In the ever-evolving world of finance, mastering the complexities of trading options on treasury futures can open doors to lucrative opportunities and enhanced portfolio diversification. Picture yourself as a skilled trader navigating the intricate markets, seeking opportunities that defy traditional investment strategies.

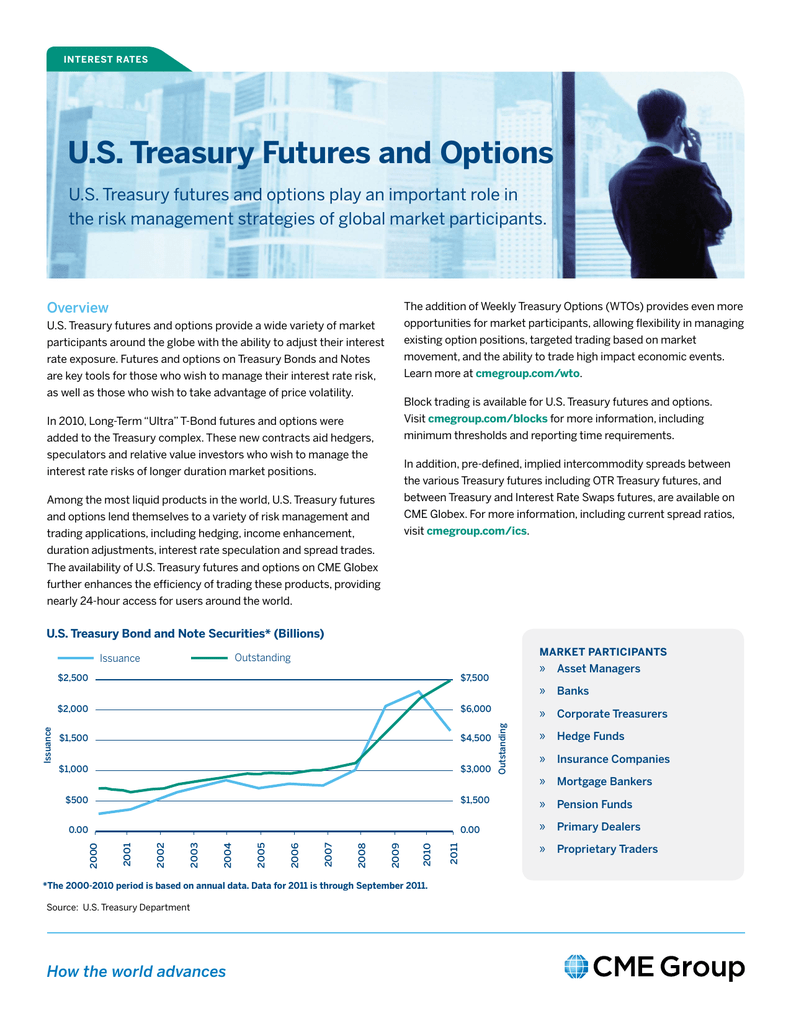

Image: studylib.net

**Treasury Futures: The Foundation of Option Trading**

Treasury futures, also known as T-futures, are standardized futures contracts that represent an agreement to buy or sell a specific amount of Treasury securities on a specific date in the future. These contracts trade on futures exchanges and offer a multitude of advantages, including price discovery, hedging, and speculation.

Options on treasury futures grant traders the right, but not the obligation, to buy or sell the underlying futures contract at a set price (the strike price) on or before a particular date (the expiration date). These options provide a versatile tool for investors to manage risk, generate income, and potentially profit from price movements in the underlying futures.

**Understanding the Interplay of Options and Treasury Futures**

Options on treasury futures derive their value from the underlying futures contract’s price and the volatility of its price movements. Volatility, a crucial metric in options trading, quantifies the potential for large price changes. Higher volatility leads to higher premiums for options, making them more expensive to purchase.

