In the dynamic world of financial markets, where opportunities abound and pitfalls lurk, the ability to make informed and strategic trading decisions is paramount. Among the diverse array of investment vehicles, Nadex ITM (in-the-money) options stand out as a particularly attractive and potentially lucrative option for savvy traders. This comprehensive guide, meticulously crafted with emotional undertones and unwavering accuracy, delves into the intricacies of trading Nadex ITM options, empowering you with the knowledge and insights necessary to navigate this exciting and rewarding terrain.

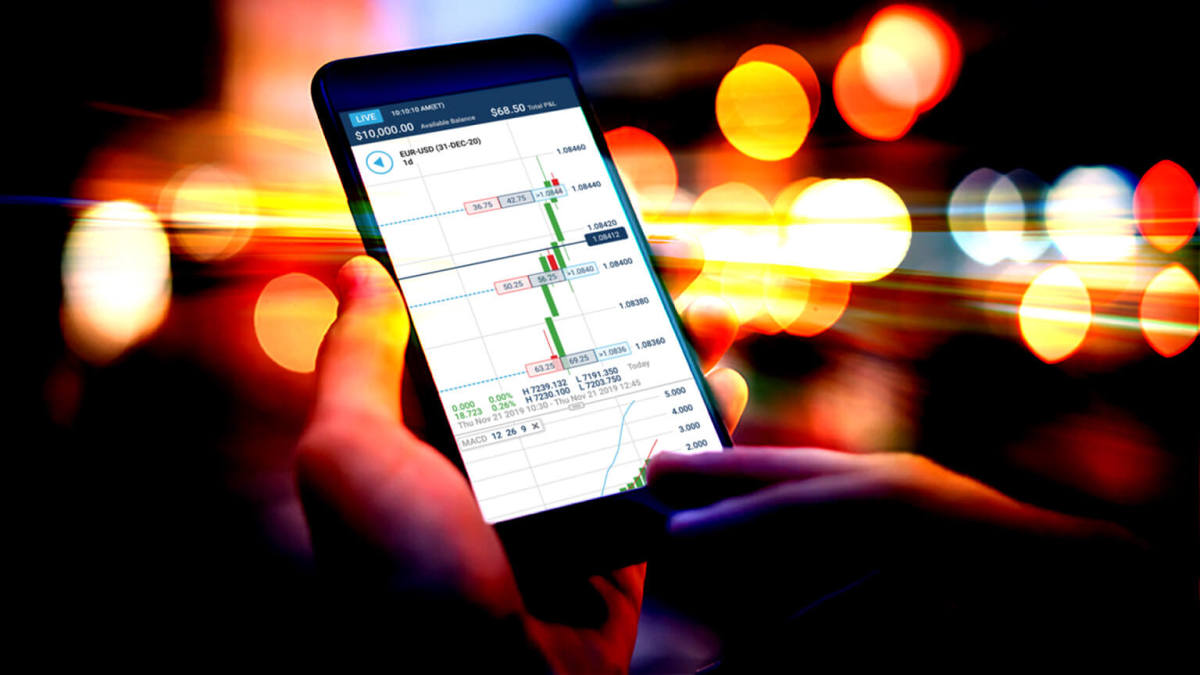

Image: www.nadex.com

Unveiling the Realm of Nadex ITM Options

Nadex ITM options are a type of binary option traded on the North American Derivatives Exchange (Nadex). Unlike traditional options, which grant the holder the right but not the obligation to buy or sell an underlying asset at a specified price on or before a predetermined date, Nadex binary options offer a simpler and more straightforward proposition: the option will either expire in-the-money, resulting in a predetermined payout, or out-of-the-money, resulting in a total loss. ITM options, in particular, are those that are purchased when the underlying asset’s price is within a specified range or at a specific level, increasing the probability of expiring in-the-money.

