Navigating the Options Market in the United Kingdom

Trading options online in the UK has gained considerable popularity as a flexible and potentially lucrative financial instrument. With options, traders have the right but not the obligation to buy or sell an underlying asset at a predetermined price within a specific time frame. Whether you’re a seasoned investor or just starting out, this comprehensive guide provides insights, trend analysis, and tips to empower you in the UK options market.

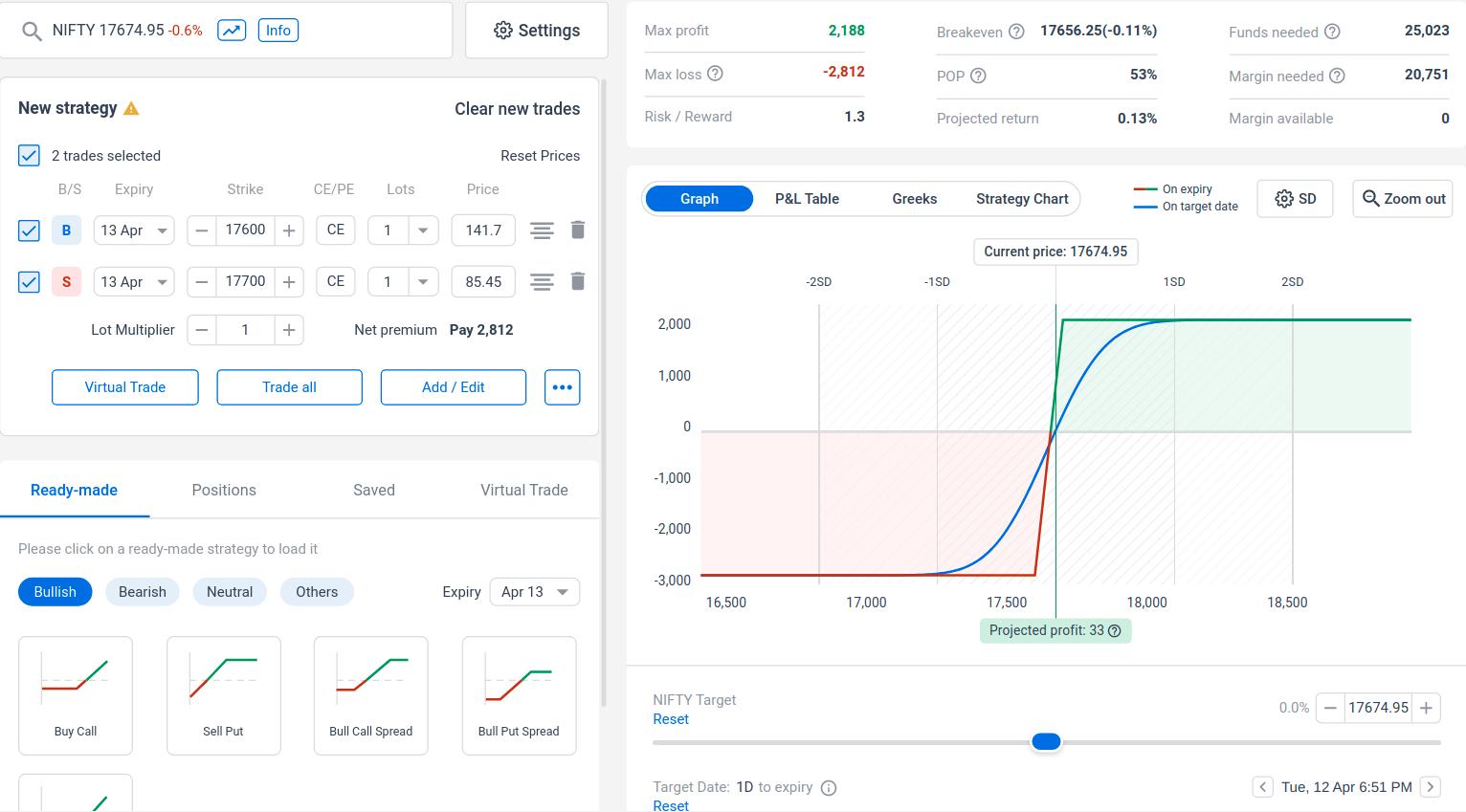

Image: eaglesinvestors.com

Understanding Options: Definition, History, and Implications

An option contract grants the buyer a right over an underlying asset, such as a stock, bond, or currency. The two main types of options are calls and puts. Call options give the buyer the right to purchase the underlying asset, while put options provide the right to sell. The value of an option is determined by factors like the underlying asset’s price, time to expiration, and volatility.

Options trading has a rich history, dating back to ancient Greece and Rome. In the 1970s, the Chicago Board Options Exchange (CBOE) revolutionized this market by standardizing and centralizing option contracts. Today, options markets worldwide facilitate billions of dollars in daily trading volume.

Exploring the UK Options Landscape: Markets, Regulations, and Opportunities

The UK options market is characterized by high liquidity and regulation, ensuring transparency and investor protection. Key exchanges include the London Stock Exchange (LSE) and CBOE Europe, providing various option contracts to cater to diverse trading strategies.

The Financial Conduct Authority (FCA) regulates the UK options market, ensuring fair and orderly trading practices. It enforces strict rules regarding capital requirements, margin trading, and investor disclosure, ensuring the market’s integrity.

Unlocking Success in Options Trading: Strategies, News, and Expert Advice

Successful options trading requires a combination of knowledge, skill, and strategic planning. Common trading strategies include covered calls, cash-covered puts, and iron condors. By leveraging options’ inherent flexibility, traders can create both offensive and defensive strategies to enhance returns.

