Navigating the dynamic world of commodities trading necessitates a comprehensive understanding of the available trading platforms. These platforms act as gateways to global markets, empowering traders with cutting-edge tools and advanced functionalities. In this comprehensive guide, we will delve into the intricacies of various trading platforms designed specifically for commodities, highlighting their features, advantages, and shortcomings to guide your trading journey.

Image: stewdiostix.blogspot.com

Understanding Commodities Trading

Commodities encompass a vast array of raw materials, energy sources, and agricultural products that form the backbone of global industries. Trading in these assets provides opportunities for diversification, hedging against inflation, and capital appreciation. However, the complexities of commodities markets demand reliable and robust trading platforms that cater to the unique requirements of traders.

Types of Commodity Trading Platforms

The landscape of commodity trading platforms is diverse, offering a range of options tailored to different trading styles and needs. Here are some prominent categories:

-

Exchange-based Platforms: These platforms, operated by licensed exchanges, facilitate centralized trading of standardized commodity futures contracts. They enforce rigorous trading rules and ensure market transparency, offering stability and liquidity.

-

Over-the-Counter (OTC) Platforms: OTC platforms connect buyers and sellers directly without involving an exchange. They allow for customized contracts, greater flexibility, and direct negotiations, but may lack the same level of standardization and liquidity as exchange-based platforms.

-

Electronic Trading Networks (ETNs): ETNs provide a virtual marketplace where traders can anonymously access liquidity providers and execute trades electronically. They offer real-time price quotes, speed, and efficiency.

-

Brokerage Firms: Brokerage firms act as intermediaries between traders and marketplaces. They offer tailored services, research, and guidance, catering to both retail and institutional traders.

Evaluating Trading Platforms

To make an informed choice among the multitude of trading platforms, consider the following criteria:

-

Regulation and Security: Ensure the platform is regulated by reputable authorities to protect your investments and personal data.

-

Tradable Commodities: Verify that the platform offers the desired commodities you intend to trade.

