Introduction

Image: centerpointsecurities.com

In the exhilarating and often-lucrative realm of investing, options trading stands as a multifaceted instrument that can potentially multiply your wealth or, if handled recklessly, erode it swiftly. Options, financial contracts that bestow the right but not the obligation to buy or sell an underlying asset (such as a stock, commodity, or currency) at a specified price and date, are a double-edged sword. While they offer the tantalizing prospect of exponential returns, they also carry significant risks that can swiftly turn financial aspirations into bitter realities.

Navigating the Perils of Options Trading

To venture into the world of options trading is to embrace both its allure and its perils. Options contracts come in two primary flavors: calls and puts. Calls grant the holder the right to buy the underlying asset at the predefined price, while puts confer the right to sell it. The price at which the asset can be bought or sold is known as the strike price.

The potential rewards of options trading can be enticing, particularly for those seeking to amplify their returns on modest investments. However, the risks are equally formidable. The most substantial risk lies in the potential for substantial losses. Unlike traditional investments where losses are typically capped at the initial investment amount, options trading can expose you to losses that far exceed your initial outlay.

The Duality of Risk and Reward

Options trading is a double-edged sword that requires a clear understanding of its risks and rewards before taking the plunge. Key risks include:

-

Unlimited Loss Potential: Unlike regular stocks or bonds where losses are limited to the investment amount, options trading can result in losses that surpass your initial investment manifold.

-

Time Decay: Options contracts have a limited lifespan. Their value erodes over time, regardless of whether the underlying asset price moves in your favor. This time decay can eat into your profits or exacerbate losses.

-

Complexity and Volatility: Options trading involves intricate strategies and a deep understanding of market dynamics. Factors like implied volatility, liquidity, and leverage can significantly impact option prices, making it crucial to have a firm grasp of these concepts.

Mitigating Risks with Prudent Strategies

While options trading carries inherent risks, adopting prudent strategies can help mitigate these risks and enhance your chances of success:

-

Understanding Your Objectives: Clearly define your trading goals before venturing into options. Determine your risk tolerance, investment horizon, and profit expectations.

-

Educate Yourself: Options trading is not for the faint of heart. Dedicate time to studying market dynamics, options strategies, and risk management techniques.

-

Start Small: Begin with small trades to minimize potential losses. As you gain experience and confidence, you can gradually increase your investment size.

Conclusion

Options trading presents a tantalizing opportunity for financial growth, but it is imperative to approach it with both excitement and caution. By understanding the inherent risks, arming yourself with knowledge, and employing prudent strategies, you can minimize the risks and maximize your chances of success in this dynamic and potentially rewarding financial arena.