Traders must carefully assess the relationship between the underlying futures price and their chosen option strategy. For example, a long call option grants the right to buy the futures contract at a higher price in the future, benefitting from a potential price increase. Conversely, a short call option obligates the trader to sell the futures contract at a higher price, requiring a bearish outlook on the market.

**The Benefits of Trading Options on Treasury Futures**

- Leverage: Options offer leverage, allowing traders to control a significant position with a relatively small investment.

- Flexibility: Options provide numerous strategies, enabling traders to customize their positions based on market conditions and risk tolerance.

- Hedging: Options can be used as a hedging tool to protect against potential losses in investments tied to Treasury securities.

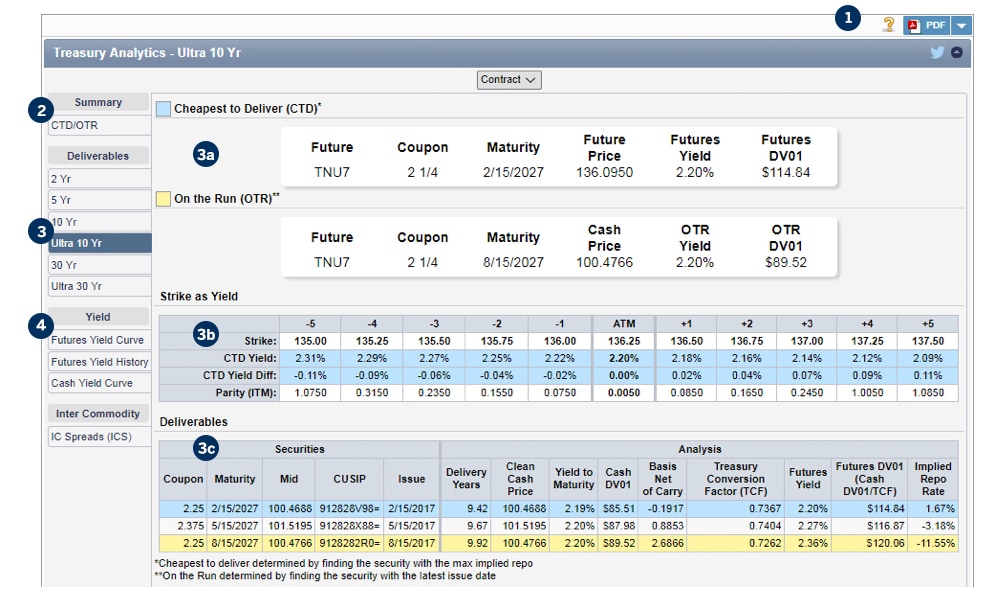

Image: www.schwab.com

**Tips and Expert Advice for Success**

To capitalize on the opportunities presented by trading options on treasury futures, consider the following expert advice:

- Master the Basics: Thoroughly understand the concepts of options trading, futures contracts, and market dynamics before venturing into the field.

- Manage Risk Prudently: Implement sound risk management strategies, including position sizing and stop-loss orders, to mitigate potential losses.

- Stay Informed: Monitor market news and economic data that influence Treasury securities and futures prices.

**FAQ on Trading Options on Treasury Futures**

Q: What is the minimum investment required to trade options on treasury futures?

A: The investment required varies depending on the premium of the option purchased and the underlying futures contract’s value.

Q: Can losses exceed the investment amount in options trading?

A: Yes, in some option strategies, losses can potentially exceed the initial investment.

Trading Options On Treasury Futures

Image: www.cmegroup.com

**Conclusion**

Trading options on treasury futures presents a realm of opportunities for savvy traders seeking to diversify their portfolios and capitalize on market dynamics. By embracing the principles outlined above, investors can harness the power of these versatile instruments to achieve their financial goals. We encourage you to explore this intriguing facet of trading and embark on a journey of learning and potential financial success.

Would you like to delve deeper into the intricacies of trading options on treasury futures? If so, please share your questions and comments below, and we will be delighted to engage in further discussions.