As a seasoned stock trader, I’ve always been captivated by the dynamic world of stockオプション. They offer a tantalizing blend of risk and reward, enabling investors to potentially magnify their profits while hedging against losses. One stock that has consistently been on my radar is Apple, a tech giant with an impressive track record of innovation and growth. In this comprehensive guide, I’ll delve into the intricacies of trading Apple stock options, providing insights into their benefits, strategies, and key considerations.

Image: www.cultofmac.com

**What are Apple Stock Options?**

Stock options grant investors the right, but not the obligation, to buy or sell a certain number of shares of a company’s stock at a predetermined price (known as the strike price) within a specific timeframe. In the case of Apple stock options, investors can choose from a range of strike prices and expiration dates.

Call options give the holder the right to buy shares at the strike price if the stock price rises above it. Conversely, put options provide the right to sell shares at the strike price if the stock price falls below it. The beauty of options trading lies in their versatility, allowing investors to tailor their strategy based on their market outlook and risk tolerance.

**Benefits of Trading Apple Stock Options**

- Potential for High Returns: Options offer the potential for significant returns, especially in volatile markets. By correctly predicting the direction of Apple’s stock price, traders can amplify their gains.

- Hedging against Risk: Options can be used to mitigate the potential losses of holding stocks. By selling covered calls or purchasing protective puts, investors can limit their downside risk.

- Flexibility: Options provide flexibility in terms of strike prices and expiration dates, allowing traders to tailor their strategies to suit their investment goals and market conditions.

**Key Considerations When Trading Apple Stock Options**

Trading Apple stock options involves several key considerations:

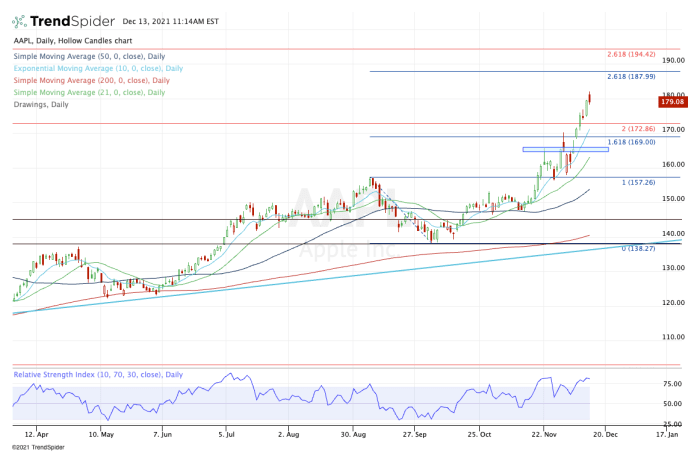

- Volatility: Apple’s stock exhibits relatively low volatility compared to other tech stocks. This may limit the potential for substantial price swings and returns.

- Liquidity: Apple stock options have high liquidity, meaning they can be easily bought and sold without significant slippage. This liquidity reduces trading costs and execution risk.

- Expiration Dates: Options have limited lifespans, known as expiration dates. Understanding the expiration date is crucial for managing risk and maximizing potential profits.

- Premium: The premium paid for an option represents the price of the underlying asset’s volatility, time value, and interest rates. Traders need to carefully consider the premium in relation to the expected price movement.

Image: www.ped30.com

**Tips and Expert Advice for Trading Apple Stock Options**

To maximize success, consider the following tips and expert advice:

- Start Small: Begin with small-sized trades to manage risk and gain experience before committing larger sums of money.

- Stay Informed: Keep abreast of market news, economic events, and industry trends that may impact Apple’s stock price.

- Use Technical Analysis: Incorporate technical analysis techniques to identify trading opportunities, such as chart patterns, indicators, and support/resistance levels.

- Consider Options Spreads: Spreads combine multiple options into a single trade, enhancing risk management and potentially reducing premiums.

- Monitor Your Trades: Regularly monitor your options positions and adjust as needed based on market conditions and your risk tolerance.

**FAQs on Apple Stock Options**

- Q: How much capital do I need to trade Apple stock options?

A: The required capital depends on the number and type of options traded, strike price, and expiration date. Contact your broker for specific margin requirements.

- Q: What is the best strategy for beginners?

A: Beginners may consider buying covered calls or selling cash-secured puts, which offer limited risk while providing some potential income.

- Q: Can I make a profit if Apple’s stock price doesn’t move?

A: Options may have a time decay component. As time passes and the expiration date approaches, the value of options will typically decline, regardless of the underlying stock’s price movement.

Trading Apple Stock Options

Image: www.thestreet.com

**Conclusion**

Trading Apple stock options can be an exciting and potentially rewarding endeavor for savvy investors. By understanding the basics, carefully considering risk factors, and employing sound trading strategies, you can harness the power of options to navigate the market fluctuations and potentially enhance your returns.

Whether you’re an experienced trader seeking new opportunities or a novice investor looking to expand your knowledge, I encourage you to explore the world of Apple stock options further. With dedication and a proactive approach, you can unlock the potential for financial success and harness the power of this versatile investment instrument.