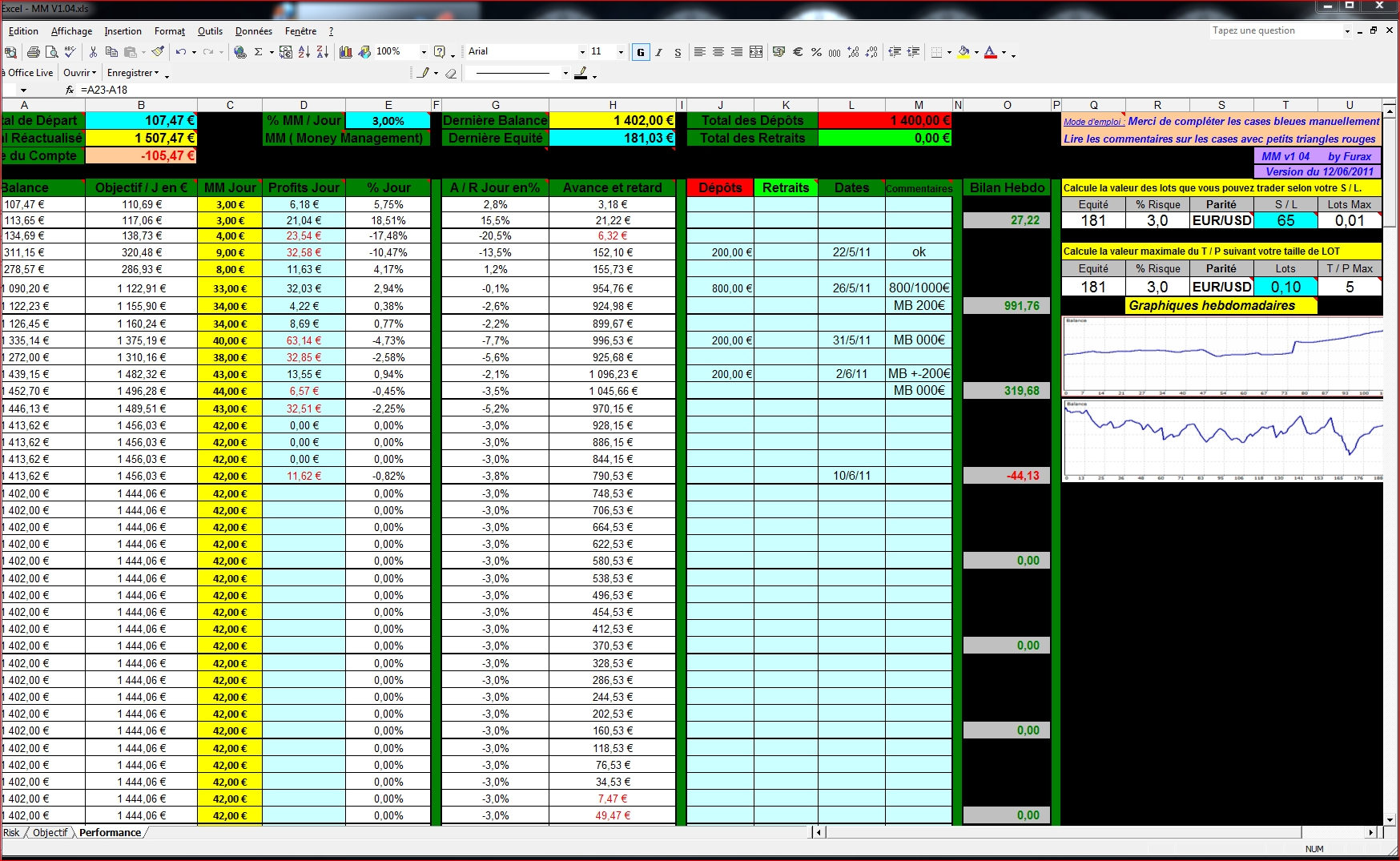

Image: db-excel.com

The Risk Of Options Trading

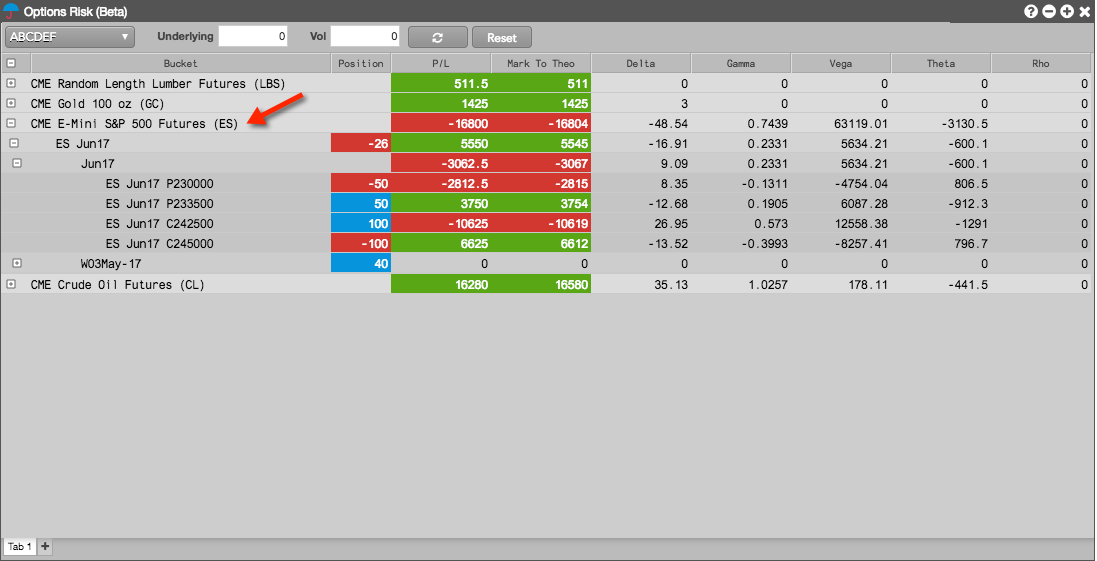

Image: library.tradingtechnologies.com