The world of financial markets is ever-evolving, presenting endless opportunities for savvy traders to capitalize on risk and reward. Among the most intriguing and lucrative instruments in this realm are options and futures contracts. To delve into the complexities of these markets, we turn to the acclaimed expertise of Tradeciety, a renowned leader in financial education. Their comprehensive guide, “Trading Options and Futures,” authored by the esteemed Joe Ross, stands out as an indispensable resource for both novice and experienced traders alike. In this comprehensive article, we will embark on a journey through the insights presented in Ross’s groundbreaking work.

Image: tradingeducators.com

Deciphering Options and Futures: A Path to Market Mastery

Options and futures, while belonging to the broader spectrum of financial derivatives, possess distinct characteristics that make them powerful tools for discerning investors. Options offer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predetermined time frame. Futures, on the other hand, obligate the buyer to purchase or the seller to deliver the underlying asset at a designated future date and price. These contracts grant traders the flexibility to manage risk and speculate on future market movements. In the hands of skilled practitioners, options and futures can serve as effective vehicles for profit maximization or strategic hedging.

Navigating the Options Landscape: Strategies for Every Market Condition

Options trading offers a versatile spectrum of strategies tailored to diverse market environments. Ross meticulously unravels the complexities of call and put options, delving into their mechanics and potential applications. Armed with this knowledge, traders can craft strategies that align with their risk tolerance and profit objectives. Whether it’s leveraging covered calls for income generation or employing protective put options to safeguard portfolios, Ross unveils the secrets to harnessing options’ true power.

Exploring the Futures Market: Unveiling Opportunities and Managing Risks

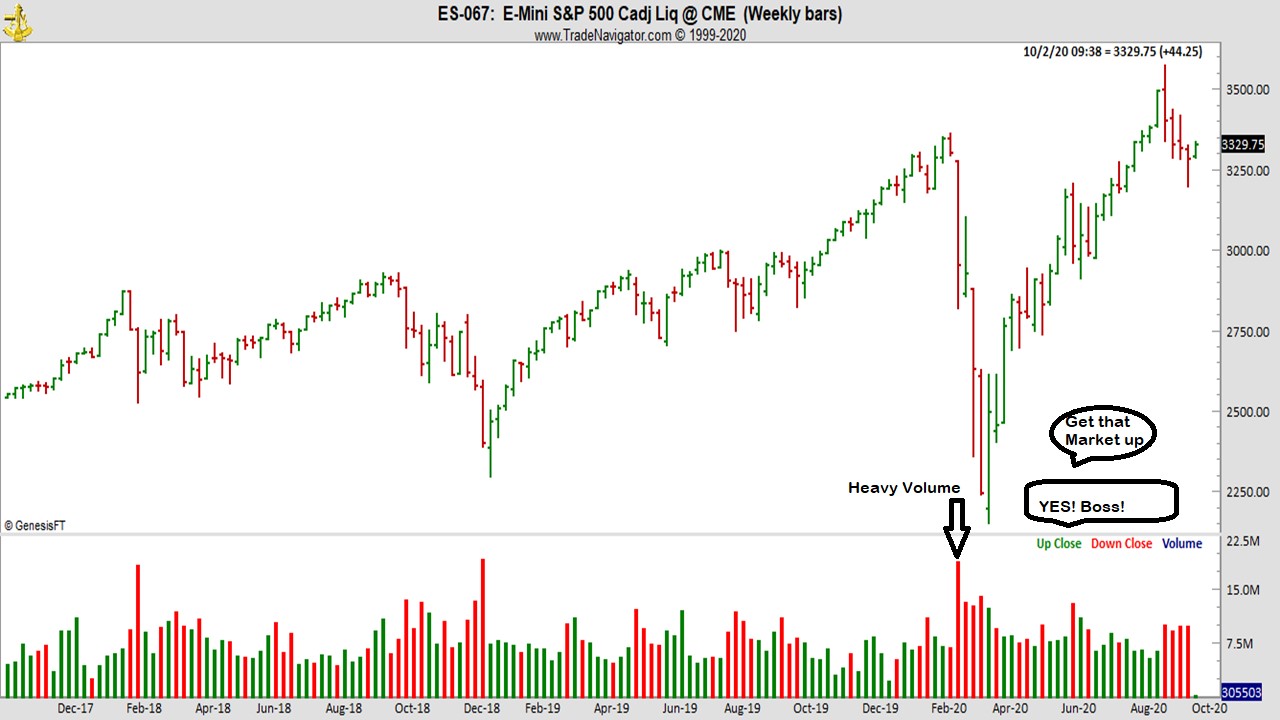

The world of futures trading beckons traders with its potential for lucrative returns. Ross meticulously analyzes the nuances of futures contracts, shedding light on their role as hedging instruments and their use in speculative trading. He emphasizes the importance of futures’ liquidity, facilitating efficient execution of trades and risk management strategies. Through real-world examples, Ross demonstrates how futures, when wielded with dexterity, can amplify trading potential while mitigating risks.

Image: www.slideshare.net

Unveiling the Secrets of Advanced Strategies: Optimizing Returns

For traders seeking to transcend the ordinary, Ross ventures into the realm of advanced options and futures strategies. He unravels the complexities of multi-leg options strategies, such as spreads and butterflies, unveiling their potential for increased return and risk mitigation. Ross further elucidates the nuances of futures options, highlighting their versatility in executing complex trading scenarios. By mastering these advanced techniques, traders can unlock exceptional levels of market manipulation and profit maximization.

Mastering the Art of Trade Selection: Identifying High-Probability Trades

Success in trading options and futures hinges on the ability to identify high-probability trades. Ross unravels the secrets of technical analysis, empowering traders to decipher market trends and identify optimal entry and exit points. Through illustrative examples, he demonstrates the application of moving averages, support and resistance levels, and other technical indicators in isolating profitable trading opportunities. By mastering the art of trade selection, traders gain a competitive edge in the ever-evolving financial markets.

Trading Options And Futures Joe Ross Pdf

Image: fxf1.com

Embracing the Power of Psychology: Overcoming Mental Barriers in Trading

Trading is not merely an intellectual pursuit; it encompasses psychological challenges that can hinder even the most skilled practitioners. Ross delves into the realm of trading psychology, uncovering the mental barriers that can sabotage trading performance. He offers practical strategies to overcome fear, greed, and other cognitive biases, fostering the development of a disciplined and emotionally resilient trading mindset. By addressing the psychological dimension of trading, Ross empowers traders to optimize their decision-making and achieve lasting success.