-

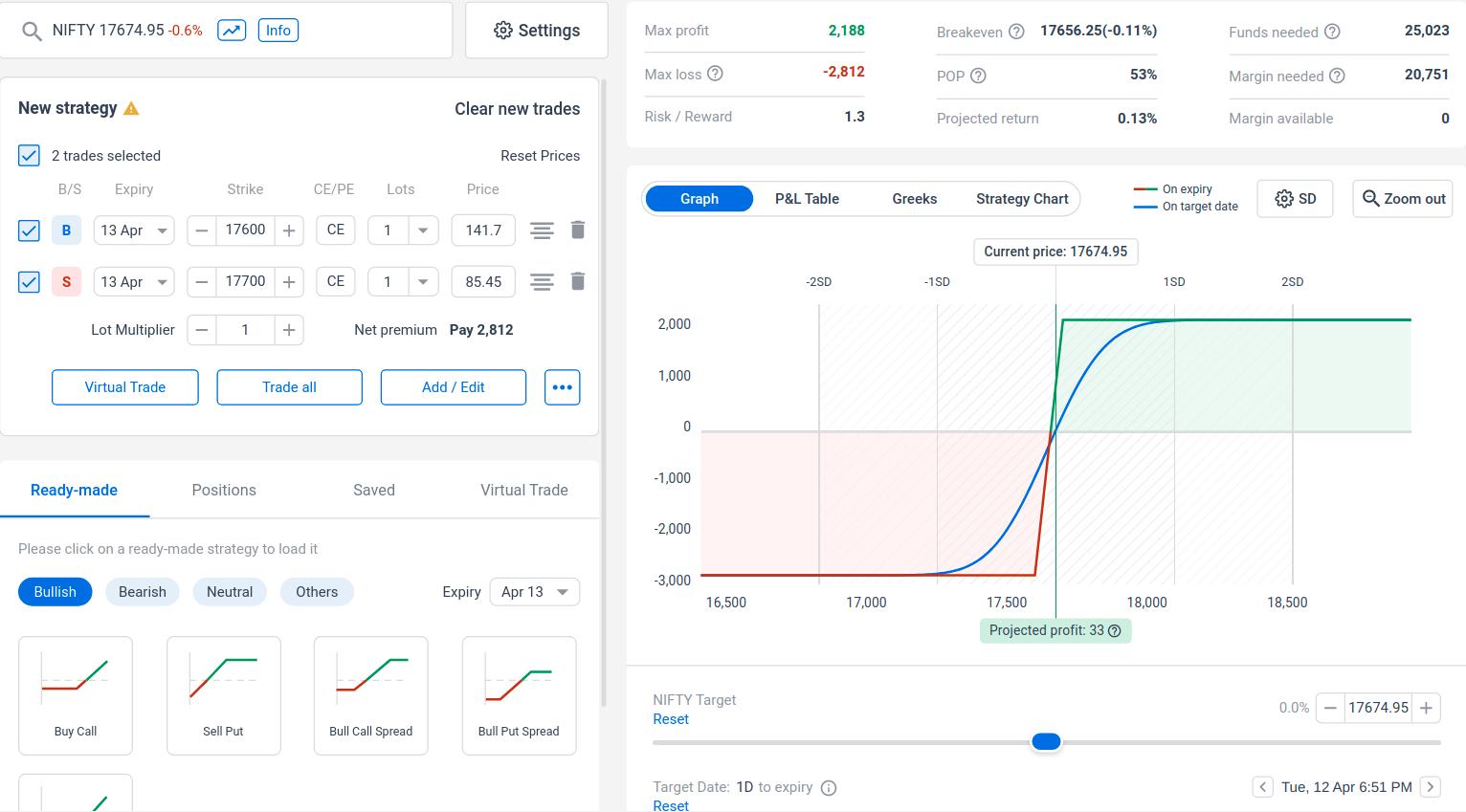

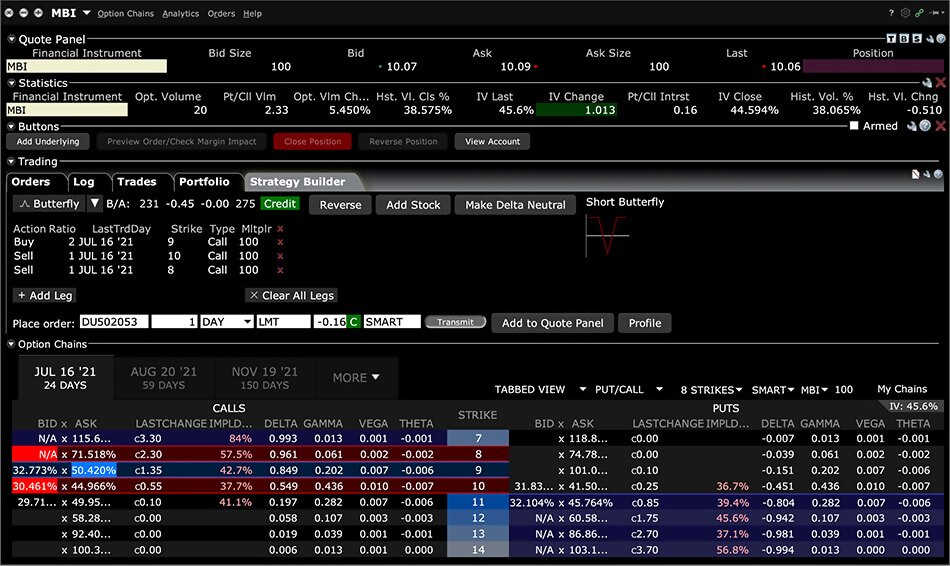

Trading Tools and Functionality: Evaluate the platform’s trading tools, charting capabilities, market analysis features, and mobile compatibility.

-

Fees and Commissions: Understand the fees associated with trading, including brokerage commissions, exchange fees, and other charges, to optimize your profit margins.

-

Customer Support: Assess the availability and quality of customer support to ensure timely assistance when needed.

Image: www.scrollreads.com

Trading Platforms Options For Commodites

Image: www.interactivebrokers.com

Conclusion

Navigating the world of commodity trading platforms requires careful consideration of your trading goals and preferences. By meticulously evaluating the different options available, you can empower yourself with the right platform to harness the opportunities and mitigate the risks inherent in this dynamic market. Harnessing the power of these platforms enables you to participate effectively in the global trade of commodities, fueling economic growth and satisfying consumer demand worldwide.