Introduction

Are you ready to venture into the world of options trading but feel overwhelmed by its complexities? Fear not! This comprehensive guide will provide a systematic roadmap for developing a solid understanding and practical knowledge of options trading. Dive in to discover a structured approach that empowers you to navigate the options market with confidence.

Image: thestockmarketwatch.com

Options trading offers a powerful avenue for enhancing returns, hedging risks, and profiting from market volatility. However, it’s essential to approach this realm with a systematic understanding rather than taking haphazard steps. This guide will equip you with the tools and strategies to learn options trading effectively, minimizing risks and maximizing potential.

Understanding Options Trading Fundamentals

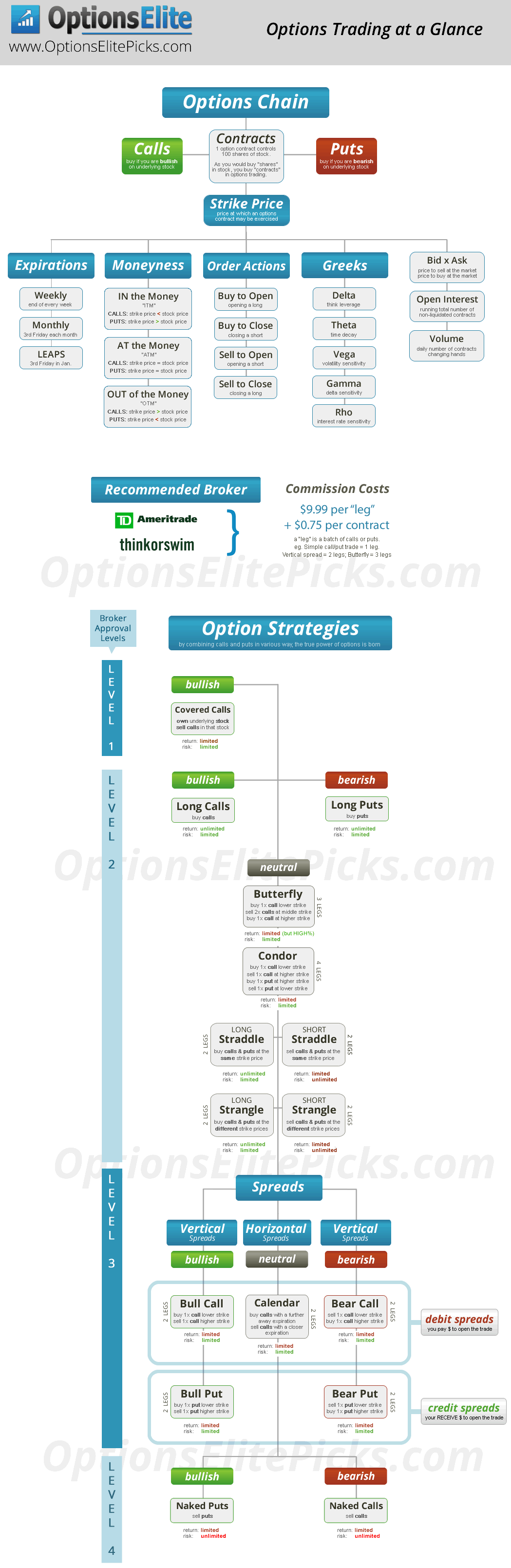

Delve into the basics of options trading to establish a strong foundation. Understand the key terms, such as call options, put options, strike prices, and expiration dates. Explore the relationship between options and their underlying assets, whether stocks, indices, or commodities. Grasp the fundamental mechanisms of how options grant the right, but not the obligation, to buy or sell an asset at a predetermined price.

Mastering options terminology is crucial. For example, a call option provides the buyer with the right to buy an underlying asset at the strike price before the expiration date. Conversely, a put option grants the buyer the right to sell the underlying asset at the strike price before expiration. Understanding these concepts is paramount to comprehending options trading strategies.

Analyzing Options Premiums

The value of an option is known as its premium. Understand the factors that influence option premiums, such as the underlying asset’s price, strike price, time to expiration, interest rates, and implied volatility. Learn to calculate option premiums using the Black-Scholes model, a widely accepted industry standard for pricing.

Premium analysis is essential for determining the potential profitability of an options trade. By considering the various factors that affect premiums, traders can make informed decisions about which options to buy or sell and at what price. The Black-Scholes model provides a valuable tool for estimating the fair value of an option based on its underlying variables.

