In the labyrinthine world of financial markets, where opportunities gleam and risks lurk, I stumbled upon the enigmatic concept of strap option trading. Initially, it seemed like an arcane language, but my relentless curiosity propelled me to unravel its intricacies. As I delved deeper, I discovered a strategy brimming with potential to bolster my trading prowess. Let’s embark on a comprehensive journey into the realm of strap option trading.

Image: peterodriguezmusic.com

Delving into Strap Options

Strap options, a peculiar subset of options contracts, provide investors with the unique ability to profit from the difference between the implied volatility and realized volatility of an underlying asset. These contracts grant the holder the right, but not the obligation, to sell the underlying asset at a predetermined “strike price” on a specific “expiration date.” Strap options thrive in environments characterized by high implied volatility, where investors anticipate significant price fluctuations.

Unveiling the Strategy: Execution and Nuances

To execute a strap option trading strategy, one must meticulously select an underlying asset exhibiting elevated implied volatility. Armed with this asset, the next step involves purchasing a strap option that aligns with its strike price and expiration date. Once the position is established, the investor patiently awaits the realized volatility to converge towards, or even surpass, the implied volatility.

Within this timeframe, the strap option’s value ascends, as the gap between implied and realized volatility narrows. Upon reaching a favorable juncture, the investor can astutely sell the strap option to reap the substantial gains accrued. However, it is imperative to monitor the option’s performance vigilantly and exit the trade strategically to optimize profitability.

Modern Trends and Evolving Landscape

The strap option trading strategy has evolved alongside the ever-changing financial markets. Technological advancements have democratized access to real-time market data, empowering investors to make informed trading decisions. Social media platforms and online forums have emerged as vibrant hubs for sharing insights, strategies, and experiences among traders.

In recent times, the advent of algorithmic trading has transformed the landscape, enabling traders to execute complex strategies with lightning-fast precision. Nevertheless, it’s crucial to remember that strap option trading, despite its potential rewards, is not without risks. Market volatility, shifting economic conditions, and geopolitical events can introduce unforeseen challenges.

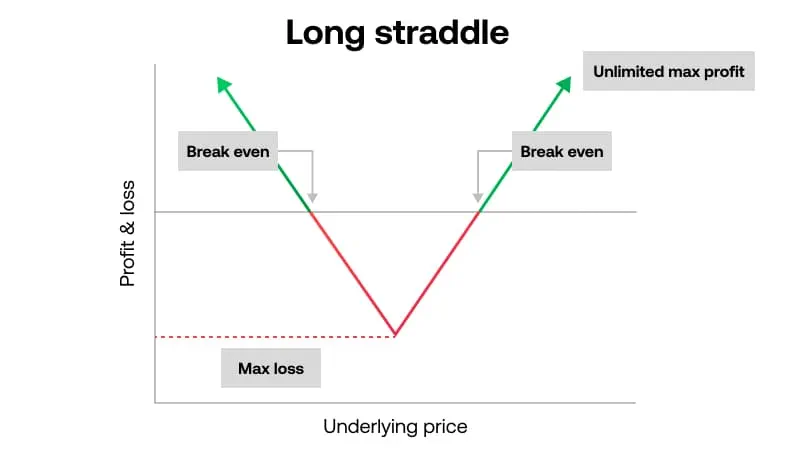

Image: www.cityindex.com

Expert Tips and Wise Counsel

To navigate the complexities of strap option trading with greater acumen, it’s prudent to heed the advice of experienced traders. Firstly, thoroughly research the underlying asset and market conditions before entering a trade. Secondly, judiciously manage risk by diversifying your portfolio and using stop-loss orders. Thirdly, continuously educate yourself by staying abreast of industry updates and innovative strategies.

Remember, patience is a virtue in strap option trading. Allow sufficient time for the strategy to unfold and avoid emotional decision-making. By embracing these principles, you can enhance your chances of success in this exhilarating yet demanding trading arena.

Frequently Asked Questions

Q: What is the primary advantage of strap option trading?

A: The ability to profit from the convergence of implied and realized volatility.

Q: How do I select the right underlying asset for strap option trading?

A: Choose assets exhibiting high implied volatility and the potential for significant price fluctuations.

Q: What is the optimal time to execute a strap option trade?

A: When the implied volatility premium is at its highest.

Q: What is the potential downside of strap option trading?

A: The strategy carries the risk of losses if realized volatility fails to meet expectations.

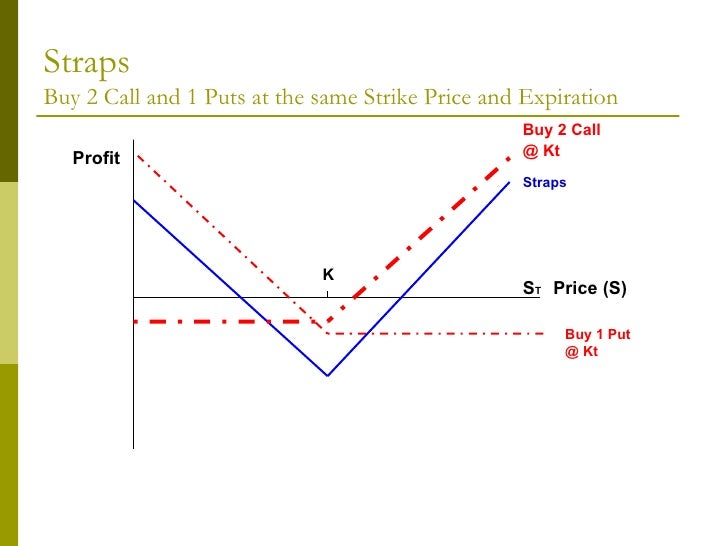

Strap Option Trading Strategy

Image: www.elearnmarkets.com

Conclusion

Strap option trading presents a compelling strategy for discerning investors seeking to capitalize on market volatility. By mastering its intricacies, managing risks prudently, and embracing expert guidance, you can cultivate a keen edge in the financial arena. Embrace this knowledge and embark on your strap option trading journey with confidence. Let your trades soar, and may the financial markets reward your strategic acumen.

Would you like to delve further into the mesmerizing world of strap option trading? Share your queries, insights, and experiences in the comments section below. Together, we shall unravel the enigmas that envelop this captivating strategy, propelling each other towards financial success.