Introduction

Stock options, a potent tool in the financial realm, empower investors to magnify potential profits while mitigating risks. As online trading platforms gain traction, the accessibility of these instruments has expanded significantly, unlocking new horizons for savvy investors. Let’s embark on a journey into the captivating world of stock options online trading, dissecting its intricacies and grasping the strategies that can propel your investment portfolio to unprecedented heights.

Image: www.qarya.org

Online stock options trading offers an unparalleled level of convenience and flexibility. From the comfort of your own home, you can access real-time market data, execute trades with lightning-fast speed, and harness sophisticated analytical tools to guide your decision-making. Whether you’re a seasoned pro or just starting your trading adventure, online platforms offer a user-friendly environment to navigate the stock options market with confidence.

Understanding Stock Options

Definition and History

Stock options are financial contracts that grant the holder the right, but not the obligation, to buy or sell an underlying stock at a predetermined price (known as the strike price) within a specified time frame (known as the expiration date). These instruments emerged in the 1970s as hedging mechanisms for corporate executives, allowing them to protect their salaries against potential stock price fluctuations. Over time, stock options evolved into a widely accessible investment vehicle, enabling retail investors to participate in the stock market’s growth potential.

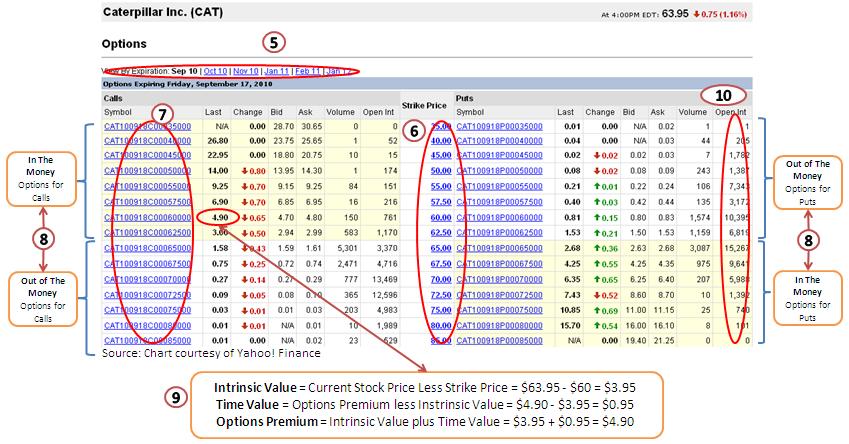

There are two main types of stock options: calls and puts. Call options give the holder the right to buy the underlying stock, while put options grant the right to sell it. The choice between a call or put option depends on the investor’s outlook on the future direction of the stock price. If the investor believes the stock price will rise, they would purchase a call option. Conversely, if they anticipate a decline in the stock price, they would buy a put option.

Trading Stock Options Online

Engaging in stock options online trading requires a thorough understanding of the market and a strategic approach. Here are some key considerations to keep in mind:

- Choose a reputable broker: The broker you select plays a crucial role in your trading experience. Look for a platform that is regulated, offers a wide range of trading instruments, and provides excellent customer support.

- Understand the risks: Stock options trading involves substantial risk. It’s essential to fully grasp the potential downside before committing any capital. Only invest what you can afford to lose.

- Develop a trading plan: A well-defined trading plan will help you stay disciplined and make informed decisions. Determine your investment objectives, risk tolerance, and trading strategies before entering the market.

- Use technical analysis tools: Technical analysis helps you identify potential trading opportunities by studying historical price patterns and market indicators. Proficiency in technical analysis can enhance your ability to make informed trading decisions.

- Monitor the market: Stay up-to-date with the latest market news and economic events that could impact the underlying stock prices and, consequently, the value of your options.

Image: regpaq.com

Latest Trends and Developments

The stock options market is constantly evolving, with new trends and developments emerging all the time. Here are some noteworthy advancements to be aware of:

- The rise of mobile trading: Mobile trading platforms have made it possible to trade options anywhere, anytime. This level of accessibility has opened up the market to a broader range of investors.

- The increasing popularity of binary options: Binary options are a type of options contract that has a fixed return and a fixed risk. These instruments have gained traction among retail investors due to their simplicity and potential for high returns.

- The emergence of algorithmic trading: Algorithmic trading uses computer programs to execute trades automatically based on predefined parameters. This advanced technology has become increasingly popular among professional traders and institutional investors.

Tips and Expert Advice

As you embark on your stock options online trading journey, it’s wise to glean from the insights of experienced traders and experts. Here are some invaluable tips to help you succeed:

- Start small: Don’t overextend yourself by investing more than you can afford to lose. Begin with small positions and gradually increase your investment size as you gain experience and confidence.

- Don’t chase losses: Accept that losses are an inevitable part of trading. When a trade goes against you, don’t try to double down to recoup your losses. This can lead to further losses and erode your capital.

- Manage your risk: Utilize risk management strategies such as stop-loss orders to limit your potential downside. These orders automatically sell your options when they reach a predetermined price, protecting you from catastrophic losses.

- Educate yourself: Continuously enhance your knowledge and skills by reading books, attending webinars, and seeking guidance from experienced traders. The more you learn, the better equipped you’ll be to navigate the complexities of the stock options market.

Frequently Asked Questions

-

Q: What are the advantages of stock options trading?

A: Advantages include the potential for high returns, hedging against stock price fluctuations, and the flexibility to adjust your risk profile.

-

Q: What are the risks of stock options trading?

A: Risks include the potential for significant losses, the time decay of options, and the volatility of the underlying stock prices.

-

Q: How do I get started with stock options online trading?

A: Open an account with a reputable broker, educate yourself about the market, and start with small positions.

Stock Options Online Trading

Image: programminginsider.com

Conclusion

Stock options online trading is a powerful tool that can unlock significant profit potential for astute investors. By understanding the mechanics of options, employing effective trading strategies, and continuously educating yourself, you can navigate the market with confidence and grow your wealth. Remember, trading options involves inherent risks, so it’s imperative to approach the market with a well-defined trading plan and a clear understanding of your risk tolerance. Embark on your stock options trading journey today and experience the exhilaration of leveraging this financial instrument to achieve your investment aspirations. Are you ready to delve into the captivating realm of stock options online trading and harness its transformative power?