Exploring Common Options Strategies

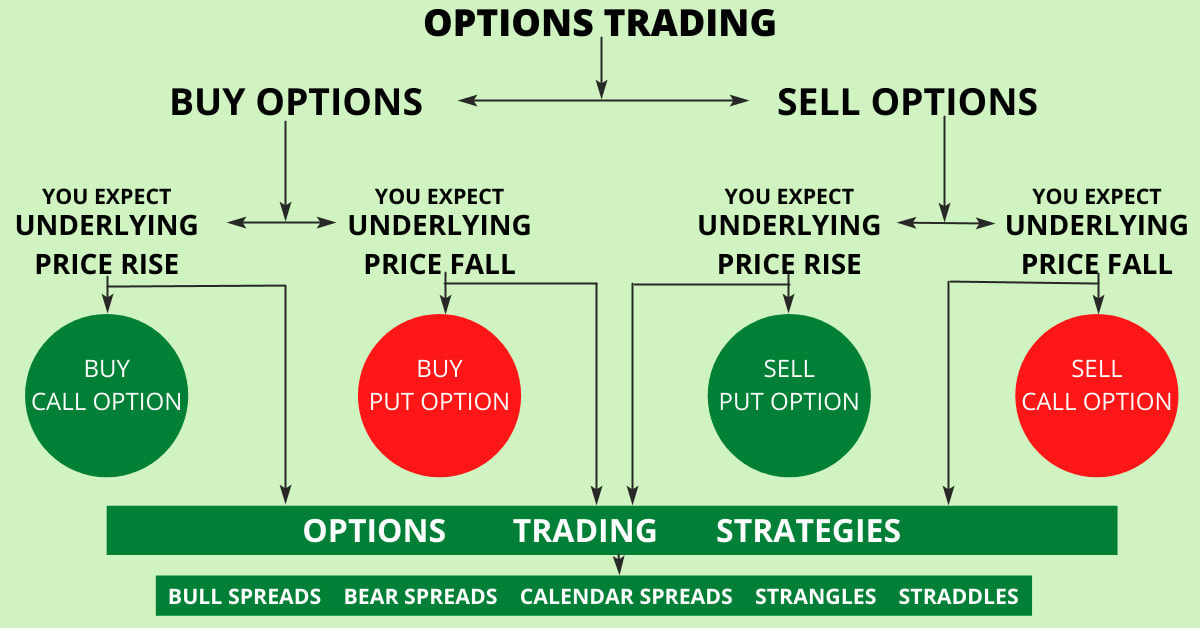

Discover a range of options strategies employed by traders to achieve specific investment objectives. Learn how to use simple strategies like covered calls and protective puts to generate income or hedge risk. Explore more advanced strategies like straddles, strangles, and butterflies to capture market volatility or profit from directional moves.

Options strategies offer a flexible approach to adapting to different market conditions. By combining options with different strike prices and expiration dates, traders can create tailored strategies that align with their risk tolerance and investment goals. Understanding the mechanics and potential benefits of various strategies empowers traders to make informed choices.

Image: margintradeab.blogspot.com

Choosing the Right Options Broker

Selecting the right options broker is crucial for your trading success. Evaluate key factors such as trading platform functionality, commission and fee structures, educational resources, and customer support. Consider platforms that provide robust trading tools, real-time data, and advanced order types to enhance your trading experience.

A reliable and supportive broker can significantly impact your options trading journey. It’s essential to thoroughly research and compare different brokers to find one that suits your needs and provides the necessary resources to navigate the options market effectively.

Managing Risk in Options Trading

Risk management is paramount in options trading. Understand the potential risks involved, including the risk of losing the entire investment, unlimited loss potential for certain strategies, and the impact of time decay. Learn techniques to manage risk, such as setting stop-loss orders, diversifying positions, and understanding position sizing.

A disciplined approach to risk management is crucial for preserving capital and achieving long-term success in options trading. By implementing sound risk management strategies, traders can mitigate potential losses, protect their trading accounts, and maintain a balanced approach to trading.

Systematic Way To Learn Options Trading

Image: stewdiostix.blogspot.com

Fostering Knowledge and Skills

Continuous learning is essential in the ever-evolving world of options trading. Read books, attend webinars, and participate in online forums to expand your knowledge. Stay updated with market trends, new strategies, and regulatory changes. Engage with experienced traders or join trading communities to gain insights and practical advice.

Embracing a mindset of continuous learning and improvement is vital for successful options trading. By staying abreast of the latest developments, honing your skills, and seeking knowledge from various sources, you can elevate