In the fast-paced world of finance, harnessing sophisticated trading techniques can unlock a gateway to success. Stock option trading presents a dynamic arena where astute investors can navigate market fluctuations and potentially generate significant returns. To empower you in this pursuit, we’ve curated an exceptional daily training program, coupled with cutting-edge software, designed to propel your trading prowess to new heights. Dive into the captivating realm of options and uncover a world of unparalleled opportunities.

Image: connectionsluda.weebly.com

Your Daily Guide to Option Trading Mastery

Our meticulously crafted daily training program is meticulously designed to guide you through the complexities of stock option trading. Each session delves into fundamental concepts and advanced strategies, progressively building your understanding. Expert instructors, seasoned in the art of options, provide personalized guidance, empowering you to navigate the dynamic market landscape with confidence and finesse.

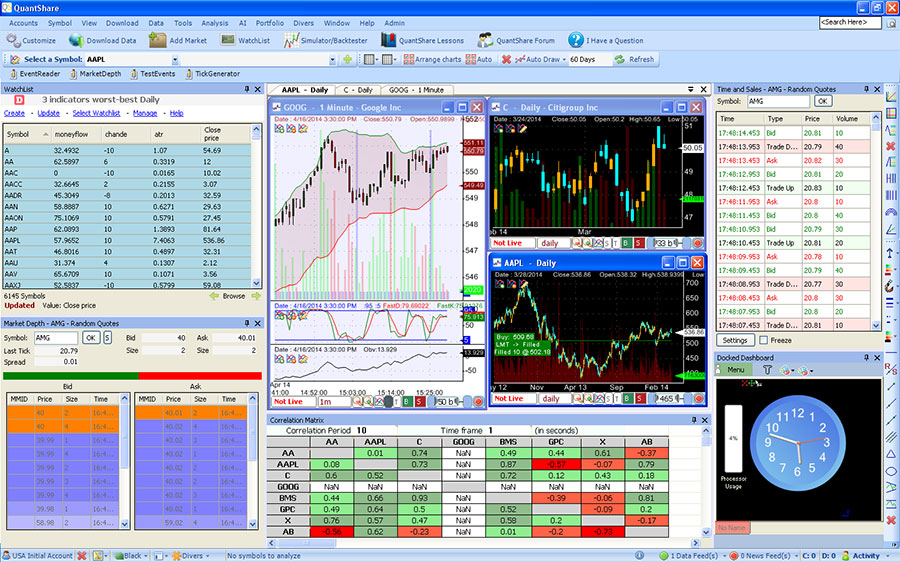

Unveiling Cutting-Edge Stock Option Trading Software

Complementing our comprehensive training regimen is an arsenal of state-of-the-art stock option trading software. This cutting-edge technology grants you real-time access to market data, enabling you to make informed decisions based on technical analysis and market trends. Our software platform seamlessly integrates advanced charting tools, automated risk management features, and intuitive trading interfaces, empowering you with unparalleled control over your trading operations.

Understanding Stock Option Trading: A Comprehensive Overview

Stock options are financial contracts that grant the holder the right but not the obligation to buy or sell a specific number of shares of a stock at a predefined price, known as the strike price, within a predetermined time frame, referred to as the expiration date. These contracts offer unique strategies for navigating market dynamics, enabling investors to leverage both bullish and bearish sentiments. Options trading involves calculating risk-reward ratios and understanding option premiums to execute effective trades.

Options trading traces its roots back to ancient Greece, where it was used to hedge cargo shipments. In modern finance, the Chicago Board Options Exchange (CBOE) played a pivotal role in popularizing and standardizing option trading in the 1970s. Today, options have become an indispensable instrument for risk management and speculation in global financial markets. The Black-Scholes model, developed by Fischer Black and Myron Scholes in 1973, serves as a fundamental framework for pricing options, taking into account factors such as stock price, volatility, strike price, time to expiration, and interest rates.

