risk mitigation tool. By purchasing a put option with a strike price below their stock holdings, they can establish a safety net, limiting potential losses in the event of an adverse market downturn. Moreover, the sale of call options can generate additional income while retaining stock ownership, effectively transforming a long stock position into a covered call strategy.

Image: optionalpha.com

Option Strategies Unleashed: A Tactical Arsenal

The allure of options lies in their boundless strategic possibilities. Collar strategies, for instance, combine protective puts with income-generating calls, creating a buffer zone around the underlying stock price. Straddles and strangles, employing both calls and puts at different strike prices, offer exposure to price volatility, enabling traders to profit from market movements in either direction. Understanding these strategies and wielding them judiciously can transform you into a financial tactician, adeptly shaping market forces to your advantage.

Expert Insights and Prudent Investments

Seasoned market strategists emphasize the significance of thorough research and risk management when navigating the realm of stock-option trading. Renowned investor Warren Buffett espouses the virtues of “moat investing,” meticulously analyzing companies with sustainable competitive advantages before investing. Similarly, options maestro Nassim Taleb advocates for meticulous risk assessment, embracing strategies that limit potential losses while maximizing potential gains. By adhering to these principles, investors can enhance their decision-making prowess, steering their financial journeys toward favorable outcomes.

Trading Stock Against An Option Position

Image: futuresoptionsetc.com

Conclusion: A Triumphant Triumph of Strategy

The judicious utilization of options against stock positions unveils a path to financial empowerment. Whether employing protective strategies to safeguard capital or harnessing complex tactics to amplify gains, investors who master this intricate dance can outmaneuver market volatility and emerge triumphant. Remember, the financial markets are not a battleground but a canvas upon which strategic minds can paint masterpieces of wealth creation.