Navigating the Dynamic Options Market with a Proven Strategy

In the ever-evolving financial landscape, where market fluctuations can make or break investments, swing trading options has emerged as a formidable strategy for harnessing volatility and maximizing returns. Swing trading options involves identifying short-term price movements, or swings, and leveraging options contracts to profit from these fluctuations. This comprehensive guide delves into the intricacies of swing trading options, empowering traders with the knowledge and techniques to navigate the dynamic options market successfully.

Image: www.walmart.com

Delving into Swing Trading Options

Options contracts are financial instruments that grant buyers the right (but not the obligation) to buy or sell an underlying asset at a predetermined price within a specific time frame. Swing traders capitalize on short-term price swings by buying or selling options that are expected to align with these price fluctuations. Unlike day traders, who typically close positions within the same trading session, swing traders hold their positions for a longer period, ranging from a few days to several weeks. This strategy allows them to capture longer-term price movements without the stress of frequent entries and exits.

The Benefits of Swing Trading Options

Swing trading options offers several advantages for both experienced and aspiring traders:

-

Potential Profitability: Skilled traders can leverage price swings to generate consistent returns while managing risk.

-

Flexibility: Swing trading allows for greater flexibility compared to day trading, as positions can be held for longer periods.

-

Risk Management: Options provide downside protection, limiting potential losses if market conditions move unexpectedly.

-

Income Generation: Options strategies can also be employed to generate income through premium collection.

Cornerstone Concepts of Swing Trading Options

Mastering swing trading options requires a solid understanding of key concepts:

-

Technical Analysis: Identifying price patterns and trends through technical analysis is crucial for predicting future price swings.

-

Volatility Measurement: Gauging market volatility is essential as it influences option premiums and profitability potential.

-

Option Greeks: These metrics, such as Delta and Theta, offer insights into the behavior of options contracts.

-

Risk Management: Effective risk management strategies are pivotal to protect against potential losses and preserve capital.

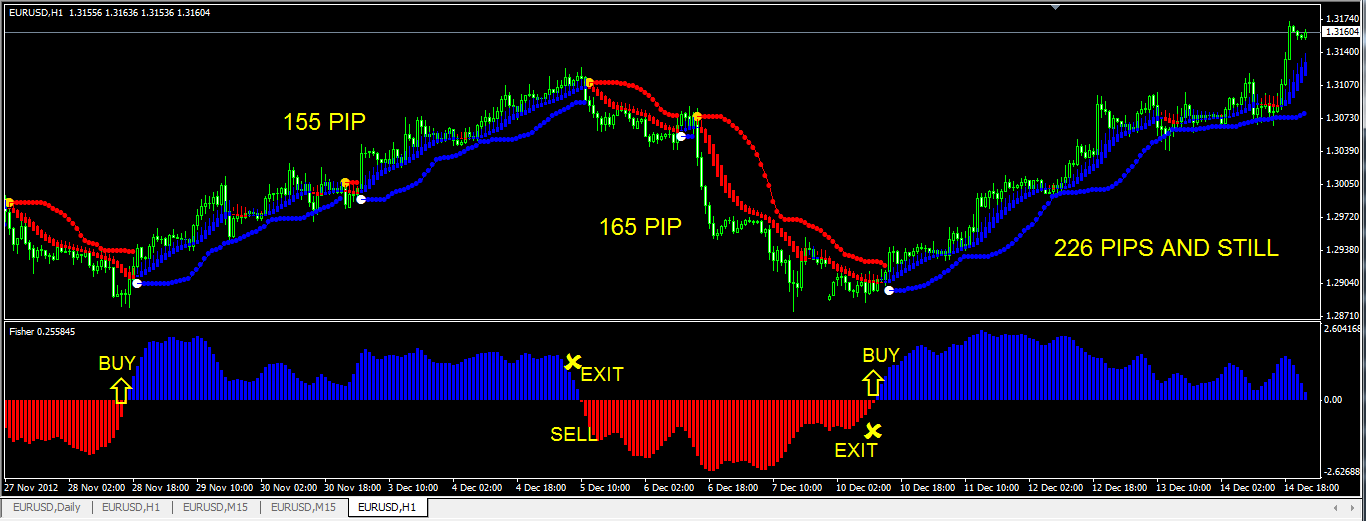

Image: forex-strategies-revealed.com

Popular Swing Trading Option Strategies

Diverse swing trading options strategies cater to different market conditions and trader preferences:

-

Bull Call Spread: A bullish strategy involving buying a call option with a lower strike price and selling a call option with a higher strike price.

-

Bear Put Spread: A bearish strategy that involves selling a put option with a higher strike price and buying a put option with a lower strike price.

-

Iron Condor: A neutral strategy designed for low volatility periods, it involves selling a call spread and a put spread with different strike prices.

-

Strangle: Similar to an iron condor, a strangle involves selling a call option and a put option with different strike prices, but the premiums are typically higher.

Executing Swing Trades with Precision

Successful swing trading options require meticulous execution:

-

Entry Timing: Pinpoint the optimal entry points by analyzing price patterns and technical indicators.

-

Position Sizing: Determine the appropriate contract size and number based on risk tolerance and account size.

-

Trade Management: Monitor positions closely, adjust stops, and exit trades based on defined exit strategies.

-

Emotional Discipline: Control emotions and adhere to trading plans to avoid irrational decisions.

Swing Trading Options System

Image: traderoomplus.com

Conclusion: Unleashing the Power of Swing Trading Options

Swing trading options is a powerful strategy that can unlock market opportunities while mitigating risk. Understanding the underlying concepts, mastering popular strategies, and implementing precise execution techniques are key to success in this dynamic financial landscape. Traders who arm themselves with these insights and remain disciplined in their approach can harness the volatility of the options market to their advantage, achieving consistent returns and growing their financial portfolios.