Image: investpost.org

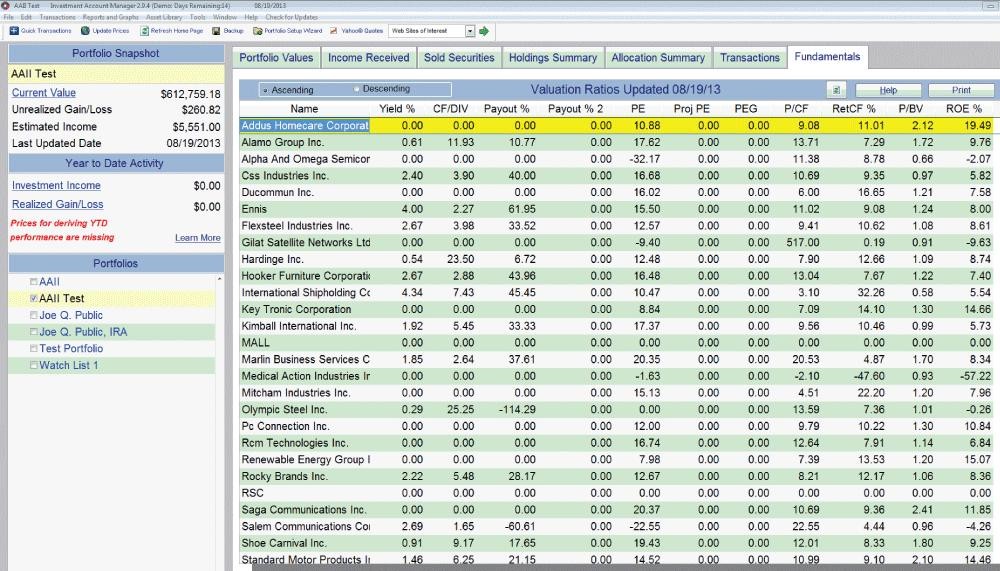

Expert Insights and Proven Strategies for Success

Our expert team of traders provides valuable insights and proven strategies to augment your trading skills. They emphasize the importance of understanding and managing risk, and they advocate the use of sound technical analysis techniques. Their guidance will provide you with invaluable tools to navigate market volatility and capitalize on opportunities. Additionally, they emphasize the significance of constant learning and adaptation in the ever-changing world of finance.

Whether you’re a seasoned veteran or a novice trader, our training program and software suite empower you to achieve your trading goals. Our experts share valuable tips for both beginners and experienced traders:

- Set Realistic Expectations: Understand that successful trading requires dedication, patience, and a commitment to continuous learning.

- Manage Risk Effectively: Implement thoughtful risk management strategies and never risk more than you can afford to lose.

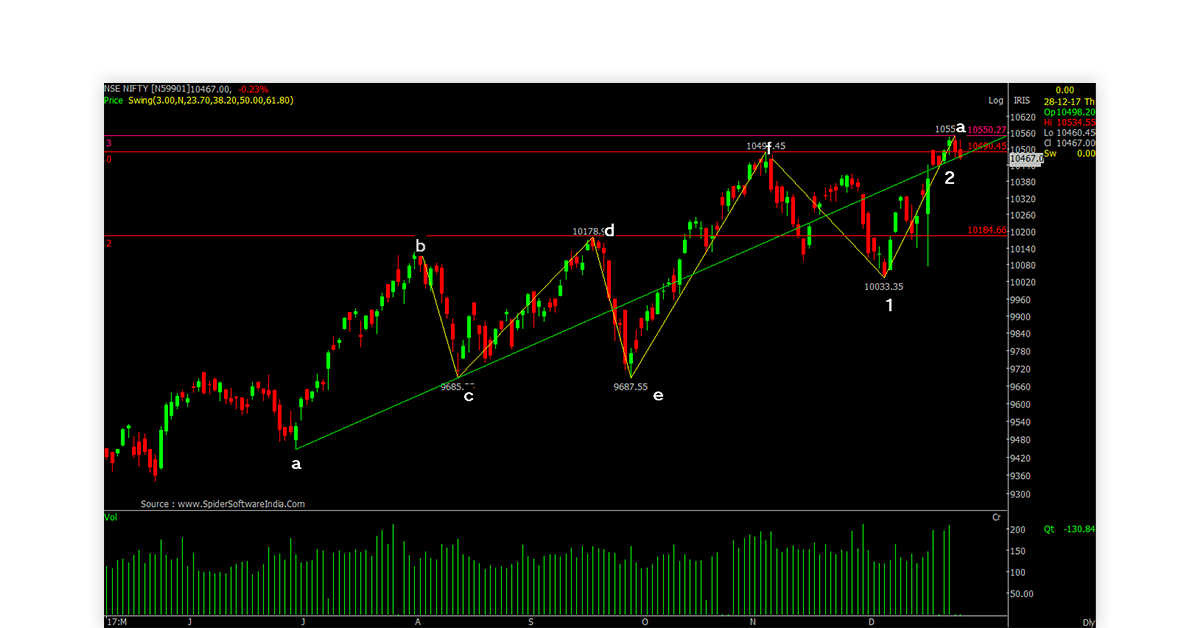

- Utilize Technical Analysis: Leverage technical indicators and chart patterns to identify potential trading opportunities.

- Stay Updated: Monitor market news, economic data, and industry trends to stay informed about market dynamics.

- Control Your Emotions: Discipline your trading decisions and avoid letting emotions cloud your judgment.

Frequently Asked Questions About Stock Options Trading

Q: What is the difference between a call and a put option?

A: A call option gives the holder the right to buy a stock at the strike price, while a put option grants the right to sell the stock at the strike price.

Q: How can I calculate the premium of an option?

A: The premium of an option is determined by the Black-Scholes model, which considers factors like the stock price, strike price, time to expiration, volatility, and interest rates.

Q: What is the best way to learn about stock options?

A: Our comprehensive training program provides a structured and interactive learning experience, equipping you with essential knowledge and techniques.

Stock Option Trading Techiques Daily Training Sale Program Software

Image: www.techjockey.com

Unlock Your Trading Potential with Stock Option Mastery

Embark on an extraordinary trading journey with our daily training program and cutting-edge software. Whether you’re a novice seeking to foray into the world of options or an experienced trader eager to refine your skills, our program provides the knowledge, tools, and support you need to achieve success. Embrace the power of stock option trading today and unlock your true earning potential.

Are you intrigued by the possibilities of stock option trading? Join our exclusive daily training program and revolutionize your approach to financial markets.