The world of finance is constantly evolving, and one area that has seen tremendous growth is options trading. This complex yet potentially lucrative market has traditionally been inaccessible to many due to its perceived complexity and the need for specialized knowledge. However, the emergence of option trading apps has changed the game, allowing individuals to delve into this exciting realm with ease.

Image: www.pinterest.com

While I’ve always been fascinated by the stock market, the thought of navigating the intricacies of options trading seemed daunting. Then, I stumbled upon a user-friendly option trading app that demystified the process and made it accessible for beginners like myself. This app’s intuitive interface, comprehensive educational resources, and powerful trading tools opened up a whole new world of financial possibilities. It proved to me that options trading could be both exciting and rewarding, regardless of your prior experience.

Understanding Option Trading Apps: A Modern Gateway to the Options Market

Option trading apps are essentially mobile platforms designed to simplify the process of buying and selling options contracts. These apps offer a wide range of functionalities tailored to both novice and experienced traders, providing them with the tools they need to make informed decisions.

The rise of option trading apps can be attributed to several factors. Firstly, the increased awareness of options trading among retail investors has created a demand for user-friendly platforms. Secondly, advancements in technology have made it possible to develop intuitive and powerful mobile applications. Finally, the growing competition in the financial technology space has led to innovation and continuous improvement in these apps.

Demystifying Options Trading: A Beginner’s Guide

To understand how option trading apps work, it’s crucial to grasp the fundamentals of options trading itself. An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price (strike price) on or before a certain date (expiration date).

Types of Options

There are two main types of options:

- Call Options: Give the holder the right to purchase an underlying asset at a specific price.

- Put Options: Give the holder the right to sell an underlying asset at a specific price.

Image: topflightapps.com

Strategic Considerations

Options trading offers various strategies, allowing traders to speculate on price movements, hedge against risk, or generate income. Some common strategies include:

- Buying Calls: Speculating on an asset’s price rise.

- Selling Calls: Generating income if the asset’s price remains stable or falls.

- Buying Puts: Speculating on an asset’s price decline.

- Selling Puts: Generating income if the asset’s price remains stable or rises.

- Covered Calls: Generating income while owning the underlying asset.

- Protective Puts: Hedging against potential losses on an existing investment.

Key Features of Option Trading Apps

Option trading apps typically incorporate various features to make the trading experience convenient and efficient:

1. User-Friendly Interface

Most apps prioritize a user-friendly interface, making navigation intuitive and accessible to traders of all experience levels.

2. Real-time Market Data

These apps provide real-time market data, including price quotes, charts, and news feeds, enabling informed trading decisions.

3. Order Placement and Management Tools

Option trading apps offer seamless order placement and management tools, allowing traders to execute trades quickly and monitor their portfolio’s performance.

4. Educational Resources

Many apps offer educational resources such as tutorials, articles, and webinars, helping users grasp the complexities of options trading.

5. Risk Management Features

These apps often incorporate risk management tools such as stop-loss orders and margin requirements to protect traders from excessive losses.

6. Personalization and Customization Options

Most apps allow for personalization and customization, allowing traders to tailor their trading experience to their specific needs and preferences.

7. Security Measures

Security is paramount in any financial platform. Option trading apps implement robust security measures, like multi-factor authentication and data encryption, to protect user accounts and sensitive information.

Navigating the Options Market with Confidence

The proliferation of option trading apps has democratized access to this complex but potentially rewarding market. By choosing the right app, traders can benefit from user-friendly interfaces, real-time data, educational resources, and risk management tools, allowing them to navigate the options market with confidence.

Tips for Using Option Trading Apps

While option trading apps simplify the process, it’s essential to approach this market with caution and a thorough understanding:

1. Start Small and Gradually Increase Your Investment

Begin with a small investment to gain experience and minimize potential losses before committing larger sums.

2. Don’t Trade with Money You Can’t Afford to Lose

Options trading carries inherent risk, so only trade with funds you are comfortable losing.

3. Leverage Educational Resources

Utilize the educational resources provided by the app and supplement them with independent research to enhance your knowledge of options trading.

4. Practice with a Demo Account

Many apps offer demo accounts that allow you to practice trading without risking real money.

5. Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversify your investments across different options contracts and asset classes to mitigate risk.

6. Monitor Your Trades Regularly

Actively monitor your trades and adjust your strategies based on market conditions and your risk tolerance.

7. Seek Professional Advice

Don’t hesitate to consult with a financial advisor if you require guidance or have specific questions about options trading.

FAQ

- What are the best option trading apps for beginners?

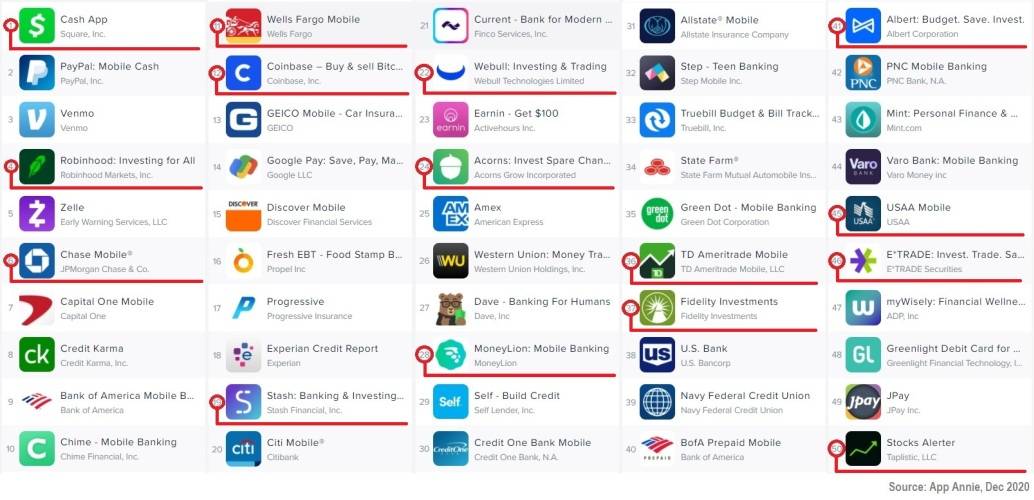

- Several apps cater to beginners, offering user-friendly interfaces, educational resources, and demo accounts. Some popular options include Robinhood, Webull, TD Ameritrade, and Interactive Brokers.

- Are option trading apps safe?

- Reputable option trading apps prioritize security and employ encryption, multi-factor authentication, and other measures to protect user accounts and data.

- How do I make money with options trading?

- Options trading can generate profits by speculating on price movements, hedging against risk, or generating income through strategies like selling covered calls.

- What are the risks involved in options trading?

- Options trading carries significant risks, including the potential for substantial losses exceeding your initial investment. It’s crucial to understand the underlying assets and trading strategies before engaging in this market.

- What are the differences between option trading apps?

- Option trading apps vary in their functionalities, fees, educational resources, and target user base. Research different apps to find one that aligns with your trading needs and experience level.

Option Trading App

Conclusion

The popularity of option trading apps is a testament to the growing interest in this complex but potentially rewarding market. By leveraging the intuitive interfaces, comprehensive data, and educational resources offered by these apps, traders can navigate the options market with greater confidence. Remember to approach options trading with caution and a strong understanding of the underlying risks and strategies.

Are you interested in exploring the world of options trading?