Staying abreast of market news and economic updates is crucial in options trading. Volatility spikes, geopolitical events, and regulatory changes can significantly impact option prices. Monitoring reputable news sources, forums, and social media platforms can provide valuable insights for making informed trading decisions.

Image: www.pinterest.com

Practical Tips and Expert Advice for Enhanced Trading

To increase your chances of success in options trading, consider the following expert advice:

- Understand the underlying asset’s characteristics: Every underlying asset has unique risk-return characteristics. Conduct thorough research to comprehend the asset’s behavior and market dynamics.

- Manage risk prudently: Options can be a double-edged sword. Utilize stop-orders and position sizing strategies to limit potential losses.

- Consider time decay: Options lose value as they approach expiration. Be mindful of the time frame and adjust positions accordingly.

- Practice on a demo account: Virtual trading platforms allow you to hone your skills and test strategies without risking capital.

- Seek professional guidance: If you’re new to options trading or struggling with profitability, consider seeking advice from a reputable financial advisor.

Frequently Asked Questions (FAQs) on Options Trading in the UK

Q: Are there any restrictions on trading options in the UK?

A: Generally, no. However, some options contracts may have specific eligibility criteria or restrictions based on investor experience or financial qualification.

Q: What is the minimum capital required for options trading in the UK?

A: The FCA requires a minimum initial capital of £2,000 for retail investors. However, individual brokers may set higher thresholds based on their risk management policies.

Q: Are options more lucrative than stocks or bonds?

A: While options can provide higher returns compared to traditional investments, they also carry higher risk. The potential payoff depends on factors such as the underlying asset’s performance, volatility, and option contract parameters.

Conclusion

Trading options online in the UK offers a vast and dynamic investment opportunity. Through careful research, strategic planning, and expert advice, you can unlock the potential of this versatile financial instrument. If you’re intrigued by options trading and believe it aligns with your investment goals and risk appetite, further exploration into this exciting market is highly encouraged.

Trading Options Online Uk

Image: stewdiostix.blogspot.com

Are you ready to embark on your options trading journey in the UK?