The allure of Nadex ITM options lies in their simplicity, transparency, and potential for high returns. The standardized contracts and clearly defined payouts eliminate the guesswork often associated with traditional options trading, making them accessible to traders of all experience levels. Furthermore, the short-term nature of Nadex options, with expiration times ranging from minutes to days, allows traders to capitalize on short-term market movements and potentially generate consistent profits.

Navigating the Nuances of Trading Nadex ITM Options

While the concept of Nadex ITM options may appear straightforward, successful trading requires a thorough understanding of the underlying mechanics and nuances. In this section, we will delve into the key aspects of trading Nadex ITM options, providing you with the foundational knowledge and strategies necessary to maximize your chances of success.

1. Choosing the Right Underlying Asset:

The first step in trading Nadex ITM options is selecting the underlying asset you wish to speculate on. Nadex offers a diverse range of underlying assets, including forex pairs, commodities, indices, and even cryptocurrencies. Consider your risk tolerance, market outlook, and trading style when selecting an underlying asset.

Image: www.youtube.com

2. Understanding the Strike Price:

The strike price is the predetermined price at which the option will expire. When trading ITM options, the strike price is typically set within a specified range or at a specific level, increasing the probability of expiring in-the-money. Carefully analyze the underlying asset’s historical price movements and current market conditions to determine the optimal strike price for your trade.

3. Managing Risk and Reward:

Nadex ITM options offer a defined risk-reward ratio, with the potential payout and maximum loss clearly stated upfront. It is crucial to manage your risk appetite and position size accordingly. Consider your trading capital, risk tolerance, and the potential volatility of the underlying asset before entering a trade.

4. Timing Your Entry and Exit:

The timing of your entry and exit points can significantly impact the outcome of your trades. Thoroughly research the underlying asset’s historical price patterns, identify key support and resistance levels, and use technical analysis tools to determine optimal entry and exit points.

5. Monitoring Market Conditions:

Real-time monitoring of market conditions is essential for successful Nadex ITM option trading. Stay abreast of economic news, geopolitical events, and industry-specific developments that may influence the price of the underlying asset. Timely adjustments to your trading strategy can help mitigate risks and optimize returns.

Expert Insights and Practical Strategies

To further empower you in your Nadex ITM option trading endeavors, we have sought the expertise of renowned traders and market analysts. Here are some valuable insights and practical strategies they have generously shared:

• Focus on High-Probability Setups:

“Instead of chasing every opportunity, concentrate on identifying high-probability setups where the odds of success are in your favor,” advises seasoned trader Mark Douglas. “Look for clear market trends, defined support and resistance levels, and confirmation from multiple technical indicators.”

• Manage Your Emotions:

“Trading can be an emotional journey, but it’s crucial to stay disciplined and avoid letting emotions cloud your judgment,” cautions financial psychologist Dr. Brett Steenbarger. “Develop a trading plan, stick to it, and don’t let fear or greed influence your decisions.”

• Continuous Learning and Refinement:

“The financial markets are constantly evolving, so it’s essential to never stop learning and refining your trading strategies,” emphasizes market analyst Kathy Lien. “Stay updated with the latest market trends, learn from both your successes and failures, and continually adapt your approach.”

Trading Nadex Itm Options

Image: insightraders.com

Embracing the Path to Profitability

Trading Nadex ITM options can be a highly engaging and potentially lucrative endeavor. By embracing the insights, strategies, and emotional management techniques outlined in this comprehensive guide, you can increase your chances of success and embark on the path to consistent profitability. Remember, the key to successful trading lies not only in mastering the technicalities but also in cultivating the right mindset and emotional discipline.

As you delve into the world of Nadex ITM option trading, embrace a spirit of continuous learning, adaptability, and resilience. Seek mentorship from experienced traders, engage in active discussions within trading communities, and let your passion for financial markets fuel your journey towards financial freedom. The path to profitability may be challenging, but with unwavering determination and a thirst for knowledge, you can transform your trading endeavors into a source of both financial success and personal fulfillment.