Introduction

In the realm of options trading, understanding the concept of percent move in IV is paramount for maximizing returns and managing risk. This article aims to provide a comprehensive guide to percent move in IV, exploring its definition, significance, calculation, and practical applications.

Image: optionstradingiq.com

Understanding Percent Move in IV

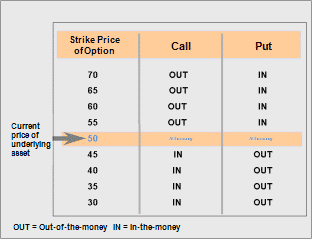

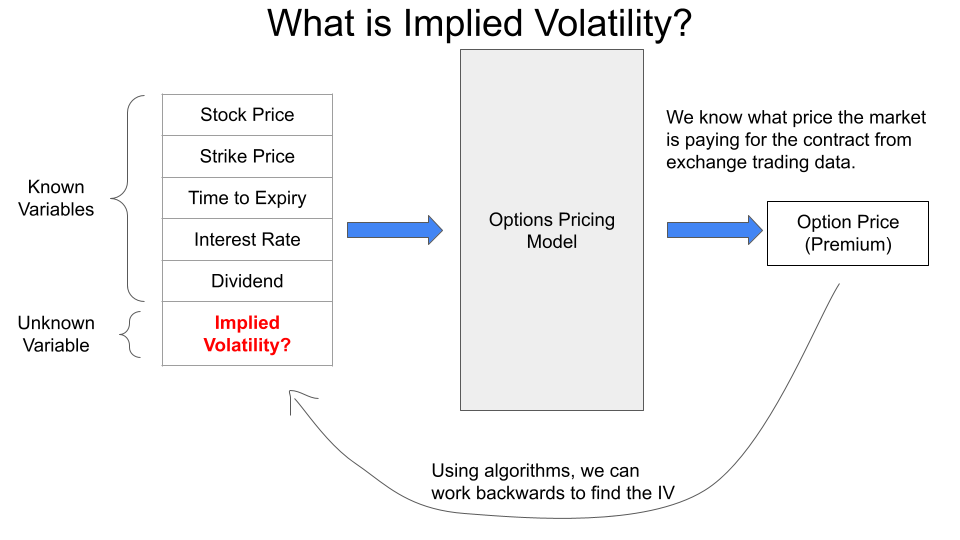

Implied volatility (IV) is a measure of the market’s expectations of an underlying asset’s future price fluctuations. Percent move in IV refers to the percentage change in IV over a specific period. It indicates how much the market expects the price volatility of the underlying asset to change in the future.

The higher the percent move in IV, the greater the market anticipates the underlying asset’s price to fluctuate. While this can lead to higher potential returns, it also increases the risk of losses. Conversely, a lower percent move in IV suggests that the market expects less volatility, resulting in lower potential returns and reduced risk.

Calculating Percent Move in IV

Calculating percent move in IV is relatively straightforward. The formula is:

Percent Move in IV = ((New IV - Old IV) / Old IV) * 100Where:

- New IV is the most recent IV value

- Old IV is the previous IV value

Significance of Percent Move in IV

Percent move in IV plays a crucial role in options pricing and strategy selection. It can indicate potential trading opportunities, help investors manage risk, and identify under- or overvalued options.

- Identifying Potential Trading Opportunities: High percent move in IV suggests increased volatility, which can lead to higher option premiums. Traders can capitalize on this by selling options that benefit from increased volatility (e.g., selling call options when IV is high).

- Managing Risk: Understanding percent move in IV can help investors adjust their trading strategies to manage risk. For instance, when IV is high, traders may consider reducing their option positions or adjusting their strike prices to account for potential volatility fluctuations.

- Valuing Options: Percent move in IV is an essential factor in options pricing models. It influences the price of options, making it crucial for traders to consider when valuing and selecting options.

:max_bytes(150000):strip_icc()/dotdash_Final_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-01-7559aba839cc410d8553868da1f1afc3.jpg?strip=all)

Image: finance.pendapat.id

Applications of Percent Move in IV

Percent move in IV has several practical applications in options trading. Some of its uses include:

- Hedging Against Volatility: Traders can use options to hedge against potential volatility by buying or selling options with percent move in IV based on their desired risk tolerance.

- Timing Trades: By analyzing percent move in IV, traders can determine optimal times to enter or exit option positions based on expected volatility changes.

- Maximizing Returns: Understanding percent move in IV can help traders identify options that are undervalued or overvalued due to market expectations of volatility. This knowledge can lead to profitable trading opportunities.

Trading Options Percent Move In Iv

Image: blog.streak.tech

Conclusion

Percent move in IV is a valuable tool that provides traders with insights into the market’s expectations for future volatility. By understanding how to calculate, interpret, and utilize percent move in IV, traders can enhance their options trading strategies, manage risk, and capitalize on potential trading opportunities. It is essential to continuously monitor percent move in IV and incorporate this knowledge into decision-making to achieve success in options trading.